The Best Energy Stocks to Buy

Energy stocks can expose investors to volatile oil and gas prices. Here's how to find the best energy stocks to buy now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Have you ever looked at rising gas prices and wondered who's getting rich off your pain at the pump? Well, that "who" could be "you" if you invest in some of the market's best energy stocks.

Just make sure you have an iron stomach. Energy stocks cover a wide range of businesses with common connections: ties to one or more of several energy commodities and the volatile price action that comes with them.

Today, we're going to talk about energy stocks generally and why you'd want to invest in them. And we'll identify factors that define the best energy stocks to buy right now.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Company (ticker) | Forward P/E ratio | Number of covering analysts | Analysts' consensus recommendation | Dividend yield |

SLB (SLB) | 11.6 | 37 | 1.5 | 3.5% |

Halliburton (HAL) | 11.5 | 34 | 1.79 | 3.0 |

Devon Energy (DVN) | 8.7 | 34 | 1.77 | 2.9 |

Diamondback Energy (FANG) | 12.7 | 34 | 1.45 | 2.8 |

ConocoPhillips (COP) | 14.6 | 33 | 1.59 | 3.5 |

Coterra Energy (CTRA) | 9.3 | 29 | 1.67 | 3.8 |

Ovintiv (OVV) | 7.9 | 27 | 1.67 | 3.3 |

Valero Energy (VLO) | 14.7 | 26 | 1.9 | 2.8 |

Kinder Morgan (KMI) | 20.6 | 26 | 1.96 | 4.3 |

Targa Resources (TRGP) | 17.1 | 26 | 1.32 | 2.7 |

Permian Resources (PR) | 11.4 | 24 | 1.32 | 4.9 |

Matador Resources (MTDR) | 8.0 | 23 | 1.37 | 2.9 |

Chord Energy (CHRD) | 12.5 | 20 | 1.59 | 5.9 |

Crescent Energy (CRGY) | 5.5 | 15 | 1.27 | 5.7 |

California Resources (CRC) | 14.6 | 13 | 1.42 | 3.2 |

Archrock (AROC) | 14.4 | 10 | 1.38 | 3.5 |

Kodiak Gas Services (KGS) | 15.8 | 8 | 1.46 | 5.2 |

What are energy stocks?

Let's start by looking at the textbook definition of energy stocks, provided by the Global Industry Classification Standard (GICS) – a framework used by major index providers to help classify public companies:

"The Energy Sector comprises companies engaged in exploration & production, refining & marketing, and storage & transportation of oil & gas and coal & consumable fuels. It also includes companies that offer oil & gas equipment and services."

Here's a closer look at some of the most common ways to slice and dice the sector:

Exploration & Production. The energy sector is broadly defined in terms of a stream: You'll often come across terms such as "upstream," "midstream" and "downstream" when you research energy stocks.

Upstream – otherwise known as exploration and production (E&P) – is the logical place to begin our discussion.

Companies involved with E&P are both exploring areas where energy commodities might be found and actually drilling and extracting those resources once identified.

Midstream. This business generally involves transportation and storage of crude oil, natural gas and other unfinished energy commodities. The most common industry in the midstream space is pipeline operations.

The midstream includes other transportation modes like tanker trucks, rail tank cars and tanker ships, as well as infrastructure such as terminals and storage facilities.

Refining. Refining is one of two primary businesses considered "downstream." Refiners take crude oil, natural gas and other energy commodities and turn them into finished products.

Refiners make first-to-mind energy products like gasoline and heating oils, as well as products such as plastics, fertilizers and preservatives.

Marketing & Selling. The other main "downstream" business is marketing and selling.

That brings us right back to the pump as well as other places where these energy products are sold to consumers.

Equipment & Services. Equipment and services companies aren't formally considered part of any "stream" but most often participate in E&P processes.

These businesses can do anything: evaluate formations, test wells, provide drilling technology, consult for midstream businesses, produce and integrate chemical injection pumps, and more.

Integrated. You'll typically hear companies such as blue chip stocks Exxon Mobil (XOM) and Chevron (CVX) referred to as "integrated oil majors." That means they're involved in at least two, if not three, streams.

Exxon Mobil, for instance, is engaged in E&P (upstream), refining, and marketing and selling (downstream).

You might be wondering where green energy stocks slot in. The answer is … nowhere.

Solar, wind and other green-energy firms typically reside outside of the energy sector. For instance, firms such as First Solar (FSLR) and Canadian Solar (CSIQ) are typically considered tech stocks because they make solar modules, wafers, cells and other technological products.

Others, such as Clearway Energy (CWEN) and Ørsted (DNNGY), are considered power generators and are classified as utility stocks.

Why do investors buy energy stocks?

Investors dive into the energy sector for all sorts of reasons, but among the most prominent:

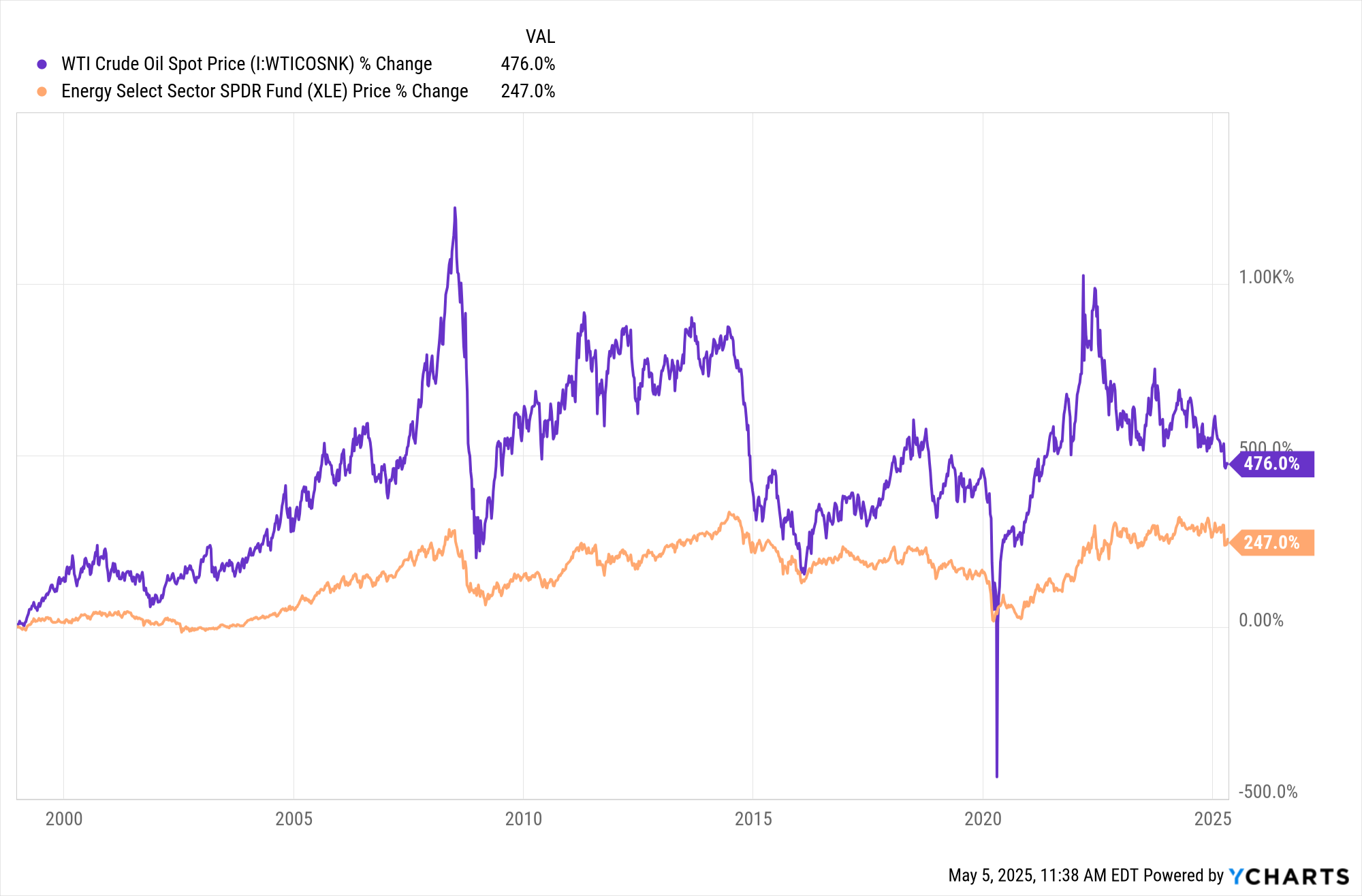

To leverage higher energy prices: Broadly speaking, investors primarily buy energy stocks so they can profit from rising oil, gas and other energy prices.

And prices can rise for any number of reasons, such as increased domestic and global energy demand, higher geopolitical risk, tightening of supply (from, say, lower domestic production, or reductions in supply from Organization of Petroleum Exporting Countries [OPEC] members) and more.

But I say "broadly speaking" because it's not always that straightforward.

Yes, if oil prices increase, decades of price action suggest that your average energy-sector fund will probably rise in tandem. But that's because most broad energy-sector funds are heavy in energy and production firms, as well as integrated oil majors that have massive presences in E&P.

Why does that matter? Because E&P is among the industries most tightly bound to commodity prices. For example, it might cost an oil producer $40 to produce a barrel of oil, which means every dollar above that price is pure profit – so the higher energy prices go, the fatter their bottom line.

That's not so much the case for other industries. Pipeline operators, for instance, get paid for the volumes that flow through their infrastructure, regardless of price. Sure, lower oil prices might indicate lower demand, which might be reflected in lower volumes, so there's still some relationship … but it's not as direct.

Not to mention, the energy sector is more than just oil. Natural gas and other commodities will affect these stocks, too, and at times, movements in these commodities might not always run parallel to one another.

To hedge against inflation. Higher consumer prices have usually been a good omen for energy stocks. Per BlackRock:

"Historically, the relative performance of the energy sector has been positively correlated with the rate of inflation. Going back to 1995, whenever inflation has been below 3% year-over-year, the S&P 500 Energy sector has generally underperformed, trailing the market by an average of approximately 0.40%/month. However, in periods when inflation has been 3% or greater, energy stocks post positive average returns of around 0.90%/month."

BlackRock also notes that energy doesn't just move with actual inflation – even expectations for high inflation can lift the sector's spirits.

For income. The energy sector can be a fertile hunting ground for income. Exxon, Chevron, and many other energy stocks deliver well-above-average dividends, and as I write this, the sector offers the S&P 500's second-highest yield, trailing only real estate investment trusts (REITs), which are literally required to pay out most of their profits as dividends.

And that high sector yield doesn't even reflect energy master limited partnerships (MLPs).

MLP income isn't subject to corporate taxation, but instead is passed through to limited partners as (typically generous) distributions. Virtually all MLPs, which in the energy space tend to involve pipelines and other infrastructure, are outside the S&P 500.

For context, the broad Energy Select Sector SPDR Fund (XLE) yields 3.2%; the Alerian MLP ETF (AMLP) yields 8.3%!

How to find the best energy stocks to buy

We can't predict exactly what you might want out of the energy sector, but we can help you start your search with a basic quality screen that includes some minimum thresholds for value and income.

To get to the following list of the best energy stocks to buy, we've looked for firms within the sector that …

Are within the S&P 1500: The S&P 1500 is made up of the S&P 500, S&P MidCap 400 and S&P SmallCap 600. So we're looking at large-, mid- and (bigger) small-cap stocks alike.

Are cheaper than the market: The S&P 500 currently trades at 22.6 times next year's earnings estimates. All the stocks on this list have a forward P/E of less than 21.

Have a dividend of at least 2.5%: You absolutely can choose to target energy stocks that significantly prioritize growth over income. However, given the sector's income allure, our screen looks for energy stocks that are yielding significantly more than what the S&P 500 is offering at present.

Have at least 7 covering analysts: We'd like to look at stocks that are on Wall Street analysts' radar, which makes it likelier that there's both more reporting and more insights on these companies. The more research we have at our disposal, the more educated a decision we can make.

Have a consensus Buy rating: All of the stocks must have an average broker recommendation of 2.5 or lower within S&P Global Market Intelligence's ratings scale. S&P Global Market Intelligence converts analysts' ratings into a numerical scale. Anything with a score of 2.5 or lower is considered a Buy. Every stock that made the list has a score of 2.0 or lower, and are thus higher-conviction consensus Buy calls.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.