Stock Market Today: Stocks Soar as Treasury Yields Retreat

The stock market rallied after the Bank of England took action to stabilize its financial markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market bounced sharply on Wednesday after the Bank of England (BoE) took emergency action to shore up its bond market.

Similar to the U.S. Treasury market, yields on U.K. government bonds have been spiking lately. The most recent surge came after the government put into effect the largest set of tax cuts in decades – a move that sent the British pound spiraling. Overnight, though, the BofE said it will begin buying longer-term U.K. bonds and delay selling bonds it purchased during the pandemic "to restore orderly market conditions."

This led to a rally in U.K. and U.S. bonds, which sent yields lower (remember, bond prices and yields move in opposite directions). Most notably, the 10-year Treasury yield, which earlier topped the 4.0% level for the first time since 2008, finished down 23.8 basis points at 3.725%. A basis point is one-one hundredth of a percentage point.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

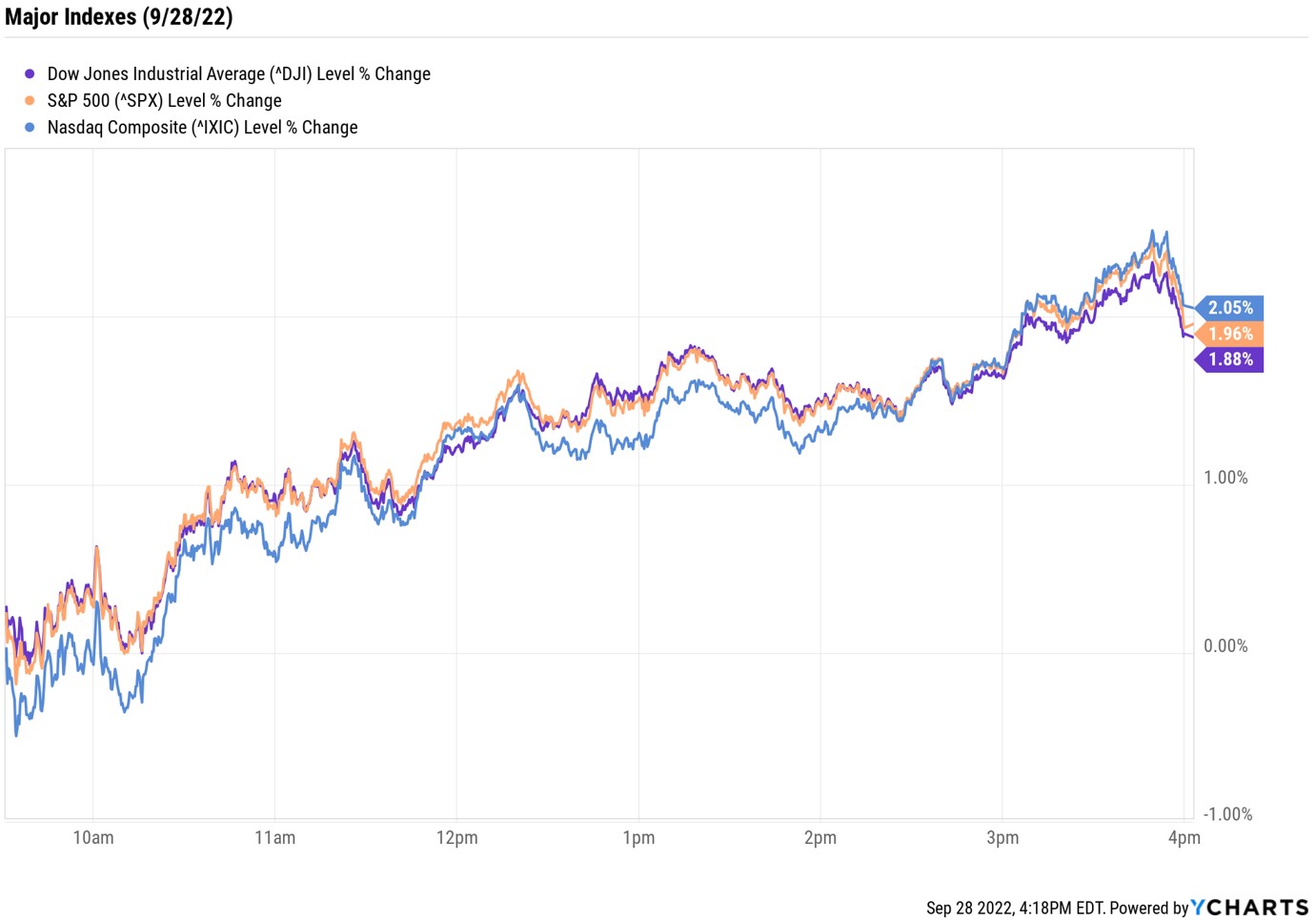

As for the equities market, the Dow Jones Industrial Average jumped 1.9% to 29,683, the S&P 500 Index rallied 2.0% to 3,719, and the Nasdaq Composite gained 2.1% to 11,051.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 3.2% to 1,715.

- U.S. crude futures spiked 4.7% to settle at $82.15 per barrel as Hurricane Ian gained strength in the Gulf of Mexico.

- Gold futures rose 2.1% to finish at $1,670 an ounce.

- Bitcoin gained 2.5% to 19,535. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Apple (AAPL) was the only Dow Jones stock to finish in negative territory today, shedding 1.3%. The move lower comes after a Bloomberg report suggested the tech giant has asked suppliers not to increase production of its new iPhone 14s as it anticipates a decline in demand. "We still believe that AAPL will meet/exceed September quarter expectations and see more favorable mix supporting average selling prices for the iPhone 14 cycle," says CFRA Research analyst Angelo Zino (Buy). "However, we see downside risk as we progress through the cycle, specifically in the March quarter, given extremely tough comparisons and our belief that not even AAPL is immune to macro headwinds. In addition, the virtually parabolic move/strength of the U.S. dollar is adding significant risk to all large-cap tech companies ahead of September quarter earnings season, including AAPL, where we see growth expectations likely be tempered within both hardware and services."

- Biogen (BIIB) soared 39.9% after the drugmaker reported positive late-stage study results for lecanemab, an Alzheimer's disease drug being co-developed with Japan's Eisai. The data showed the treatment slowed cognitive decline by 27% after 18 months. UBS Global Research analyst Colin Bristow (Buy) was one of many to chime in on BIIB stock today, calling the results "clinically meaningful" and "the positive Alzheimer's data point we were waiting for."

What's Next for Stocks?

So, what's next for the stock market? It's a question that will only be answered with time, but also one that has sparked a lot of chatter around Wall Street.

"We know the stock market doesn't just go up in a straight line," says Scott Wren, senior global market strategist at Wells Fargo Investment Institute. For investors, Wren says "it is helpful to look at history and realize that at some point inflation will ease, financial markets will stabilize, and the Federal Reserve will be finished hiking interest rates. While those things won't likely happen tomorrow or next week, we believe the markets are pricing in much of the bad news we expect to hear in coming months."

Wren is just a single voice of many, and here, we've rounded up what some other top minds are expecting next for stocks – including one strategist who makes a compelling case for owning both value and growth stocks in the current environment. See what they have to say.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.