Stock Market Today: Stocks Finish Mixed After Boffo Jobs Report

A far-better-than-expected June employment situation might tamp down recessionary fears, but it also might clear the Fed for more aggressive rate-hiking.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A whopper of a June jobs report landed in Wall Street's lap Friday morning, and it kept investors and traders guessing all session.

Anyone looking to the Bureau of Labor Statistics' latest employment situation for signs of a coming recession walked away mighty disappointed. The U.S. added 372,000 nonfarm payroll jobs last month, shattering consensus forecasts for 265,000. The unemployment rate held firm at 3.6% for the fourth consecutive month. And aggregate hours worked by private workers was up another 2.6% annualized during 2022's second quarter, following 3.4% annualized growth in Q1.

"You just don't see that in a recession," says Bill Adams, chief economist for Comerica Bank.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Indeed, Adams believes between that and average monthly payroll job growth of 457,000 during the first half of the year, "it would be no surprise to see the first quarter's contraction in GDP revised to growth as statistical agencies get more complete information to measure the economy; GDP is hard to measure in real time and subject to many revisions."

This good news for the U.S. economy got a more nuanced reaction from the stock market, as some experts think the Federal Reserve could continue an aggressive pace of interest-rate hikes if the economy has strength to bear them.

Jason Pride, chief investment officer of private wealth at wealth management firm Glenmede, says of the central bank's dual mandate of full employment and low inflation: "For the time being, [full employment] appears intact, affording the Fed the flexibility to tackle its price stability goal head-on. While next week's [consumer price index] print will be the next important indicator to watch, today's jobs report likely gives the Fed headway for another 75-basis-point rate hike later this month."

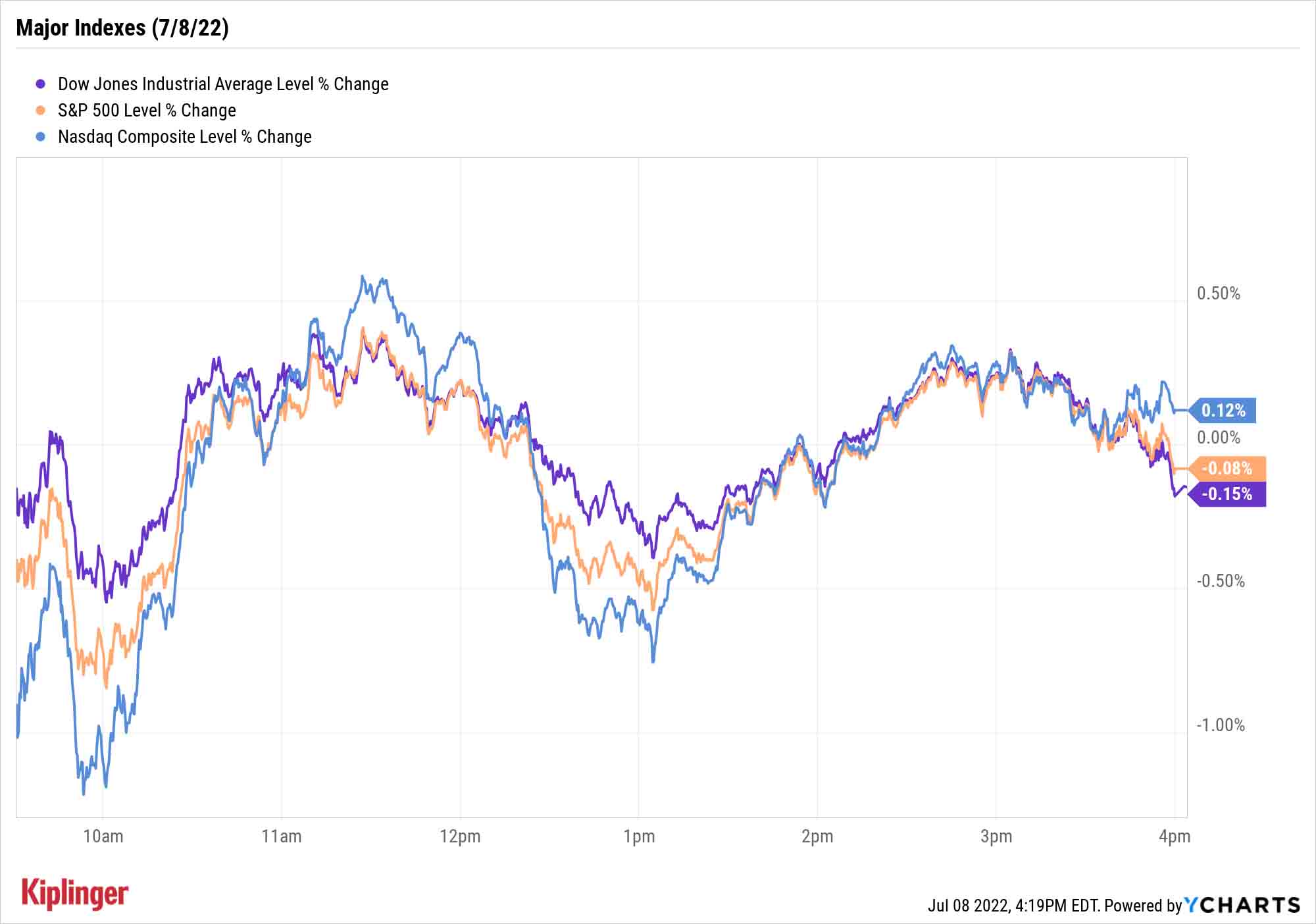

Stocks swung between shallow losses and gains throughout the day before settling with mixed results. The Nasdaq Composite (+0.1% to 11,635) closed in the black for the fifth consecutive session. However, Friday marked the end of winning streaks for the Dow Jones Industrial Average (-0.2% to 31,338) and S&P 500 (down marginally to 3,899).

Other news in the stock market today:

- The small-cap Russell 2000 was marginally lower to 1,768.

- U.S. crude oil futures gained 2% to end at $104.79 per barrel, but still finished the week down more than 3%.

- Gold futures edged up 0.2% to close at $1,742.30 an ounce. For the week, gold futures gave back more than 3%.

- Bitcoin also finished with a tiny gain, of 0.1%, to $21,811.80. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR) fell 5.1% after a report in The Washington Post on Thursday suggested Tesla (TSLA, +2.5%) CEO Elon Musk's plans to buy the social media platform for $44 billion could fall through. Citing people familiar with the matter, the article said Musk's team has pulled back on talks with investors in recent weeks amid concerns over an unverified number of spam accounts on Twitter. "We believe the chances of a deal ultimately happening are currently at ~60% with a renegotiated bid at a lower price likely in the $42-$45 range due to the fake account issue," says Wedbush analyst Dan Ives, who has a Neutral (Hold) rating on TWTR stock. "There is still a ~35% chance Musk decides to walk away from the deal, try to pay the $1 billion breakup fee, and likely end up in a nasty court battle with Twitter's Board for the coming months." As for the current bid of $54.20 per TWTR share, Ives says that is "essentially out the window" at this point.

- Upstart Holdings (UPST) was one of the biggest decliners on the Street today, shedding 19.7% after the consumer lending firm last night lowered its second-quarter revenue guidance, now expecting sales to arrive around $228 million compared to its previous forecast of $295 million to $305 million. UPST also said its quarterly net loss will range from $27 million to $31 million, wider than its prior guidance for a loss of $4 million to $0 million. In a press release, Dave Girouard, co-founder and CEO of Upstart, pointed to "inflation and recession fears" that have driven interest rates up and put banks and capital markets on cautious footing." Wedbush analyst David Chiaverini maintained an Underperform (Sell) rating on UPST stock. "The company has yet to operate through a true recession which means its underwriting model has yet to be battle-tested," the analyst says. "We fear that weakening delinquency and loss trends combined with macro- and geopolitical risks could lead to waning appetite from Upstart's credit buyers and the securitization market."

What Do Q2 Earnings Have in Store?

Coming up next week: the start of a pivotal second-quarter earnings season. The earnings calendar will kick off with reports from the likes of Delta Air Lines (DAL), JPMorgan Chase (JPM) and UnitedHealth Group (UNH). And despite Friday's encouraging employment news, a broader cadence of data pointing toward an eventual recession has some gloomy about the coming earnings season.

Lindsey Bell, chief markets and money strategist for Ally Invest, isn't necessarily one of them.

"There are plenty of reasons to be cautiously optimistic heading into what could be a volatile Q2 earnings season," she says. "Several companies have already cut profit outlooks while others have hinted at the broad economic backdrop being not so bad. With estimates having been reduced in some key sectors and stock prices down big from earlier this year, the bar might be low enough to spark a near-term rally."

Cautious sentiment is often best met with prudent positioning. You ultimately want your portfolio to be able to harness any surprise upside without gambling on unproven stocks with lousy fundamentals.

One way to thread that needle can be found within the Dividend Aristocrats. A reminder: The Aristocrats are a group of 65 dividend stocks that have raised their annual payout in each of the past 25 years – at a minimum. But even within this subset of income-producing royalty, you can give yourself an even higher chance at success.

The 12 Dividend Aristocrats we're featuring today don't just have a fantastic dividend track record – they're also trading at fire-sale prices and boasting higher yields than they historically do. Take a look.

This is Senior Investing Editor Kyle Woodley, letting you know it's my final day with Kiplinger. I'm extremely grateful for getting to serve Kiplinger readers for the past few years, and I wish you both good health and good fortune.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.