What a DraftKings-ESPN Tie-Up Will Mean for Investors

DraftKings stock shot higher recently amid speculation the sports gambling site could partner with Disney's ESPN.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

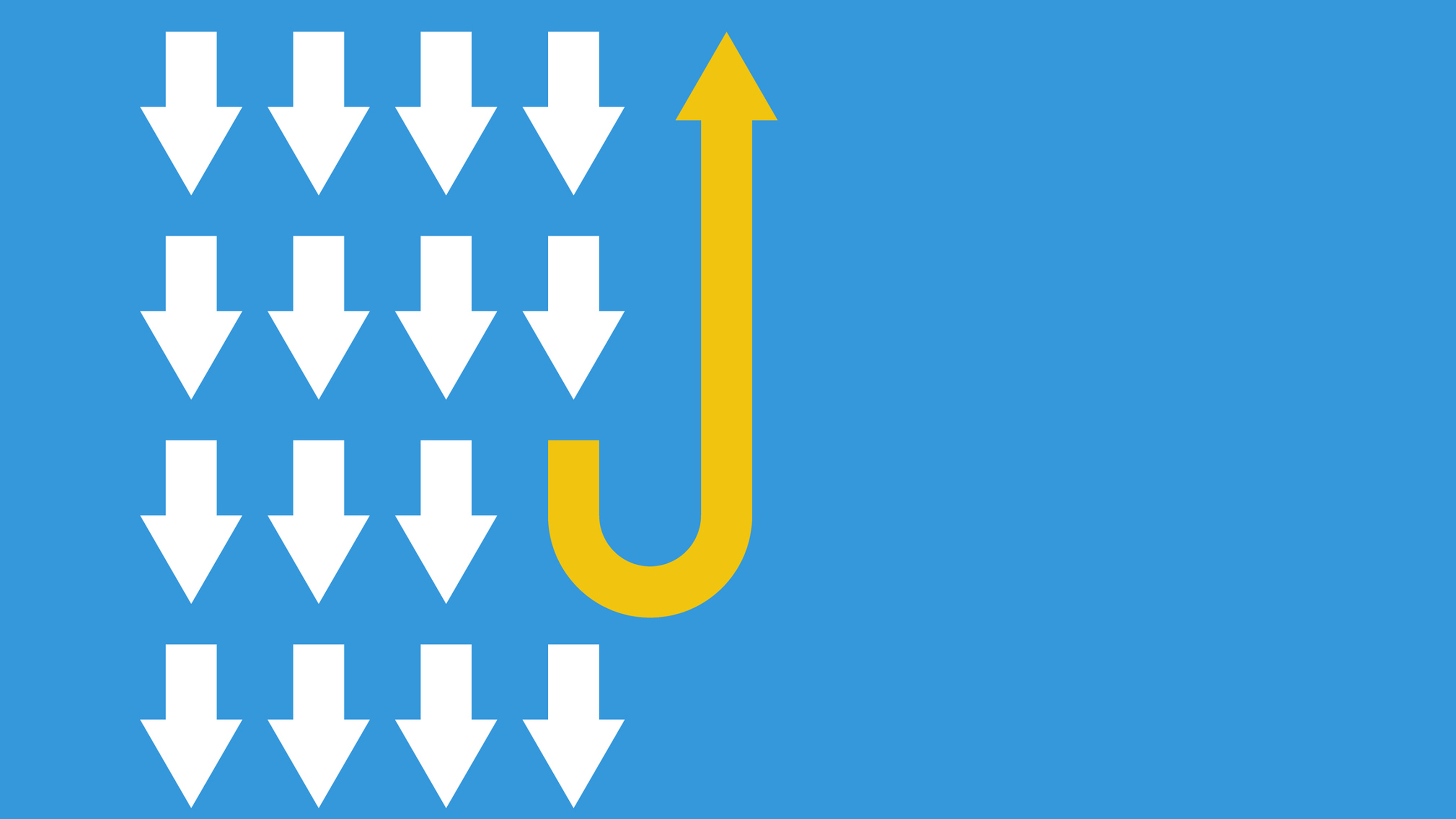

Last Friday, as the September jobs report dealt a blow to the broader stock market, shares of sports betting site DraftKings (DKNG, $13.49) jumped more than 3%. Why? Reports surfaced over a potential partnership with Walt Disney's (DIS) ESPN.

The speculation dates back to summer of 2021, when The Wall Street Journal, citing people familiar with the matter, reported that ESPN is looking to partner with a sports-betting partner. The rumors caught wind again last week, and while nothing is confirmed, a deal between the sports gambling company and one of America's leading sports media empires would benefit both parties.

What does this mean for investors?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here's a look at what this partnership would do for DraftKings and, to a lesser extent, ESPN.

An ESPN Partnership Could Help DraftKings Gain Market Share

DraftKings rival FanDuel currently has an edge in certain markets, including New York, where sports gambling became legal in January 2022. The state, which has a stiff 51% tax on online sports gambling operators, tapped nine companies, including DraftKings and FanDuel, to lead its initial launch of licensed sports betting.

The competition between all nine operators has been intense., and in September, the Legal Sports Report suggested that FanDuel held a 39.7% market share of the online sports betting market in New York, 510 basis points higher than DraftKings (a basis point = 0.01%). Rounding out the top five are Caesars (13.0%), BetMGM (7.6%) and BetRivers (2.8%).

So, in New York, at least, it's a two-horse race, and FanDuel's ahead halfway through the first quarter of a four-quarter game.

From a revenue perspective, FanDuel's revenues in New York increased by 66% from June to September, from $39.6 million to $65.7 million. Over the same period, DraftKing's revenues increased 174%, from $16.4 million to $44.9 million.

In September, the nine operators made $70.2 million in total revenue after the 51% tax, while New York State brought in $73.1 million. So far, the state appears to be the big winner in online sports betting. It's projecting $615 million for the state's fiscal year, from April 1, 2022, to April 1, 2023.

It's not surprising that the nine operators have asked for a cut in the tax rate. That lobbying should intensify in 2023.

Nationally, according to Eilers & Krejcik Gaming's July 2022 report on the U.S. sports-betting market, FanDuel held 46.6% of the market with $744 million in gross gaming revenue – based on trailing three-month revenue from March to May. DraftKings was a distant second at 20.2% ($322.5 million).

FanDuel had the top spot in 14 states compared to three – New Hampshire, Oregon and Wyoming – for DraftKings.

To say that an ESPN tie-up would help DraftKings' cause is an understatement.

ESPN Brings a Mass Audience of Sports Fans

Disney CEO Bob Chapek told Bloomberg in September that ESPN's younger fans want sports betting integrated into the network's programming and content.

"Sports betting is a part of what our younger, say, under-35 sports audience is telling us they want as part of their sports lifestyle,” Chapek said.

In the same interview, Chapek indicated the company is "working very hard" on an ESPN sports-betting app.

So, what does ESPN bring to DKNG's table? According to The Wall Street Journal, a long-term deal could net DraftKings at least $3 billion.

That would go a long way in DKNG accelerating its sports-betting aspirations nationwide, including in California, where Proposition 27 will be on the ballot in the midterm election. Prop 27 would allow online and mobile sports wagering outside tribal lands in California.

Most believe California voters will not approve this proposition, and Oppenheimer analyst Jed Kelly sees Prop 27's defeat as a blessing in disguise for DraftKings. It gives the company 2-3 years to scale its sports-betting business and become profitable before entering what's likely to be the biggest prize for U.S. sports gambling operators.

More important than a big outlay of money by ESPN is the instant credibility it gives DraftKings as the official operator of ESPN sports betting. If Barstool Sports is big for PENN Entertainment (PENN), ESPN is massive for DraftKings.

"We think an agreement is likely and could include licensing of the ESPN brand and media integration that could deliver market share and player engagement boosts," says Benchmark analyst Mike Hickey.

While DKNG stock is down 51% year-to-date, it's unlikely that a failed bid to partner with ESPN would hurt its stock too badly. However, an official announcement would certainly help its share price and its fight with FanDuel to own the U.S. sport-betting audience.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.

-

5 Top Tech Disruptors to Watch

5 Top Tech Disruptors to WatchBig change catalyzed by top tech disruptors often leads to big growth.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

Stock Market Today: Stocks Rise Despite Stagflation Risk

Stock Market Today: Stocks Rise Despite Stagflation RiskThe business of business continues apace on continuing hope for reduced trade-related uncertainty.

-

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye On

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye OnA turnaround stock is a struggling company with a strong makeover plan that can pay off for intrepid investors.

-

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending Concerns

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending ConcernsMarkets seesawed amid worries over massive costs for artificial intelligence and mixed economic news.

-

Is Disney Stock Still a Buy After Earnings?

Is Disney Stock Still a Buy After Earnings?Walt Disney stock is down Wednesday after the entertainment and media company beat fiscal 2025 first-quarter expectations. Here's what you need to know.