Stock Market Today: Stocks Earn a Decent End to a Dreadful Week

Friday's mild up day had a "dead-cat bounce" feel to it, as lousy manufacturing data and continued recession fears didn't provide much reason to the rally.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

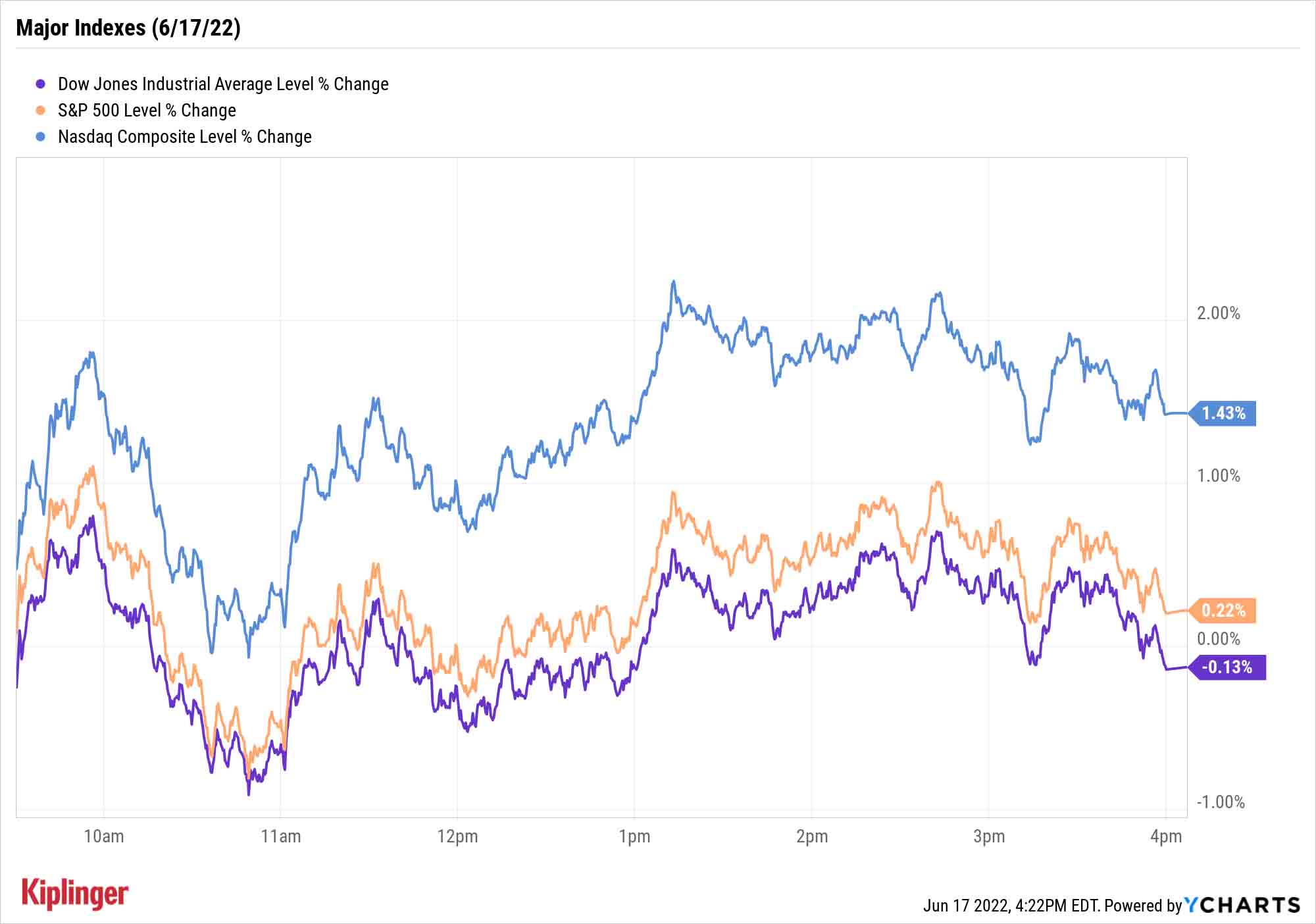

A Friday rally still left the major indexes significantly lower over the past five days of trading.

There wasn't much good news to which to credit Friday's move. U.S. industrial production improved less than expected in May, up 0.2% versus estimates for 0.4%; manufacturing actually declined by 0.1%. Wells Fargo economists Tim Quinlan and Shannon Seery defend the release as "actually a decent report," however, noting that an upward revision to April's number (+1.4% from +1.1%) puts May's level of output slightly above expectations.

Edward Moya, senior market strategist at currency data provider OANDA, says that yesterday's selloff might have been overdone. This quarter's "quadruple witching" event – the simultaneous expiration of stock and stock-index futures and options – "may have accelerated the selling pressure leading up to today," he says.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. equities remained faithful to their 2022 narrative, with rate-sensitive stocks recovering most briskly as the 10-year Treasury yield cooled to as low as 3.19%. Communication services (+1.4%) and technology (+0.9%) shares were among the leaders; Charter Communications (CHTR, +6.4%) rebounded somewhat from yesterday's gashing, with T-Mobile US (TMUS, +2.7%) and Salesforce.com (CRM, +2.1%) among Friday's noteworthy winners.

The energy sector (-5.5%) was pummeled again, however, as U.S. crude oil prices sank (by 6.8% to $109.56 per barrel) as investors weighed both a possible downturn in demand amid global recessionary fears and the potential for higher supplies as U.S. production ramps up.

The end result was a nice 1.4% snap-back (to 10,798) for the Nasdaq Composite, which nonetheless finished the week with a 4.8% decline. The S&P 500 (+0.2% to 3,674) modestly improved to close the week down 5.8%, while the Dow Jones Industrial Average let its lead slip away and lost 0.1% to 29,888, ending the five-day period off 4.8%.

And a reminder: The stock market will be closed on Monday in observance of Juneteenth.

Other news in the stock market today:

- The small-cap Russell 2000 was bid 1.0% higher to 1,665.

- Gold futures fell 0.5% to settle at $1,840.60 an ounce.

- Bitcoin finished its week with a 1.6% decline to $20,512.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Seagen (SGEN) jumped 12.7% amid buzz that blue-chip pharmaceutical firm Merck (MRK, -0.7%) is considering buying the biotech. Citing people familiar with them atter, a report in The Wall Street Journal suggested talks have been going on for awhile, but regulatory concerns exist. The acquisition would reportedly help the Dow Jones stock boost its portfolio of cancer treatments, which is currently led by blockbuster drug Keytruda.

- The AZEK Company (AZEK) gained 6.2% after BofA Global Research analyst Rafe Jadrosich upgraded the building products manufacturer to Buy from Hold. The bullish note came in the wake of AZEK's analyst day, where the company forecast average annual revenue growth of 10% through 2027. Plus,"Azek is now trading roughly in-line with the building product group despite a significant material conversion opportunity in composite decking," says Jadrosich. "In the last down cycle, decking only declined 20%. We would anticipate the composite decking companies to outperform the overall market given the acceleration of the conversion trend over the last two years."

Accept the Volatility (And Profit During It)

There's no gussying it up: This was a gut-wrenching week for most anyone with a stake in the market. And while strategists largely remain optimistic about stocks' long-term prospects, investors might need to gird themselves for more of the tumultuous same over the coming months.

"Volatility and a bearish sentiment seem to have descended permanently on the US market for quite some time," says Kunal Sawhney, CEO of Australian research firm Kalkine Group. "Inflation, impending recession, global economic slowdown and other macroeconomic fallouts of the Russia-Ukraine crisis have weighed heavily on investors. Hence, invariably, the U.S. stock market has become unsettled with a different outcome every day. If indexes end higher on one day, they drift lower the next."

Investors can lean on a few areas of the market to settle their stomachs, however. Dividend-happy utility and real estate stocks, for instance, have provided some protection of late.

But you don't have to silo yourself to one or two sectors.

UBS recently highlighted 43 stocks from across the market that look like attractive ways to profit during the market's carnage. UBS focused on stocks where its analysts have "a truly differentiated view vs. the consensus, and where we have interesting or proprietary data sources." If you're a nimble investor looking to not just protect yourself, but generate a little alpha amid the chaos, read on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.