Stock Market Today: Wall Street Rallies Around Reassuring Retail Data

Airlines, semiconductors among several pockets of relative strength in an overall strong Tuesday session for the broader indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market enjoyed a broad rebound Tuesday as fresh economic data suggested the U.S. consumer is still shopping strong.

The U.S. Census Bureau said today that April retail sales improved by 0.9% over March. Though that was slightly less than the 1.0% expected, there was a show of strength in the significant upward revision to March's numbers, to 1.4% growth from 0.5% originally.

"To the extent that markets are worried about a growth slowdown, this is good news, but it is also a further catalyst for the Fed to raise rates even higher to get inflation under control," says Chris Zaccarelli, chief investment officer for registered investment advisor Independent Advisor Alliance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While Zaccarelli joins other names in believing a recession is unlikely in 2022, "the Fed is going to need to raise interest rates to a point where they are likely to cause a recession in 2023 or 2024, and that gives us cause for concern," he says.

Despite the promising retail data, success in retail stocks wasn't a gimme.

Walmart (WMT, -11.4%) plunged after delivering a mixed quarterly report. Revenues improved 2.4% year-over-year to $141.6 billion to easily top expectations, and Walmart lifted its full-year sales outlook. However, that windfall is coming from cost-conscious consumers flocking to its grocery aisle, which has lower margins than its other offerings. This, as well as supply-chain problems and other headwinds, caused Walmart to report profits of $1.30 per share that were well short of estimates, and to lower its income forecast for 2022.

Home Depot (HD, +1.7%) fared better, however, after delivering record fiscal first-quarter sales and upgrading its full-year outlook.

"Walmart's report this week basically confirmed all the negative scenarios that you would expect given inflationary pressures and rising interest rates," says David Keller, chief market strategist at StockCharts.com. But he added that "Home Depot's report had a much more encouraging tone as consumers fueled a strong earnings win for the company."

Other pockets of strength Tuesday included airline stocks such as American Airlines (AAL, +7.7%) and Delta Air Lines (DAL, +6.7%), which were boosted by United Airlines' (UAL, +7.9%) higher second-quarter revenue outlook. Semiconductor stocks including Micron Technology (MU, +5.7%) and Qualcomm (QCOM, +4.3%) also rallied around Piper Sandler's upgrade of Advanced Micro Devices (AMD, +8.7%).

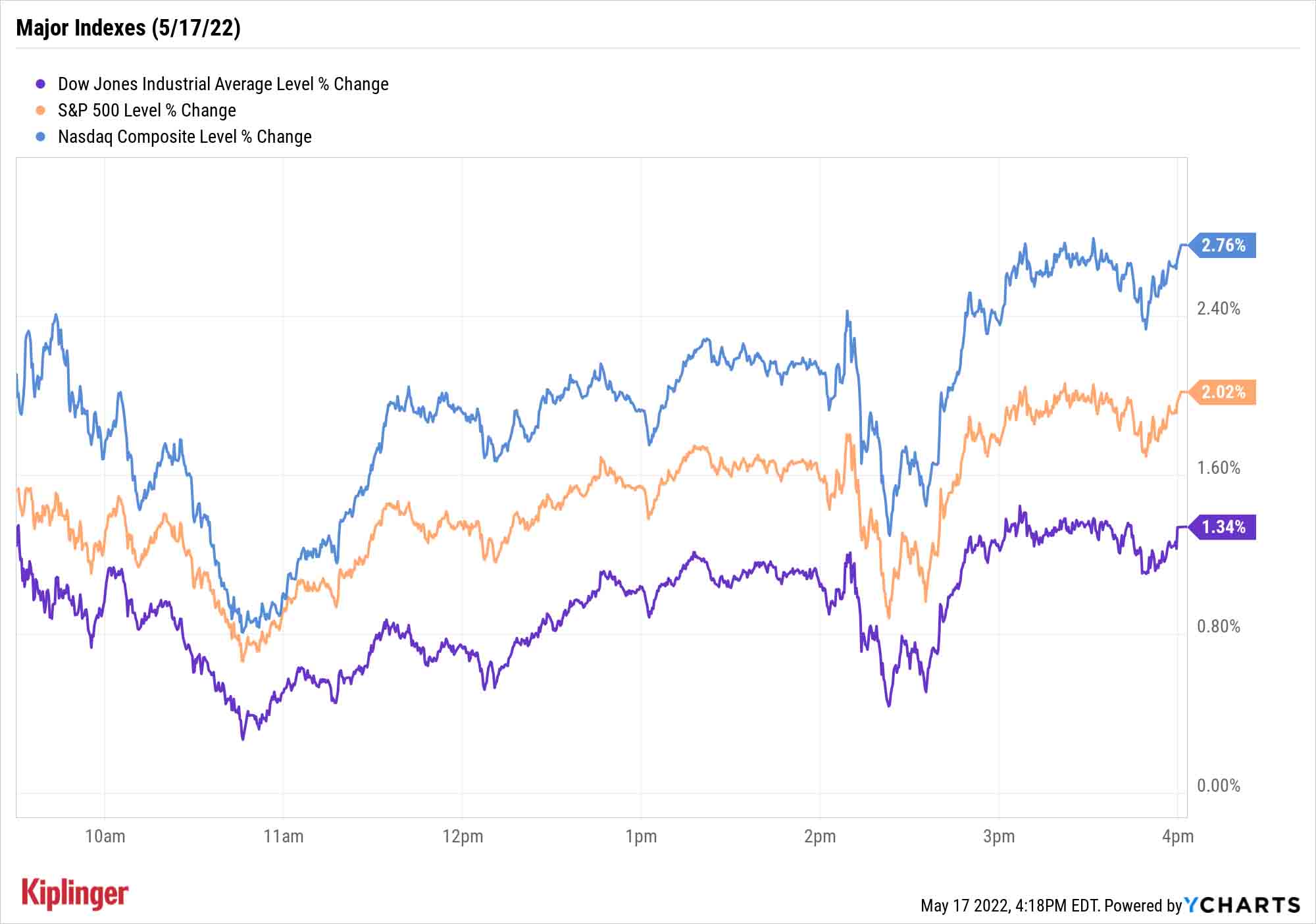

The Nasdaq Composite was tops among the major indexes Tuesday, up 2.8% to 11,984. The S&P 500 delivered a 2.0% gain to 4,088, while the Dow Jones Industrial Average improved 1.3% to 32,654.

Other news in the stock market today:

- The small-cap Russell 2000 surged 3.2% to 1,840.

- U.S. crude oil futures slumped 1.6% to $112.40 per barrel.

- A retreat in the U.S. dollar helped gold futures tick 0.3% higher to $1,818.90 per ounce.

- Bitcoin improved by 1.7% to $30,058.48. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR, +2.5%) made some gains despite a potential deal with Tesla (TSLA, +5.1%) CEO Elon Musk looking increasingly unlikely. Musk insisted today that he would back out of his $44 billion bid to buy the social platform unless Twitter proved that fewer than 5% of its users are bots. He tweeted that "20% fake/spam accounts, while 4 times what Twitter claims, could be *much* higher" without providing proof. Numerous analysts have now said they believe Musk's sudden interest in Twitter's bot numbers is either an attempt to escape his deal, or lower the $54.20-per-share price tag.

Buffett's Latest Buys Are In!

A number of other stocks were driven higher Tuesday by their newfound inclusion into a prestigious order: the equity portfolio of Warren Buffett's Berkshire Hathaway.

Berkshire filed its quarterly Form 13F with the SEC yesterday afternoon, revealing that after more than a year of heavy selling, Warren Buffett was finally eager to buy. Paramount Global (PARA, +15.4%) and Celanese (CE, +7.5%) were just two of the eight new positions Berkshire entered during the first quarter, and among the top beneficiaries of earning Buffett's seal of approval.

We recently mentioned that inflation has been a major driver of many of Buffett's purchases of the past few months, but it's not the only story.

Read on as we explore each and every one of Buffett's 22 moves from the first quarter of 2022, including what likely drew the Oracle of Omaha (or his lieutenants) to the position.

Kyle Woodley was long AMD as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.