Should You Buy Food Stocks? We All Gotta Eat

Food stocks — which include agriculture, manufacturing, packaged goods and grocers — are one area of the market that's doing well.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In a terrible time for most stocks, a few sectors have done awfully well. Energy stocks, of course. Also defense and aerospace (there’s a war on) and healthcare (needed always). Another strong sector may come as a surprise: food stocks.

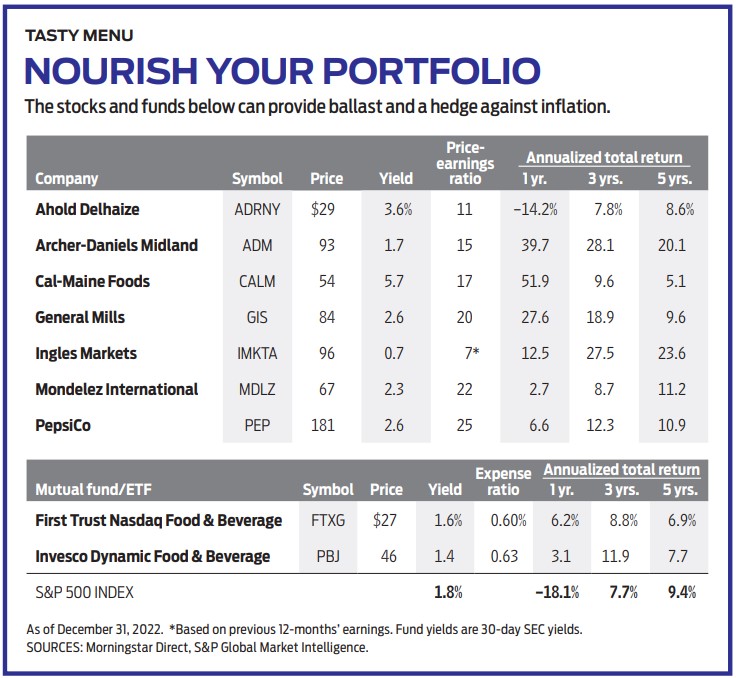

Archer-Daniels-Midland (ADM), the giant food-processing company, surged 39.7% in 2022, and General Mills (GIS), whose brands include Pillsbury, Häagen-Dazs and Progresso, returned 27.6%, including an attractive 2.6% dividend yield.

I’m doing a little cherry-picking here (perhaps an apt metaphor), but the food sector — which includes agriculture, manufacturing, packaged goods and grocers — has outperformed the averages. (Stocks and funds I like are in bold. Prices and other data are as of December 31.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The First Trust Nasdaq Food & Beverage (FTXG), an exchange-traded fund, returned 6.2% in 2022, beating the S&P 500 Index, the large-cap benchmark, by more than 24 percentage points. The ETF has a broad portfolio that includes Lamb Weston (LW), an Idaho-based maker of frozen potato products, and Bunge (BG), a 200-year-old company that’s the world’s largest processor of oilseeds. The Invesco Dynamic Food & Beverage (PBJ) whose assets include food distributor Sysco (SYY) and Campbell Soup (CPB), whipped the S&P by 21 points.

But let’s consider why food stocks have risen and whether the phenomenon is temporary. In other words, does the sector makes sense long-term?

Food stocks have benefited from drought, war, COVID

Food companies have recently benefited from three factors: drought, war in Ukraine and COVID. The western half of the U.S., especially major agricultural states such as Kansas, Nebraska and California, has been experiencing a long-term lack of rain. Drought is not restricted to the U.S. China is also suffering, and half of Europe is drier than it has been since the Renaissance. Many farmers and ranchers are producing less. Reduced supply means higher prices, which, for many food businesses (though not always the farmers and ranchers themselves), means higher profits.

Meanwhile, the war in Ukraine has cut production of wheat and corn from one of the world’s largest grain exporters, pushing up prices around the world. Because grain is so widely traded and easily shipped, its price is global, like the price of oil.

Finally, the waning of the COVID pandemic has boosted demand for restaurant food, which helps companies such as Sysco, a major distributor to restaurants. Its revenues increased 33.8%, and profits were up 31.7% for the 2022 fiscal year ending in July. The New York Times reported in November that the average price of a bag of potato chips rose from $5.05 to $6.05 in a year. “A dozen eggs that could have been picked up for $1.83 now average $2.90. A two-liter bottle of soda that cost $1.78 will now set you back $2.17.”

Of course, food-company expenses — gasoline for delivery trucks, parts for processing machinery, salaries — have also risen with inflation, but in general, the companies’ bottom lines have benefited from higher food prices. Take Pepsico (PEP), maker of potato chips (Lay’s) as well as soft drinks and oatmeal (Quaker). In the company’s most recent quarter, earnings were up 22% compared with the same period last year. The stock, which yields 2.6%, returned 6.6% in 2022.

The big question is whether food companies will continue to benefit from rising prices. I am not so sure. Droughts come and go, and grain prices are already moderating. They peaked last June. The U.S. Department of Agriculture maintains an “All Farm Index” of prices paid for U.S. crops. Those prices were remarkably steady for a decade. The index then shot up between mid-2020 and late 2022, from 110 to 137, but the curve is leveling off. Even in the case of food, higher prices dampen demand and encourage more investment in supply.

Food stocks as an inflation hedge

Still, there’s no doubt that food companies are some of the best inflation-proof stocks, which is one good reason to own them.

Another is that properly chosen, food stocks add stability to a portfolio — especially the big manufacturers with powerful brands, which provide a moat against competitors.

My favorite in this sector is General Mills, but also consider Mondelez International (MDLZ), Chicago-based maker of Oreo cookies, Tang, Ritz crackers and more. The stock was up 2.7% in 2022, and over the past 10 years, it has returned an annual average of 11.6%, rising consistently. Or Cal-Maine Foods (CALM), which sells $2 billion worth of eggs a year. The stock stumbled in December after it reported quarterly earnings that didn’t meet analysts’ high expectations. But the shares have nearly tripled in the past 10 years and currently yield more than 5%. The stock is well priced, with a forward price-earnings ratio of 17, based on analysts’ estimates for the fiscal year ending in May 2024.

Food stocks can tank, too. Poor management has crushed shares of Kraft Heinz (KHC) despite its spectacular array of brands, which include Oscar Mayer, Jell-O and Ore-Ida, among many others. The stock peaked at more than $90 a share in 2017 and now trades at less than half that. But contrarians should note that Warren Buffett’s Berkshire Hathaway owns 26% of the company, and he’s not selling. The stock price of Tyson Foods (TSN), the global chicken, beef and pork purveyor, is also lower than it was five years ago. Tyson is suffering lately as consumers move to cheaper cuts of meat — or to no meat at all — as a way to deal with inflation.

With two exceptions, the supermarket sector is unattractive. Walmart (WMT) leads in sales, but U.S. groceries account for less than 40% of total company revenues, so it’s not a pure play. The number-two supermarket chain is Kroger (KR), which also owns Ralph’s and Harris Teeter. Kroger is trying to purchase number-three Albertson’s (ACI), which owns Safeway, but is running into government opposition. The uncertainty means neither of those stocks is a good bet now.

Publix is private, and Whole Foods and other brick-and-mortar grocery stores represent just 4% of total sales for Amazon (AMZN). The future of food shopping may be online, but not even Amazon has cracked the code. I consider Ahold Delhaize (ADRNY), a Dutch company with 7,400 stores in Europe and the U.S. (brands include Giant, Stop & Shop and Food Lion), the best of the large chains. It trades at a P/E of 11 and yields 3.6%.

I also like a smaller chain, Ingles Markets (IMKTA), which operates in the Southeast and has a market capitalization (shares times stock price) of just $1.8 billion. Ingles is a consistent grower with strong profit margins. Investors have noticed, and the stock has risen at an average annual rate of 24% over the past five years. Analyst estimates are scarce, but the P/E based on earnings for the past 12 months is a mere 7.

Guessing when the next war or drought will boost food prices — or whether the current dislocations will continue — is a fool’s errand. But it makes sense to nourish your portfolio with food stocks. They offer a balanced diet in a time when sectors like technology can upset even the strongest stomachs.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. He owns none of the securities listed here. You can reach him at jkglassman@gmail.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

New Ways to Keep Online Accounts Safe

New Ways to Keep Online Accounts SafeAs cybercrime evolves, the strategies you use to protect yourself need to evolve, too.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.