Pfizer (PFE) COVID, Cancer Drugs Key to Top-Line Growth

Our preview of the upcoming week's earnings reports include Pfizer (PFE), Advanced Micro Devices (AMD) and DraftKings (DKNG).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

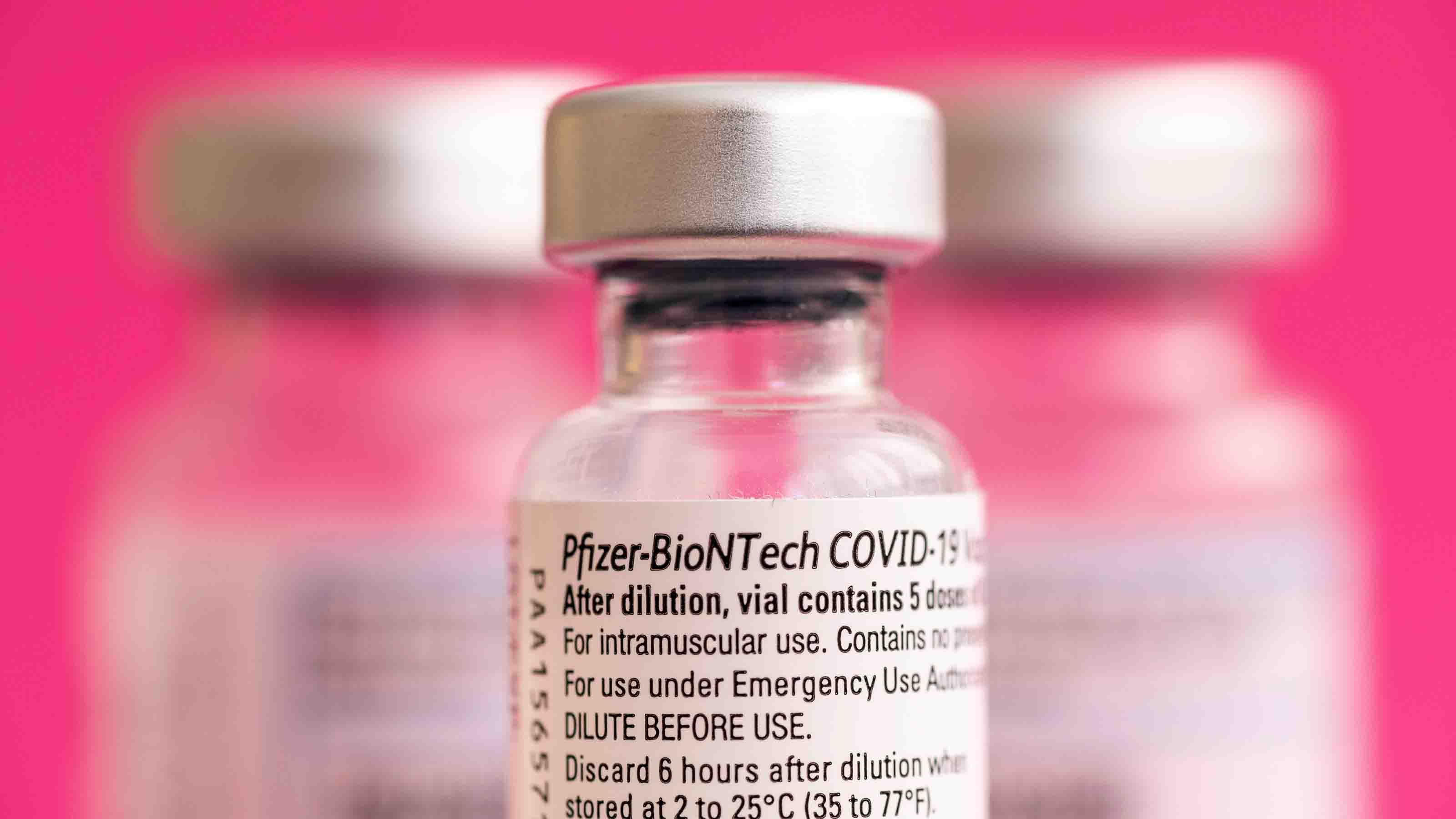

We're in the thick of first-quarter earnings season, and on this week's busy lineup is blue-chip drugmaker Pfizer (PFE, $49.34).

PFE shows up early on this week's earnings calendar, with the Big Pharma firm scheduled to unveil its first-quarter results ahead of Tuesday's open. Analysts are anticipating earnings of $1.48 per share, up 59% on a year-over-year (YoY) basis. Revenue is expected to arrive at $24.0 billion (+64.4% YoY).

Wall Street thinks Pfizer's COVID-19 regimens that include a vaccine co-developed with BioNTech (BNTX) and Paxlovid, its oral treatment granted regulatory approval last December, will contribute $12.5 billion to its top line, says Wells Fargo analyst Mohit Bansal.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While Bansal expects PFE to fall a little short of this estimate, he anticipates a solid beat in the company's non-COVID business, with cancer drugs Ibrance and Inlyta "tracking ahead of consensus." The analyst has an Overweight rating (equivalent of Buy) on the Dow Jones stock.

And Bansal is in good company. Of the 23 analysts following the stock that are tracked by S&P Global Market Intelligence, eight say it's a Strong Buy, one calls it a Buy and 14 have it at Hold.

Advanced Micro Devices Stock Cheap Ahead of Earnings

Advanced Micro Devices (AMD, $87.93) has been hit hard with broad-market headwinds in 2022, down more than 38% for the year-to-date.

Can a solid earnings report give the semiconductor stock a jolt?

Raymond James analyst Chris Caso recently upgraded AMD to Strong Buy from Outperform. He believes Advanced Micro Devices is attractively valued, remaining well below its average forward price-to-earnings ratio of 40 over the last three and five years.

Caso admits a potential PC market slowdown and the sustainability of revenue growth for recently acquired Xilinx are concerns. However, "We have strong confidence regarding AMD's position and share gains in the datacenter market," the analyst says, with "tight supply conditions encouraging customers to commit to AMD to ensure supply."

Analysts are optimistic heading into AMD's Q1 2022 report. Consensus estimates are for Advanced Micro Devices to report earnings of 91 cents per share (+75% YoY) and revenue of $5.5 billion (+60.3% YoY).

DraftKings Q1 Revenue to Show Strong Growth

DraftKings (DKNG, $14.20) stock is down nearly 50% for the year-to-date, but Wall Street's pros are more bullish than not toward the online sports betting company. Of the 28 analysts following DKNG that are tracked by S&P Global Market Intelligence, 12 have it at Strong Buy, four call it a Buy and 12 believe it's a Hold.

Needham analyst Bernie McTernan is one of those with a Buy rating on DKNG, calling the company "a leader in the emerging North America online gambling market," with a $35 billion market opportunity.

Oppenheimer analyst Jed Kelly (Outperform) shares this sentiment, adding the company's "competencies in product development and customer acquisition" have helped it become a market leader. These will also play a key role in DKNG taking a roughly 25%-30% share of a quickly growing market as more states regulate online sports gambling (OSB).

In the near term, DraftKings "is acquiring players faster and more efficiently as OSB scales nationally (3.5% of Arizona adults in the first six months vs. New Jersey's 1.3%)," Kelly says.

As for DKNG's first-quarter earnings report – due out ahead of the May 6 open – analysts, on average, are looking for $414.4 million in revenue (+32.7% YoY) and a loss of $1.16 per share, wider than the 87 cents-per-share loss the company incurred in the year-ago period.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.