Stock Market Today: Stocks Fall as Global Banks Follow in Fed's Footsteps

Treasury yields on the two-year and 10-year notes spiked to their highest levels in over a decade as central banks around the world rush to tame inflation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wednesday's selling carried into Thursday as investors continued to take a risk-off approach to markets following the Federal Reserve's latest policy announcement.

The central bank issued its third jumbo-sized rate increase yesterday and set expectations that it will continue to hike rates over its next few meetings. However, the Fed is not alone in its aggressive stance. Several global central banks have increased their benchmark rates this week in an ongoing effort to tame inflation, including the Bank of England and Switzerland's National Bank, which earlier today issued 50 basis point and 75 basis point rate hikes, respectively. (A basis point is one one-hundredth of a percentage point.)

"Global equities are struggling as the world anticipates surging rates will trigger a much sooner and possibly severe global recession," says Edward Moya, senior market strategist at currency data provider OANDA. "Most of these rate hikes around the world are not done yet which means the race to restrictive territory won't be over until closer to the end of the year."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The reaction here at home was a selloff in bond prices, which sent yields on government notes spiking. The 10-year Treasury yield surged 19.2 basis points to 3.704% – its highest level since early 2011 – while the 2-year Treasury yield spiked 12.1 basis points to 4.116%, its loftiest perch since late 2007.

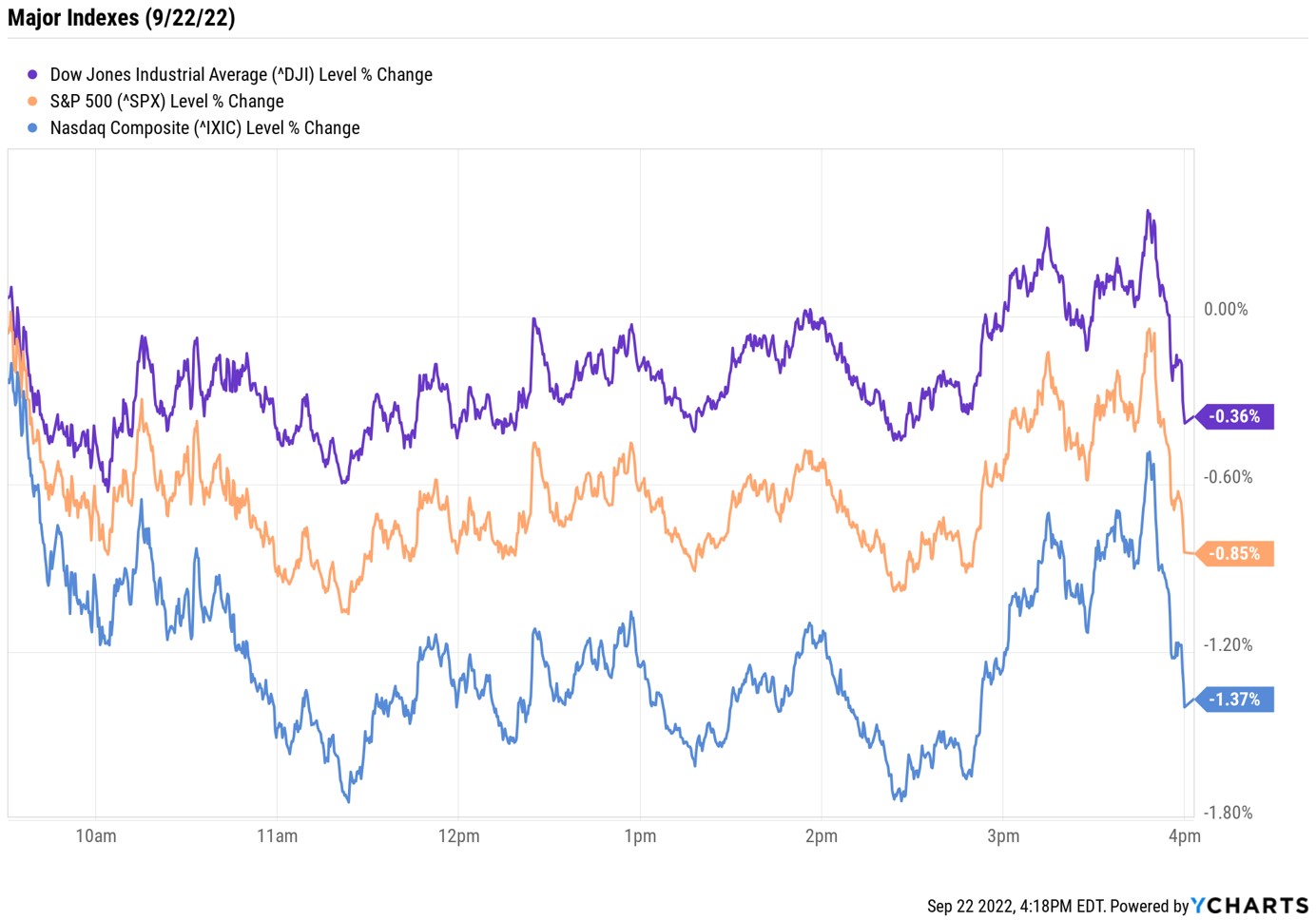

As for stocks, the tech-heavy Nasdaq Composite slumped 1.4% to 11,066, while the S&P 500 Index (-0.8% to 3,757) and the Dow Jones Industrial Average (-0.4% at 30,076) suffered more modest losses.

Other news in the stock market today:

- The small-cap Russell 2000 spiraled 2.2% to 1,722.

- U.S. crude futures rose 0.7% to finish at $83.49 per barrel.

- Gold futures added 0.3% to end at $1,681.10 an ounce.

- Bitcoin added 1.7% to $19,322.51. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Eli Lilly (LLY) jumped 4.9% after UBS Global Research analyst Colin Bristow upgraded the healthcare stock to Buy from Neutral. The analyst says following positive data for the company's SURMOUNT-1 obesity drug and Food and Drug Administration (FDA) approval for its diabetes treatment, T2DM, "we now view LLY as being the most attractive name in our large-cap coverage, with the greatest potential upside to numbers."

- KB Home (KBH) fell 5.1% after just missing analysts' consensus top-line estimate for its fiscal third quarter. The homebuilder reported earnings of $2.86 per share, more than expected, but revenue of $1.84 billion fell short. Sector peer Lennar (LEN) also unveiled its quarterly results, reporting higher-than-expected fiscal Q3 earnings of $5.03 per share on inline revenue of $8.9 billion. LEN stock rose 2.0% on the day.

Choppy Trading Continues, Consider Defensive ETFs

This is a challenging time for investors, and it's not likely to get any easier in the near term. "The markets are likely to remain very choppy and range-bound for the foreseeable future in our view because they now have to determine the timing and potential depth of recession ahead plus ongoing inflationary pressures overhead," says Dan Wantrobski, technical strategist and associate director of research at Janney. He adds that investor sentiment is likely to erode even further as the midterm elections near, and he anticipates a choppy path for stocks in the weeks ahead.

As we've mentioned several times over the past few months, the best course of action for investors, then, is to take a more defensive approach with their portfolios. Low-volatility strategies, quality dividend stocks and yield-friendly real estate investment trusts (REITs) are just a few of the ways investors can cope with non-compliant equity markets. Another tack is to take a broader approach with defensive exchange-traded funds (ETFs). The 10 funds featured here cover a number of strategies, but all are designed to protect portfolios against a turbulent investing environment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.