Stock Market Today: Caterpillar's Revenue Miss Sends Dow Down 402 Points

House Speaker Nancy Pelosi's visit to Taiwan also kept investors on edge for most of the day.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks struggled to get off the ground on Tuesday amid concerns that a visit to Taiwan by U.S. House Speaker Nancy Pelosi will raise political tensions between Washington and Beijing. This marks the first visit by a House speaker to Taiwan since 1997 – and sparked warnings by China of retaliatory measures. It claims the self-ruled island as part of its territory.

And underwhelming jobs data did little to lift investor sentiment. The latest Job Openings and Labor Turnover (JOLTS) data showed job openings fell to 10.7 million in June from 11.3 million in May.

The number of hires and quits also slowed on a month-over-month basis, which could indicate the job market is leveling off, says Robert Conzo, CEO of investment advisory firm The Wealth Alliance. "We believe the Fed will utilize this data point to determine if the economy is slowing," Conzo adds. "Although continued interest rate rises may occur in the near term, data such as this may warrant smaller hikes than originally planned, helping the Fed to engineer a soft-landing."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the earnings front, Caterpillar (CAT) fell 5.8% as the construction giant's top-line miss overshadowed higher-than-expected earnings. Plus, CAT's Q2 sales are still lower than pre-pandemic levels, and the company's 11% year-over-year rise in revenue is more reflective of higher prices versus additional products being sold, says CFRA Research analyst Colin Scarola.

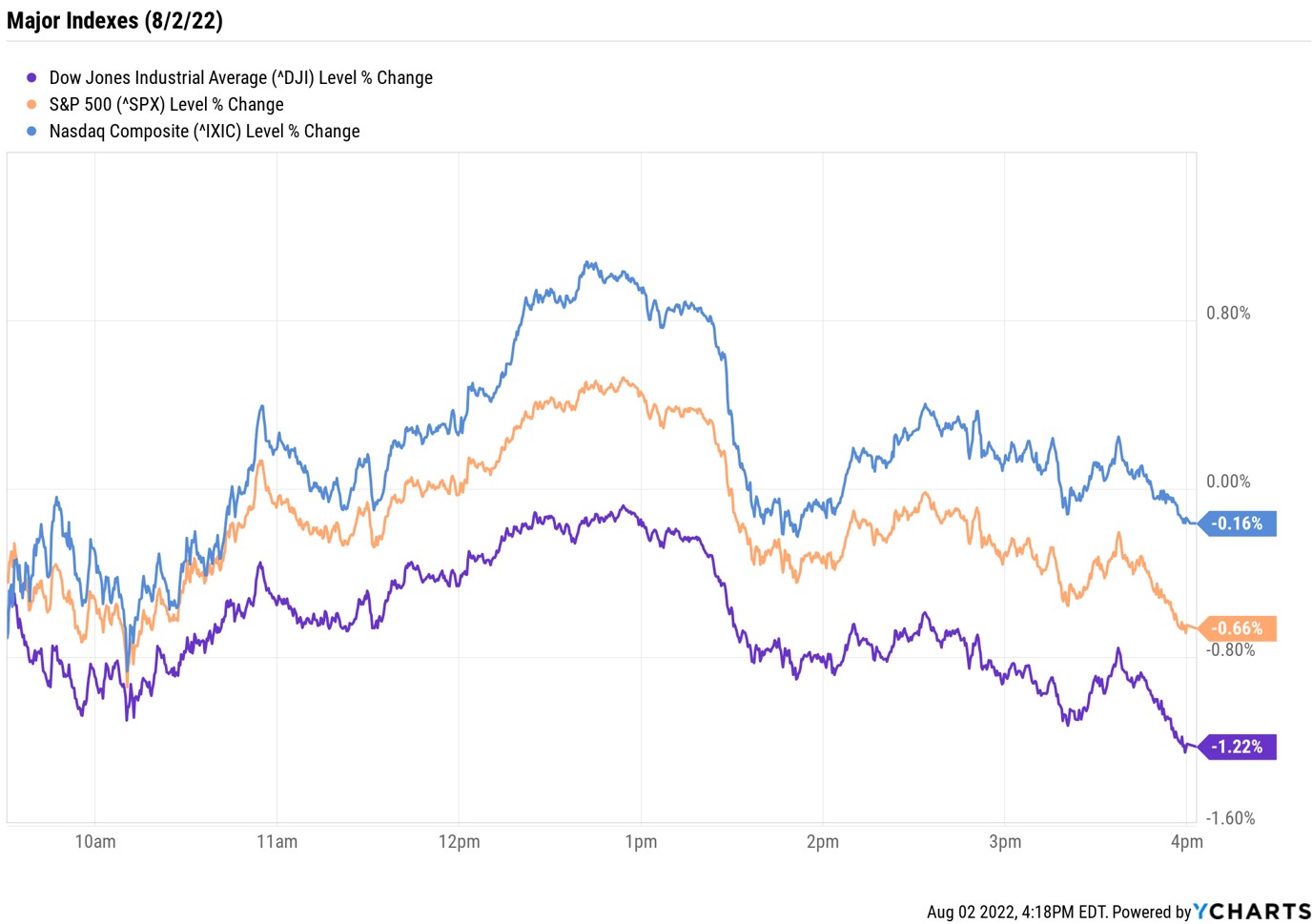

Caterpillar's loss weighed on the Dow Jones Industrial Average, which fell 1.2% to 32,396. The S&P 500 Index (-0.7% at 4,091) and Nasdaq Composite (-0.2% to 12,348) also ended in negative territory.

Other news in the stock market today:

- The small-cap Russell 2000 ended marginally lower at 1,882.

- U.S. crude futures gained 0.6% to settle at $94.42 per barrel.

- Gold futures rose 0.1% to $1,789.70 an ounce, their fifth straight win.

- Bitcoin edged down to $22,962.37. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Uber Technologies (UBER) soared 18.9% after the ride-hailing company reported adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) of $364 million and revenue of $8.07 billion in its second quarter. Plus, the company said gross bookings were up 33% year-over-year to $29.1 billion. "We are constructive on the risk/reward for the stock with positive share and margin trends," says BofA Global Research analyst Justin Post (Buy).

- Pinterest (PINS) spiked 11.6% today after the social media stock reported earnings. While PINS adjusted earnings per share of 11 cents and revenue of $666 million were both below analysts' estimates, global monthly users of 433 beat expectations. "PINS reported a mixed but better-than-feared second quarter and offered what we view as constructive commentary, indicating 1) positive revenue growth in 3Q (+MSD), 2) global MAUs should return to more normal seasonal growth trends in 2H, and 3) investment pace should moderate in 2023," says Wells Fargo analyst Brian Fitzgerald (Overweight). "While we believe some investors remain skeptical of PINS' Idea Pins content strategy, we see an emerging content consumption/creation flywheel and think PINS is making the right moves to drive engagement while continuing to refine relevance and shopping tools." Separately, activist investor Elliott Management last night confirmed that it is PINS biggest shareholder.

The Best Dividend Growth Stocks

There's likely more volatility ahead, which makes the case for high-quality stocks as strong as ever. True, the S&P 500 just marked its best month since November 2020 and its best July since 1939, says Savita Subramanian, head of equity and quantitative strategy at BofA Securities, but "we view this as a bear market rally."

No need for investors to be alarmed. Bear market rallies, which are simply short-term stock market rebounds amid a longer-term decline, are common, adds Subramanian. She points out that they have occurred 1.5 times, on average, in each bear market going back to 1929. But combine this with the fact that August and September are, historically, two of the weakest months for the S&P 500, the strategist says, and it's likely that volatility will continue. As such, she prefers high-quality stocks.

Investors looking for high-quality stocks will want to focus on those prioritizing shareholder-friendly initiatives like share buybacks or impressive yields, as these can help protect portfolios against broad-market downturns. They'll also want to consider the best dividend growth stocks, which can provide both income and capital appreciation over the long haul. Read on as we explore 10 such stocks that are expected to grow their dividends and revenue by at least 10% over the next two years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.