Stock Market Today: Big Tech Boosts Stocks to Best Month Since 2020

Positive earnings reactions for Amazon.com (AMZN) and Apple (AAPL) lifted the broader market today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks kept on rising Friday, as Amazon.com (AMZN) and Apple (AAPL) closed out a busy week of Big Tech earnings in fine fashion.

Amazon stock soared 10.4% after the e-commerce company reported a second-quarter top-line beat due in part to 33% year-over-year revenue growth in its cloud segment (Amazon Web Services) and an 18% jump in ad sales. AMZN also gave an upbeat current-quarter revenue outlook thanks to what it called a "record-breaking Prime Day."

Meanwhile, Apple shares gained 3.3% after the iPhone maker reported higher-than-expected earnings and revenue in its fiscal third quarter. However, the company's revenue growth rate slowed significantly when compared to the year-ago period.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the economic front, the personal consumption expenditures (PCE) index rose 6.8% on an annualized basis in June – its biggest year-over-year rise since January 1982. But, the headline figure might not be as jolting as it initially appears. "This inflation metric is for June and we know much has changed since then, especially gas prices, so investors should put this inflation report into historical context," says Jeffery Roach, chief economist for independent broker-dealer LPL Financial. He adds that July inflation rates should ease a bit as food and energy costs have likely pulled back this month.

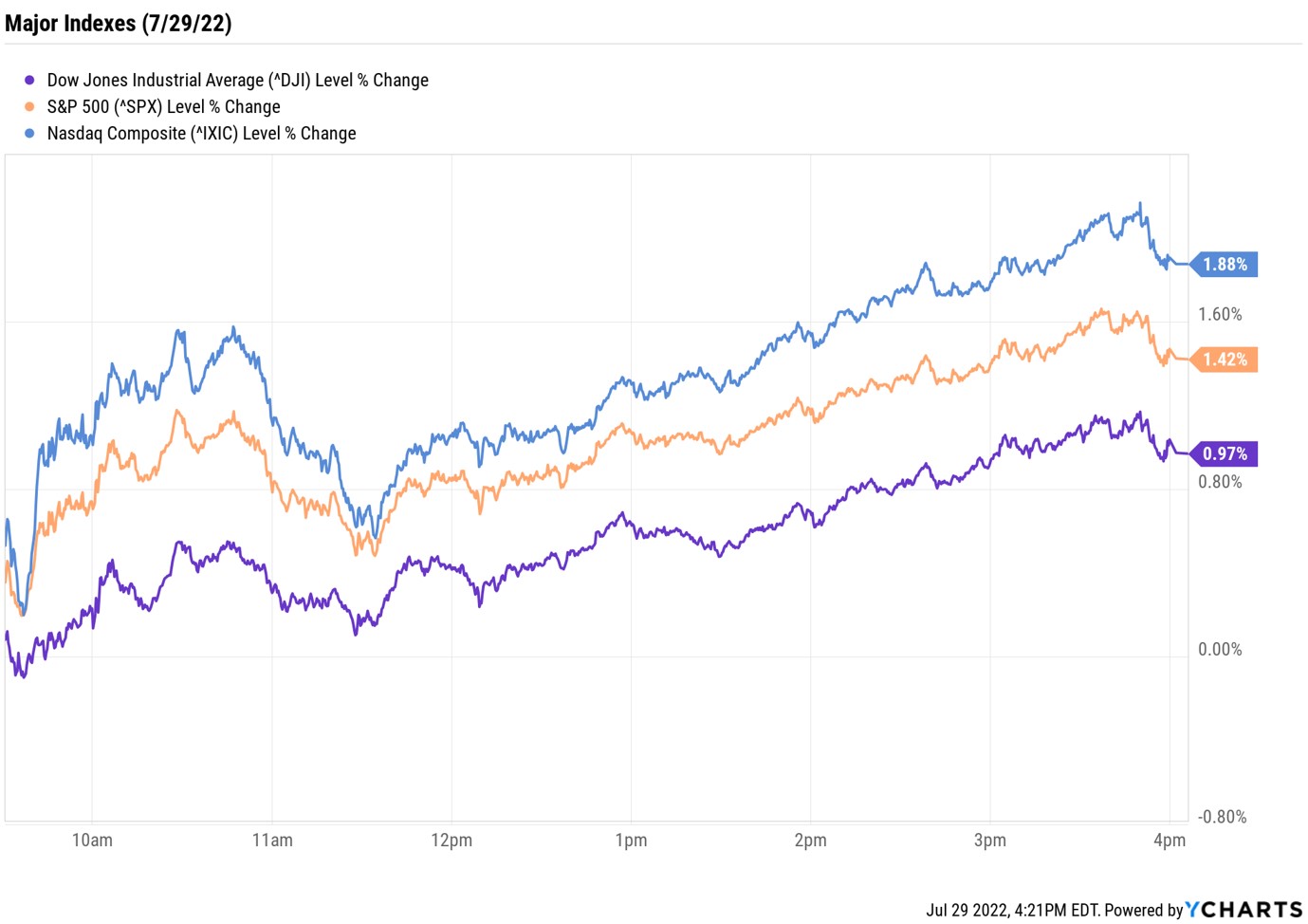

The tech-heavy Nasdaq Composite outpaced its peers, soaring 1.9% to 12,390, though the S&P 500 Index (+1.4% to 4,130) and Dow Jones Industrial Average (+1.0% to 32,845) still posted solid gains. All three indexes ended higher on a weekly basis. And for July, the Dow and S&P 500 had their best month since November 2020, while the Nasdaq enjoyed its biggest monthly gain since April 2020.

Other news in the stock market today:

- The small-cap Russell 2000 tacked on 0.7% to 1,885.

- U.S. crude futures jumped 2.3% to $98.62 per barrel.

- Gold futures rose 0.7% to finish at $1,781.80 an ounce.

- Bitcoin edged up 0.5% to $23,906. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Roku (ROKU) plummeted 23.1% after the streaming company reported earnings. ROKU reported a wider-than-anticipated loss of 82 cents per share in its second quarter, while revenue of $764 million also missed the mark. The company also forecast current-quarter revenue below analysts' consensus estimate due to a struggling advertising market. "Roku is facing various near-term challenges, including reduced variable advertising spending, and ongoing supply chain issues coupled with inflationary pressure have impacted smart TV sales," says Wedbush analyst Michael Pachter. "Meanwhile, Roku continues to invest heavily for future growth, resulting in unpalatable results for investors." But while the analyst called ROKU "dead money over the next quarter at least," he maintained an Outperform rating on the stock, expecting a rebound over the next 12 months.

- Oil majors Chevron (CVX) and Exxon Mobil (XOM) reported record profits in Q2 thanks to booming commodity prices. For the three-month period, CVX brought in adjusted earnings of $5.82 per share on $68.8 billion in revenue, while XOM reported adjusted earnings of $4.14 per share on $115.7 billion in revenue. Both energy stocks soared in reaction, with CVX up 8.7% and XOM spiking 4.7%.

What the Smart Money is Buying

Investors may be cheering as the stock market wraps up its best month of 2022, but that excitement could be fleeting, if history is any guide. "Analyzing monthly average returns for the S&P 500 back to 1950, the worst month [for stocks] is September, followed by August," says Gieseppe Sette, president of AI-driven investment research firm Toggle AI.

While we have covered numerous ways for investors to ride out rougher waters – think yield-friendly sectors like utilities or real estate investment trusts (REITs) – it sometimes pays to see what the "smart money" is doing during these volatile times. While you can't get rich by simply copying moves billionaire investors are making, their resources and connections give them unique insight into the market that most of us don't have, and that alone makes their top stock picks worth a closer look.

Karee Venema was long AMZN and AAPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.