Stock Market Today: Downgraded Apple Drags on Stocks

The iPhone maker was handed a rare downgrade on concerns over weakening consumer demand.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Yesterday's market rise proved just a blip as stocks on Thursday returned to the script for most of September by finishing solidly in negative territory.

The decline came as yields on government bonds resumed their climb. After the 10-year Treasury yield notched its biggest one-day decline since 2009 yesterday, it rose 6.2 basis points today to 3.769% (a basis point is 0.01%).

A pair of economic reports did little to lift sentiment. The final reading on Q2 gross domestic product (GDP) confirmed the U.S. economy contracted for a second straight quarter, meeting the technical definition of a recession. Additionally, weekly jobless claims fell more than economists were expecting (193,000 actual vs. 215,000 estimate), hitting their lowest level since April. While this jobs data "would ordinarily be celebrated, on this occasion that resilience could translate to stubborn inflation and more rate hikes," says Craig Erlam, senior market analyst at currency provider OANDA.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In terms of single-stock movers, Apple (AAPL, -4.9%) took a notable slide after BofA Securities analyst Wamsi Mohan downgraded the tech giant to Neutral (the equivalent of Hold) from Buy, citing weaker consumer demand for its new iPhone 14.

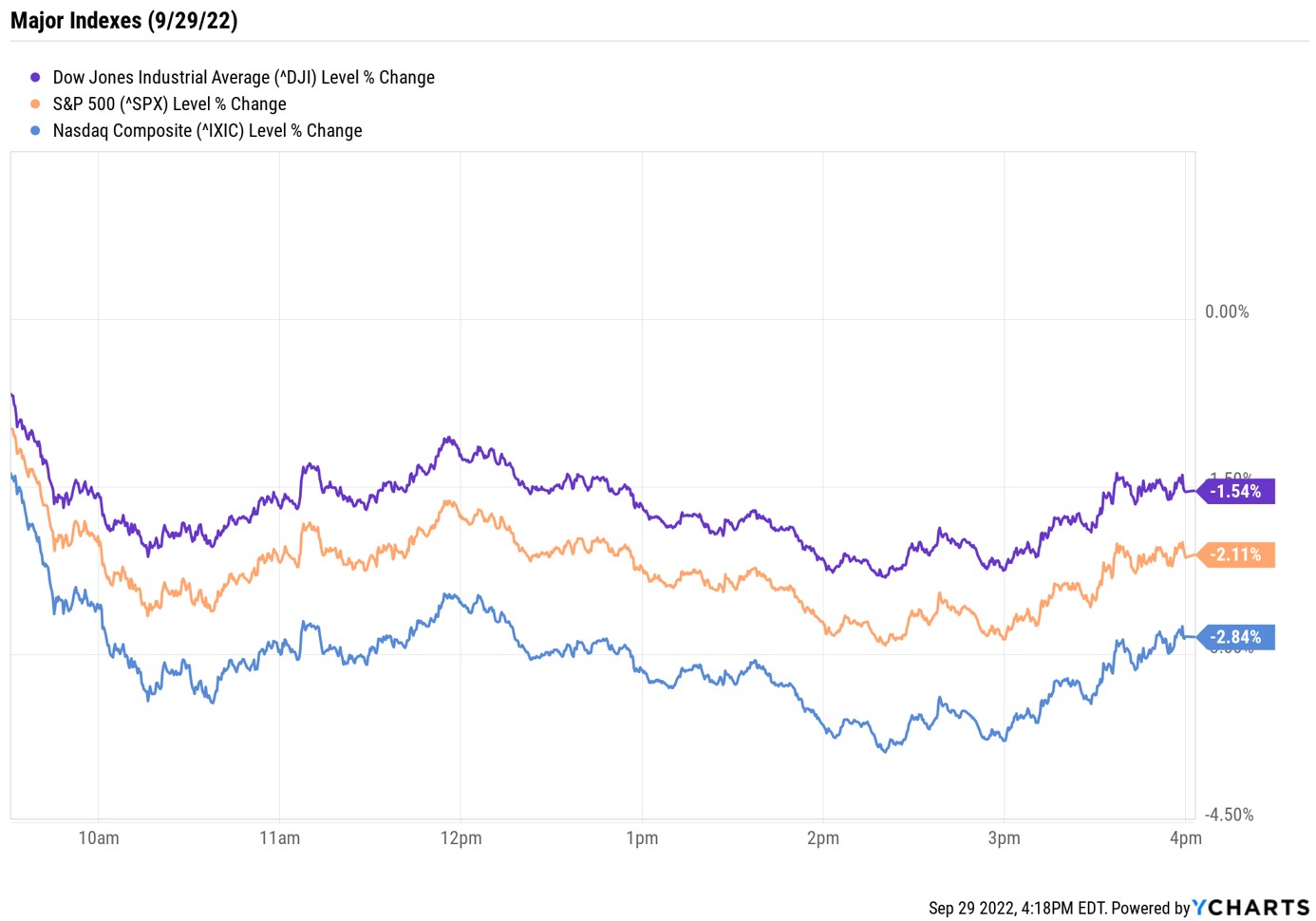

AAPL's decline put more pressure on the major indexes, with the Dow Jones Industrial Average shedding 1.5% to 29,225, the S&P 500 Index giving back 2.1% to 3,640, and the Nasdaq Composite sliding 2.8% to 10,737.

Other news in the stock market today:

- The small-cap Russell 2000 spiraled 2.4% to 1,674.

- U.S. crude futures fell 1.1% to finish at $81.23 per barrel.

- Gold futures ending marginally lower at $1,668.60 an ounce.

- Bitcoin slipped 0.6% to $19,420.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- CarMax (KMX) plummeted 24.6% after the used car dealer reported earnings. In its fiscal second quarter, KMX recorded a 54% year-over-year drop in earnings to 79 cents per share, while revenue ticked up 2% to $8.1 billion. Analysts were expecting earnings of $1.72 per share on $8.5 billion in sales. "On their conference call the company's CEO highlighted broad weakness in the used car market," says Michael Reinking, senior market strategist at the New York Stock Exchange. "This news has hit the auto makers, OEMs and semiconductor stocks hard. One slight positive takeaway from this report is that car prices are moving lower. This has been a big source of inflationary pressure over the last year so we should expect to see this flow through the data in the coming months."

- Bed Bath & Beyond (BBBY) tumbled 4.2% after the home goods retailer said fiscal second-quarter sales fell 28% to $1.4 billion, while its net loss widened to $4.59 per share from 72 cents per share in the year-ago period. Consensus estimates were for revenue of $1.5 billion and a per-share loss of $1.85. Additionally, same-store sales plummeted 26% over the three-month period.

Q4 Stock Opportunities

We're rounding third and heading for home. More specifically, tomorrow marks the end of the third quarter, meaning there's just one more to go in what has been a tough year for stocks.

We're certain to see more volatility through the end of the year, with the third-quarter earnings season set to kick off in two weeks, midterm elections happening in early November and two more Fed meetings on the docket. But we are also entering a historically positive stretch for stocks. Since 1928, the S&P 500 has averaged gains of 0.5% in October, 0.8% in November and 1.4% in December, according to Yardeni Research.

This year's slump creates "incredible opportunity," says Sonia Joao, chief operating officer of Robertson Wealth Management. "Some of our favorite growth names, particularly in technology, are trading at prices we never expected to see again." With that in mind, take a look at the best stocks to buy for the rest of 2022 and beyond. Some of these are familiar names and others are not so well known, but they all present potential opportunities heading into the final quarter of the year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.