Stock Market Today: Energy Sector Drags on Stocks

The latest economic data showed slowdowns in both factory activity and construction spending.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks started August on shaky footing, with markets struggling to find direction following their best month since 2020.

Much of last week's gains came on the heels of well-received tech earnings. And while the earnings calendar heats up later this week, the main focus on Monday was economic data. Namely, the Institute for Supply Management's purchasing managers' index (PMI) – a measure of factory activity in the U.S. – fell to 52.8 in July from 53.0 in June.

"Manufacturing was still expanding in July, but at the slowest rate in over two years," says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial. "As demand slows and supply bottlenecks improve, we should expect a corresponding slowdown in inflation during the back half of this year."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Separately, the Commerce Department released data this morning that showed construction spending fell 1.1% month-over-month in June – due in part to a 3.1% drop in single-family homes (the largest one-month drop in this metric since the start of the pandemic). Economists had been expecting a 0.4% increase.

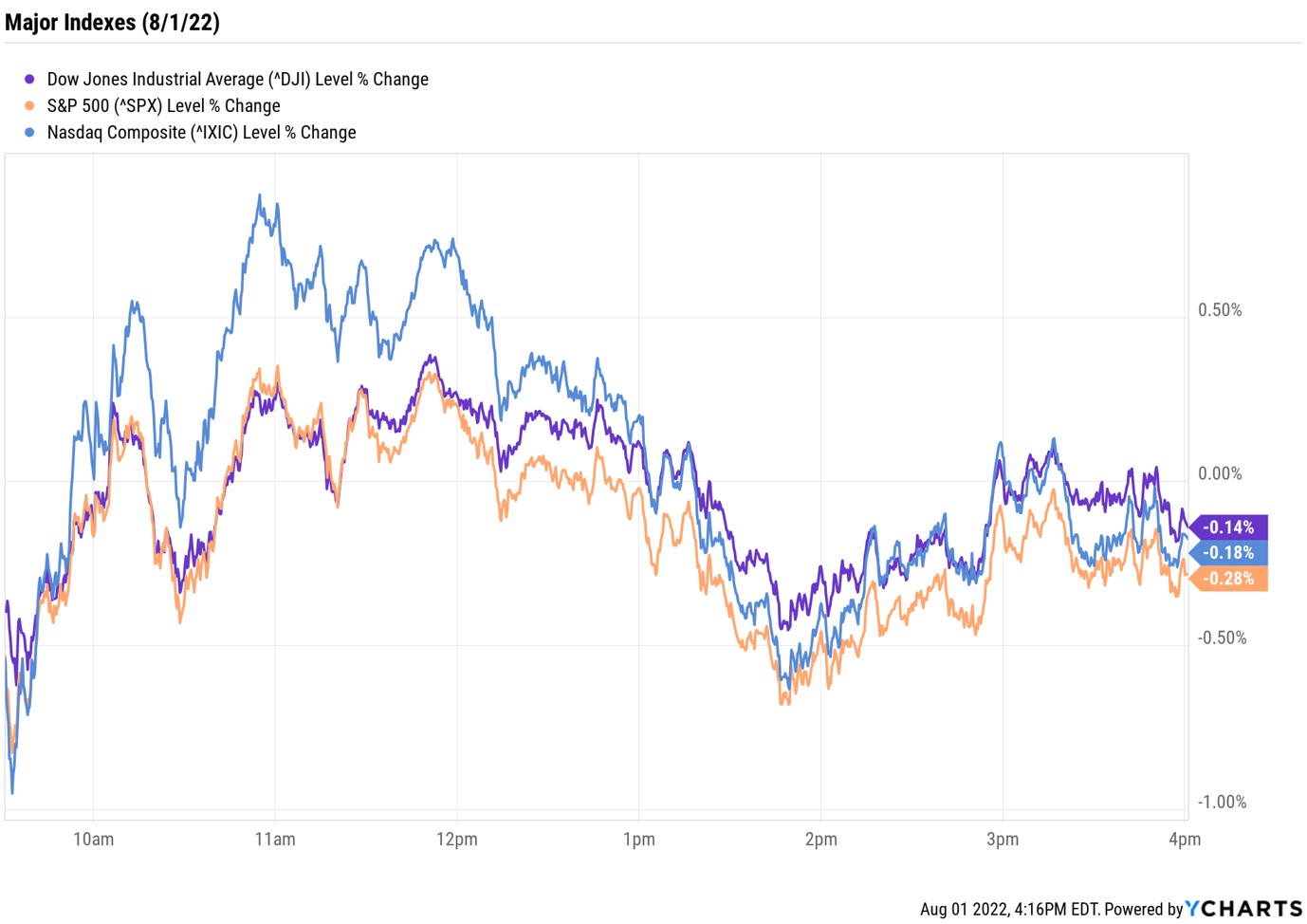

While markets spent most of the morning in positive territory, they turned lower around lunchtime – dragged down by the energy sector, which slumped 2.1% as U.S. crude futures plummeted 4.7% to $93.95 per barrel.

By the close, the Dow Jones Industrial Average was off 0.1% at 32,798, the S&P 500 Index was 0.3% lower at 4,118 and the Nasdaq Composite had given back 0.2% to end at 12,368.

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.1% to 1,883.

- Gold futures rose for a fourth straight day, gaining 0.3% to settle at $1,787.70 an ounce.

- Bitcoin shed 4% to $22,956.73.(Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Boeing (BA) was the best Dow Jones stock today, adding 6.1%. The surge in share price came amid media reports indicating the Federal Aviation Administration (FAA) on Friday said it would approve the company's plan to fix issues on planes before they are sent to customers. This will allow BA to resume deliveries of its 787 aircraft, which have been halted since May 2021.

- Target (TGT) jumped 1.3% after Wells Fargo analyst Edward Kelly upgraded the retail stock to Overweight from Equal Weight (the equivalents of Buy and Hold, respectively. "TGT's sell-off provides the opportunity to pick up a proven share gainer into an underappreciated earnings recovery at the right price, in our view," Kelly says. While the company deserves criticisms for its inventory missteps, it "took the earliest and biggest margin hit in retail, suggesting relatively lower risk from here and a faster recovery," he adds.

How to Prepare Your Portfolio for a Recession

Are we in a recession? That's the question that's been bouncing around since data released from the Commerce Department last Thursday showed the U.S. economy contracted for a second straight quarter in Q2.

While that meets the unofficial criteria for a recession, the official judge is the National Bureau of Economic Research – and they have yet to chime in. Still, plenty of experts have, including Cliff Hodge, chief investment officer for Cornerstone Wealth, who is pushing back on the notion that the U.S. economy is in a recession. "Personal consumption grew for the eighth straight quarter [in Q2]," he says. "Looking at the gains in spending alongside continued strength in payrolls, it's really difficult to call what we’re experiencing right now a recession."

So what does this mean for investors? Opportunity, says Kiplinger columnist James K. Glassman, who recently put together a tidy primer on how to invest for a recession. While we won't know for certain until the NBER makes the official call, there are plenty of areas of the market that are priced as if there will be one – and that presents an opportunity for investors. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Where's the Best Place to Save for a House Down Payment?

Where's the Best Place to Save for a House Down Payment?Learn how timing matters when it comes to choosing the right account.

-

We want our RMDs to fund a vacation with our kids and grandkids.

We want our RMDs to fund a vacation with our kids and grandkids.An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

The Roth Conversion Bandwagon is Rolling: Should You Jump On?

The Roth Conversion Bandwagon is Rolling: Should You Jump On?Roth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.