Stock Market Today: Stocks Slide as ECB Unveils Rate-Hike Plan

Wall Street also weighed a five-month high in weekly jobless claims.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks extended this week's decline on Thursday amid another choppy trading session. The focus today was on the latest European Central Bank (ECB) meeting – which comes ahead of next week's policy update from the Federal Reserve. While the ECB maintained the status quo for now, it unveiled plans to raise rates, likely by 25 basis points (a basis point is one-one hundredth of a percentage point), or 0.25%, in July and again in September. It also said it would end its bond-buying program on July 1.

Meanwhile, back at home, data from the Labor Department showed that weekly jobless claims rose 27,000 to a seasonally adjusted 229,000 in the week ended June 3 – their highest level since mid-January.

"The market has been searching for some direction amid a relatively quiet week on the economic data front," says Mike Loewengart, managing director of Investment Strategy at E*TRADE. "A bump up in jobless claims may not be the catalyst, but in a perverse way, a rise in jobless claims could be one indicator that the Fed’s rate-hike plan is slowing demand and could stick the landing. But with a Fed decision on the horizon and with the ECB signaling rate hikes in its future, investors will likely continue to be in 'wait and see' mode."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

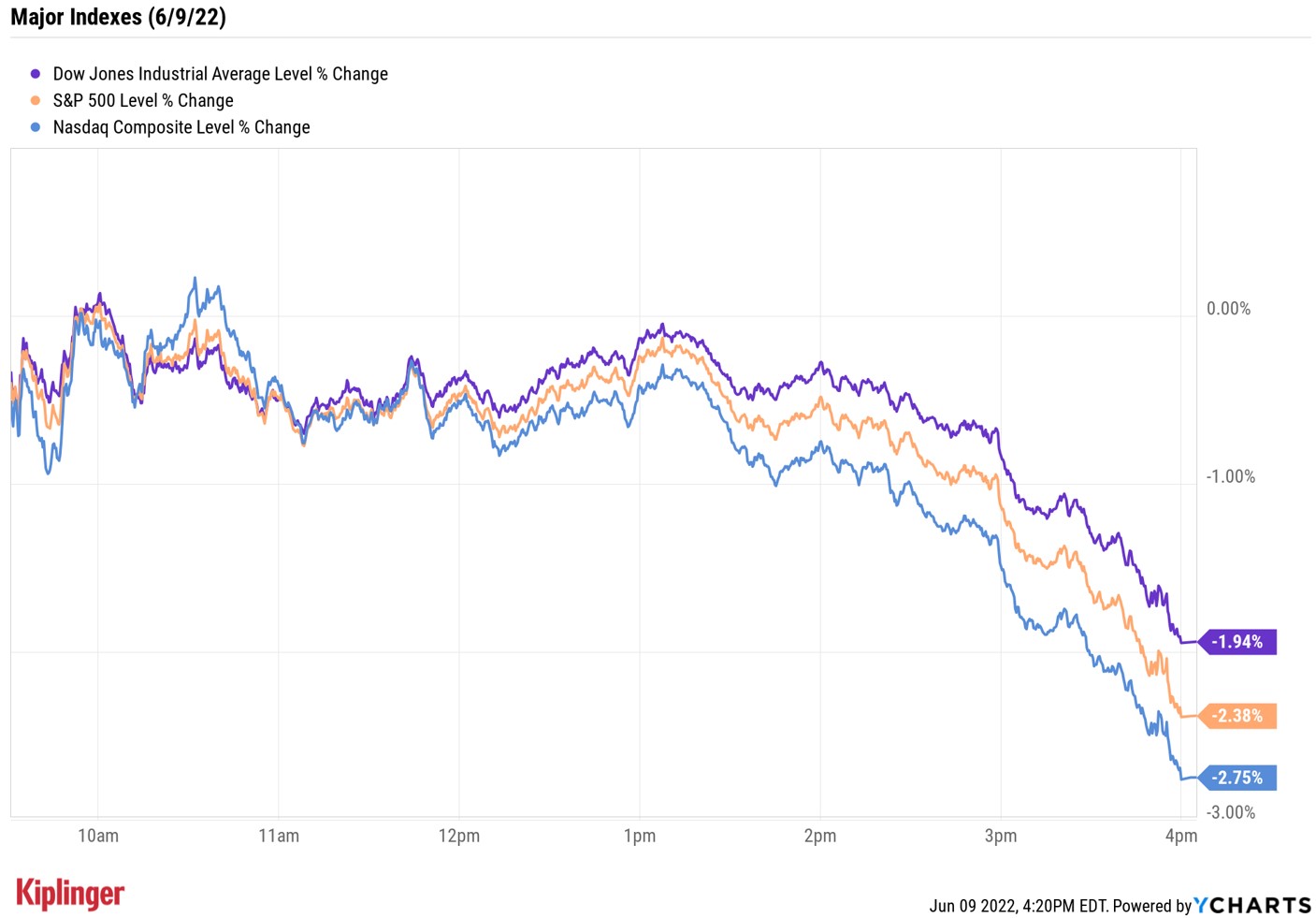

The "wait and see" mode was evident early on in today's trading, but losses for the broad-market indexes accelerated as the session wore on ahead of tomorrow morning's release of the latest consumer price index (CPI). The selling was widespread too, with all 11 sectors finishing in the red, led by big drops for financials (-2.5%) and technology (-2.7%).

At the close, the Dow Jones Industrial Average was down 1.9% to 32,272, the S&P 500 Index fell 2.4% to 4,017 and the Nasdaq Composite – which briefly traded in positive territory mid-morning – plunged 2.8% to 11,754.

Other news in the stock market today:

- U.S. crude futures fell 0.3% to settle at $121.63 per barrel.

- Gold futures slipped 0.2% to end at $1,852.80 an ounce.

- Bitcoin edged down 0.3% to $29,989.54. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- It's been a rough stretch for Target (TGT), with the consumer discretionary stock down more than 30% in the past month following a negative earnings reaction and current-quarter operating margin warning. The retailer today tried to right the ship by announcing that it is hiking its quarterly dividend by 20% to $1.08 per share, but shares still slid 1.4%. Despite the recent woes, Argus Research analyst Chris Graja maintained his Buy rating. While risks remain, such as reduced consumer spending amid elevated inflation and higher commodity costs, "we believe that Target has the right strategy and has made the right investments to gain market

share over time," Graja writes in a note. - Cruise stocks were some of the biggest decliners on Wall Street today, with Carnival (CCL), Royal Caribbean Cruises (RCL) and Norweigian Cruise Line Holdings (NCLH) shedding 9.3%, 8.3% and 9.2%, respectively.

Time to Jump Back Into Small Caps?

Small-cap stocks also suffered significant losses in today's trading, with the Russell 2000 index shedding 2.1% to end at 1,850. The benchmark has lagged its larger-cap peers over the past 12 months, down 19.3% (compared to losses of 6.7% for the Dow, 5.0% for the S&P 500 and 15.6% for the Nasdaq). Given this lengthy stretch of underperformance, are the tides set to turn for small caps?

"Small-cap stocks tend to be relatively high beta, implying that they outperform when the economic environment is improving," BCA Research says in a note. "Slowing global growth is therefore a headwind for small-cap stocks. Moreover, they are more vulnerable to negative dynamics from inflationary pressures due to their typically smaller profit margins."

However, the investment research firm asserts that the longer-term underperformance of small caps could suggest that many of these growth concerns are already priced in. Plus, many smaller cap stocks are now "extremely attractive on a valuation basis, which could support their performance going forward," BCA adds.

Investors who are looking to dip their toes into small caps – but are still wary of potential risks – may want to consider these exchange-traded funds (ETFs), which help provide more diversified exposure. But for those ready to dive right in, here are 12 of Wall Street's favorite small-cap stocks right now. We scoured the Russell 2000 to find the top-rated picks among small companies, and each name featured here is projected to deliver outsized returns over the next 12 months or so. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.