Stock Market Today: Stocks Bounce as Oil Prices Crumble

U.S. crude futures finished at their lowest level since mid-January amid concerns over slowing global economic growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

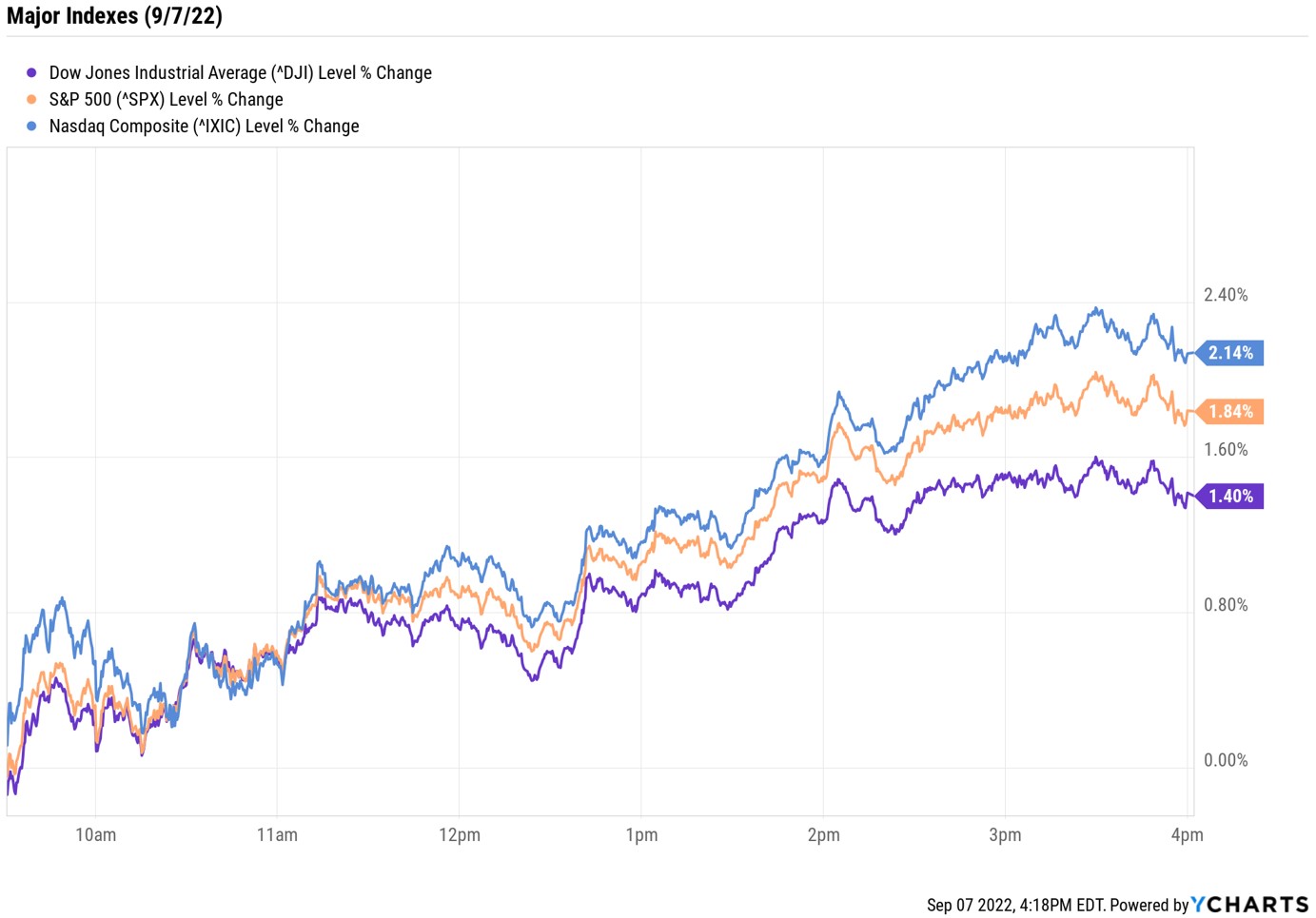

Stocks closed higher Wednesday as bargain hunters swooped in following a lengthy stretch of losses for the major indexes.

Today's positive price action came as the 10-year Treasury yield eased back from yesterday's two-month high, finishing down 6.7 basis points at 3.273%. A basis point is one-one hundredth of a percentage point.

And the buying persisted even after Federal Reserve Vice Chair Lael Brainard said in an early afternoon speech that the central bank is "in this for as long as it takes to get inflation down." The Fed will meet later this month, with the market largely pricing in the probability of a third straight 75 basis-point rate hike.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Nearly all sectors finished higher, with utilities (+3.1%) and consumer discretionary stocks (+3.1%) leading the charge. The one outlier was energy, which slumped 1.2% as U.S. crude futures tumbled 5.7% to $81.94 per barrel – their lowest close since Jan. 11, according to Dow Jones Market Data – amid expectations of slowing global economic growth. "Oil's breakdown today is a bigger shot across the bow, pointing to further struggles ahead in our opinion," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. "We believe the commodity can break below $80 from here, targeting the mid-$70s range in the weeks ahead."

As for the major indexes, the Nasdaq Composite jumped 2.1% to 11,791 – snapping its seven-day losing streak, its longest one since 2016. The S&P 500 Index (+1.8% at 3,979) and the Dow Jones Industrial Average (+1.4% at 31,581) also notched impressive gains.

Other news in the stock market today:

- The small-cap Russell 2000 spiked 2.2% to 1,832.

- Gold futures gained 0.7% to finish at $1,727.80 an ounce.

- Bitcoin rose as high as $19,183, before backtracking to $19,011.19, up 1% from this time yesterday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR) rose 6.6% after a report in The Wall Street Journal said a Delaware judge ruled that Elon Musk is allowed to include whistleblower allegations against the social media company in his countersuit. However, the judge denied Musk's request to push the trial back to November from its currently scheduled date of Oct. 17. Twitter is suing Musk over his attempt to walk away from a $44 billion deal to buy the company, while the Tesla (TSLA) CEO in a countersuit has accused TWTR of misrepresenting key metrics for its business. "Although we believe the whistleblower comments do provide Musk some hope in the upcoming trial while adding a slightly greater deal of uncertainty, we think it will ultimately be moot and continue to see a high probability that TWTR will be victorious in the courts," says CFRA Research analyst Angelo Zino (Hold). "We still think the most likely outcome is a purchase of TWTR by Musk, either forced by the courts or a settlement at less than a 15%-20% discount."

- Coupa Software (COUP) jumped 17.9% after the company, who offers cloud-based business spend management software, reported earnings. In its second quarter, COUP saw quarterly subscription revenues spike 23% year-over-year to a record $193 million, which helped boost total revenue 18% to $211 million. The firm also said its board of directors approved a $100 million stock buyback program. UBS Global Research analyst Taylor MicGinnis called the results "solid," but kept a Neutral (Hold) rating on the stock, citing a "more reasonable" valuation at current levels given "limited visibility beyond high-teens growth near term."

Stay Focused on the Bigger Picture

Uncertainty over the magnitude of the Federal Reserve's next rate hike will continue to move markets until the central bank's next policy meeting, scheduled for Sept. 20-21. That makes tomorrow morning's speech from Fed Chair Jerome Powell a key event to watch, and one that could potentially spark more volatility for stocks.

But sage investors know these short-term ups and downs are merely noise when compared to the bigger picture. "In the end, the day-to-day machinations of the market only matter to the extent we allow them to," says Ross Mayfield, investment strategy analyst at Baird. "Volatility and sell-offs – in all of their various shapes and sizes – are just a reality to bear for the long-term stock owner."

Indeed, investors can take advantage of the down days to gradually boost their core portfolio holdings. Not sure where to start? How about with these sturdy blue-chip stocks or by checking out some of Wall Street's best dividend payers. For investors wanting a broader approach, may we suggest the Kip 25. This list of Kiplinger's favorite low-cost mutual funds boast solid long-term performance records and managers with tenures to match. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.