Stock Market Today: Stocks Earn a Decent End to a Dreadful Week

Friday's mild up day had a "dead-cat bounce" feel to it, as lousy manufacturing data and continued recession fears didn't provide much reason to the rally.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

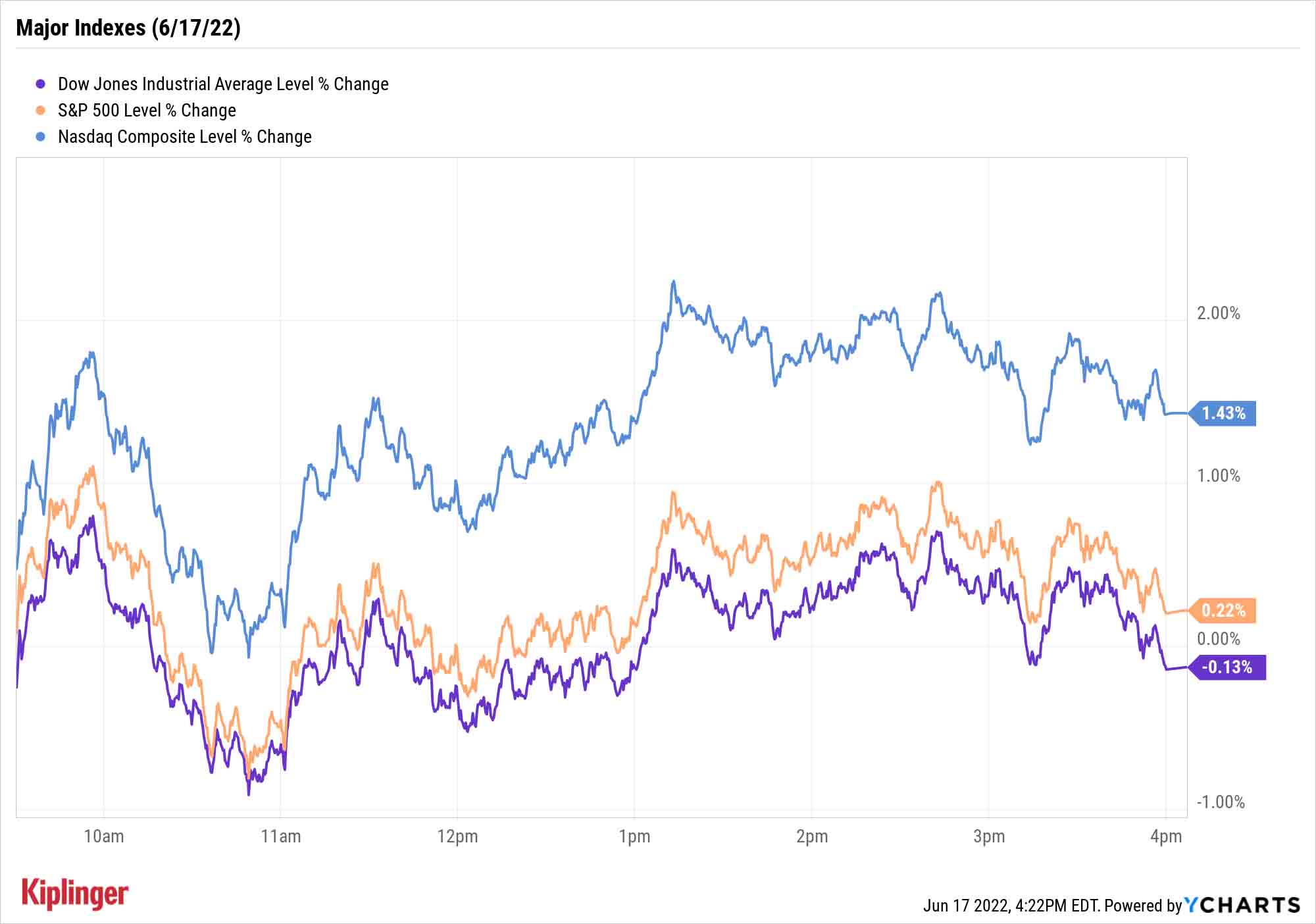

A Friday rally still left the major indexes significantly lower over the past five days of trading.

There wasn't much good news to which to credit Friday's move. U.S. industrial production improved less than expected in May, up 0.2% versus estimates for 0.4%; manufacturing actually declined by 0.1%. Wells Fargo economists Tim Quinlan and Shannon Seery defend the release as "actually a decent report," however, noting that an upward revision to April's number (+1.4% from +1.1%) puts May's level of output slightly above expectations.

Edward Moya, senior market strategist at currency data provider OANDA, says that yesterday's selloff might have been overdone. This quarter's "quadruple witching" event – the simultaneous expiration of stock and stock-index futures and options – "may have accelerated the selling pressure leading up to today," he says.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. equities remained faithful to their 2022 narrative, with rate-sensitive stocks recovering most briskly as the 10-year Treasury yield cooled to as low as 3.19%. Communication services (+1.4%) and technology (+0.9%) shares were among the leaders; Charter Communications (CHTR, +6.4%) rebounded somewhat from yesterday's gashing, with T-Mobile US (TMUS, +2.7%) and Salesforce.com (CRM, +2.1%) among Friday's noteworthy winners.

The energy sector (-5.5%) was pummeled again, however, as U.S. crude oil prices sank (by 6.8% to $109.56 per barrel) as investors weighed both a possible downturn in demand amid global recessionary fears and the potential for higher supplies as U.S. production ramps up.

The end result was a nice 1.4% snap-back (to 10,798) for the Nasdaq Composite, which nonetheless finished the week with a 4.8% decline. The S&P 500 (+0.2% to 3,674) modestly improved to close the week down 5.8%, while the Dow Jones Industrial Average let its lead slip away and lost 0.1% to 29,888, ending the five-day period off 4.8%.

And a reminder: The stock market will be closed on Monday in observance of Juneteenth.

Other news in the stock market today:

- The small-cap Russell 2000 was bid 1.0% higher to 1,665.

- Gold futures fell 0.5% to settle at $1,840.60 an ounce.

- Bitcoin finished its week with a 1.6% decline to $20,512.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Seagen (SGEN) jumped 12.7% amid buzz that blue-chip pharmaceutical firm Merck (MRK, -0.7%) is considering buying the biotech. Citing people familiar with them atter, a report in The Wall Street Journal suggested talks have been going on for awhile, but regulatory concerns exist. The acquisition would reportedly help the Dow Jones stock boost its portfolio of cancer treatments, which is currently led by blockbuster drug Keytruda.

- The AZEK Company (AZEK) gained 6.2% after BofA Global Research analyst Rafe Jadrosich upgraded the building products manufacturer to Buy from Hold. The bullish note came in the wake of AZEK's analyst day, where the company forecast average annual revenue growth of 10% through 2027. Plus,"Azek is now trading roughly in-line with the building product group despite a significant material conversion opportunity in composite decking," says Jadrosich. "In the last down cycle, decking only declined 20%. We would anticipate the composite decking companies to outperform the overall market given the acceleration of the conversion trend over the last two years."

Accept the Volatility (And Profit During It)

There's no gussying it up: This was a gut-wrenching week for most anyone with a stake in the market. And while strategists largely remain optimistic about stocks' long-term prospects, investors might need to gird themselves for more of the tumultuous same over the coming months.

"Volatility and a bearish sentiment seem to have descended permanently on the US market for quite some time," says Kunal Sawhney, CEO of Australian research firm Kalkine Group. "Inflation, impending recession, global economic slowdown and other macroeconomic fallouts of the Russia-Ukraine crisis have weighed heavily on investors. Hence, invariably, the U.S. stock market has become unsettled with a different outcome every day. If indexes end higher on one day, they drift lower the next."

Investors can lean on a few areas of the market to settle their stomachs, however. Dividend-happy utility and real estate stocks, for instance, have provided some protection of late.

But you don't have to silo yourself to one or two sectors.

UBS recently highlighted 43 stocks from across the market that look like attractive ways to profit during the market's carnage. UBS focused on stocks where its analysts have "a truly differentiated view vs. the consensus, and where we have interesting or proprietary data sources." If you're a nimble investor looking to not just protect yourself, but generate a little alpha amid the chaos, read on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Small Caps Hit a New High on Rate-Cut Hope: Stock Market Today

Small Caps Hit a New High on Rate-Cut Hope: Stock Market TodayOdds for a December rate cut remain high after the latest batch of jobs data, which helped the Russell 2000 outperform today.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.