Stock Market Today: Stocks Stumble to Start But End With a Win

The major indexes started the day lower on Microsoft's weak guidance, but rallied into the close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks endured another roller-coaster session on Thursday as investors weighed a weak forecast from one tech giant, the latest comments on the Federal Reserve's rate-hike timeline and mixed jobs data.

Microsoft (MSFT, +0.8%) was the main catalyst for the broader market's slow start this morning. The Redmond, Washington-based software developer lowered its current-quarter sales and earnings guidance citing the impact from a stronger U.S. dollar, which is currently trading near a 20-year high relative to its global counterparts.

MSFT now expects fiscal fourth-quarter revenue to arrive between $51.94 billion and $52.74 billion, down from its prior outlook for sales of $52.40 billion to $53.20 billion; and earnings per share of $2.24 to $2.32, compared to previous guidance for earnings of $2.28 per share to $2.35 per share.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also on Thursday, Federal Reserve Vice Chair Lael Brainard said in an interview on CNBC that it is too early to tell if inflation has peaked and that it is "reasonable" for the central bank to issue 50 basis-point (a basis point is one-one hundredth of a percentage point) rate hikes at each of its next two meetings (in June and July). The Fed will need to see more current economic data to determine the appropriate path forward from there – though the central bank is unlikely to pause raising rates, she added.

And ahead of tomorrow's May nonfarm payrolls update, data from ADP showed the U.S. added a much lower-than-expected 128,000 jobs last month. Separately, a report from the Labor Department indicated weekly jobless claims fell by 11,000 to 200,000 in the week ended May 28.

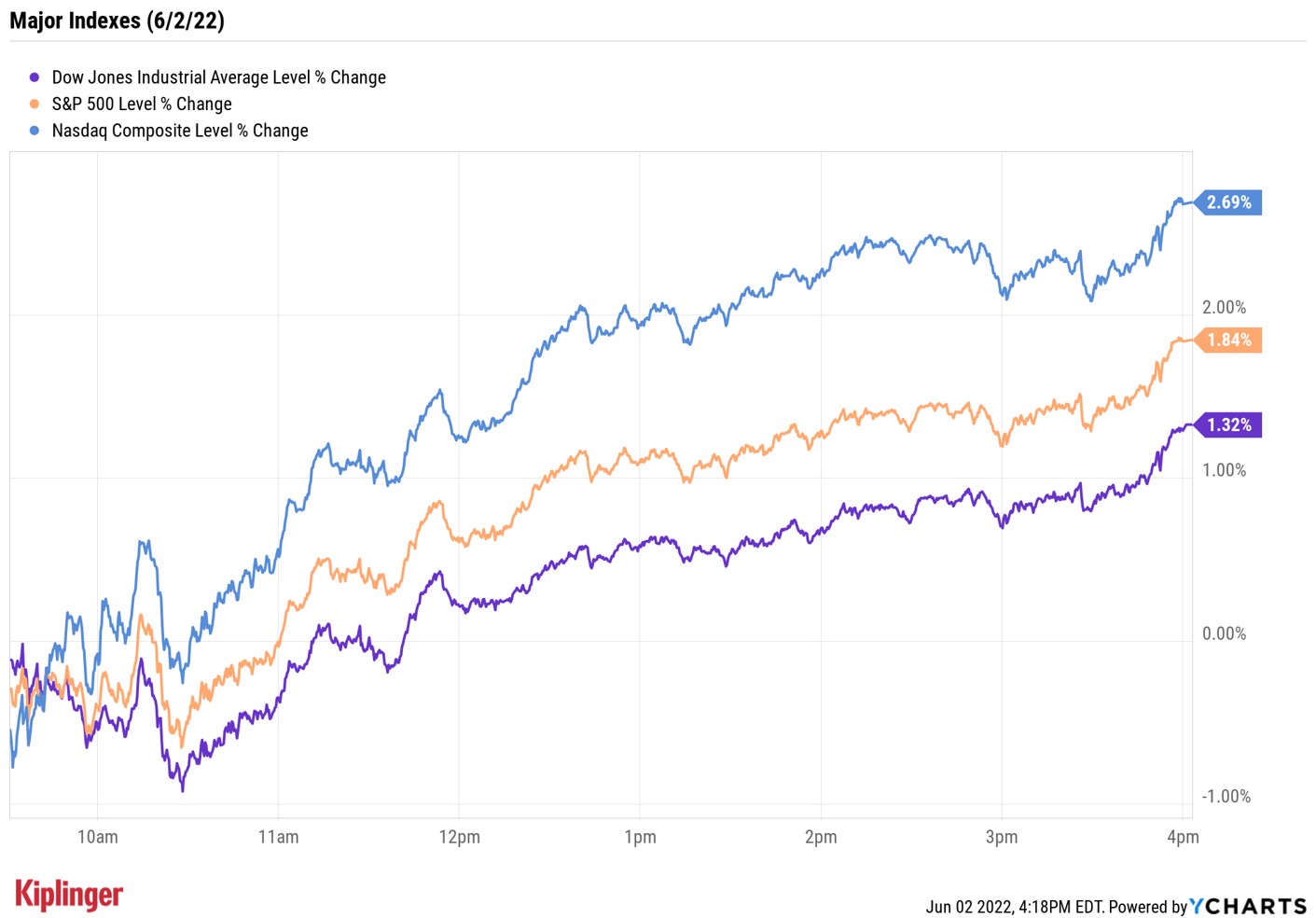

The broader markets spent most of the morning in negative territory, but were higher by lunchtime and closed near their intraday peaks. The Nasdaq Composite finished up 2.7% at 12,316, the S&P 500 Index gained 1.8% to 4,176 and the Dow Jones Industrial Average was 1.3% higher at 33,248.

Other news in the stock market today:

- The small-cap Russell 2000 spiked 2.3% to 1,897.

- U.S. crude futures gained 1.4% to settle at $116.87 per barrel after OPEC+ agreed to boost production to 648,000 barrels per day from 432,000 barrels per day.

- Gold futures gained nearly 1.4% to finish at $1,873.60 an ounce.

- Bitcoin edged up 0.5% to $30,262.62. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Chewy (CHWY) jumped 24.2% after the online pet supplies retailer reported earnings. In its first quarter, CHWY reported a per-share loss of 4 cents on revenue of $2.43 billion, beating analysts' estimates for a per-share loss of 14 cents and revenue of $2.42 billion. "CHWY protected margins during the first quarter by raising prices to offset costs and managing advertising tightly (lowest % of sales on record) but lost customers along the way – net ads declined for the first time as a public company and could still be negative in the second quarter," says Needham analyst Anna Andreeva. While Andreeva raised her full-year revenue and EBITDA (earnings before interest, taxes, depreciation and amortization), she maintained a Hold rating. "We think both positive net ads and margin expansion are necessary for the story to work from here," the analyst adds.

- Generac Holdings (GNRC) spiked 10.3% after UBS Global Research analyst Jon Windham (Buy) named the industrial stock a "top pick" in alternative energy. "We forecast GNRC's clean energy revenues to grow from ~$550 million in 2022 estimates to $1.7 billion by 2026 estimates (~ 23% revenue)," Windham says. "GNRC's diverse product suite, dominant market position in home standby power, and existing national installer network are hard to replicate assets that in our view position GNRC as a long-term winner in the emerging U.S. smart home energy market." The analyst also said Generac stock provides an "attractive buying opportunity" following its nearly 24% year-to-date decline.

Are Brighter Skies Ahead for Investors?

This could be the case, say Jeff Buchbinder and Ryan Detrick, equity strategist and market strategist, respectively, at independent broker-dealer LPL Financial, but it will require investors to look through some heavy cloud cover.

"We fully acknowledge how tough it is to see the bull case for stocks right now, and a retest of recent lows is certainly possible," the strategists say, but they believe a second-half recovery could be in the cards.

For starters, the two expect inflation pressures will likely ease over the next seven months should progress be made on supply-chain disruptions, the Ukraine war and the labor front (specifically, more workers entering the market). And since lower inflation tends to support higher valuations, this could be a "powerful combination" alongside solid earnings momentum to help get the S&P 500 back into the green by year-end, Buchbinder and Detrick contend.

A second-half recovery could spell good things for growth stocks, which have been particularly beat down in 2022's market meltdown. And while investors still need to be prudent when sifting through the rubble, this sharp selloff has some of Wall Street's most coveted stocks trading at much more attractive valuations.

These growth-at-a-reasonable price (GARP) stocks, for instance, are all attractively priced but are still expected to grow earnings by double digits over the next year. Another potential source of inspiration is this list of top-rated high-growth stocks that analysts expect will see an average of 20% earnings and revenue growth over a two-year timeframe. While many of the names featured here have had a rough 2022, investors with a long-term horizon may want to take a closer look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.