Stock Market Today: Twitter Buyout Outshines Relief Rally

An afternoon rally helped the major indexes snap their short skid. But Twitter accepting Elon Musk's bid stole the spotlight.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

U.S. equities followed up last week's losses with a comeback in this week's opening session, but the day's biggest news was a deal cementing an M&A Monday for the ages.

Numerous global bourses finished lower earlier Monday amid worries about a COVID-19 breakout in China and fear that restrictions would weigh on global growth.

"Beijing is on 'high COVID alert," with three days of testing to begin in a central district of Beijing after 15 new cases came to light, which will impact 3 million people," says Jennifer Lee, senior economist for BMO Capital Markets. "Lockdowns are not planned, apparently, but let's see how these tests go and if there are any new cases."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

U.S. crude oil futures, which end trading earlier than the stock markets, dropped 3.5% to a two-week low of $98.54 per barrel. That hampered shares of energy firms including Exxon Mobil (XOM, -3.4%) and Chevron (CVX, -2.2%).

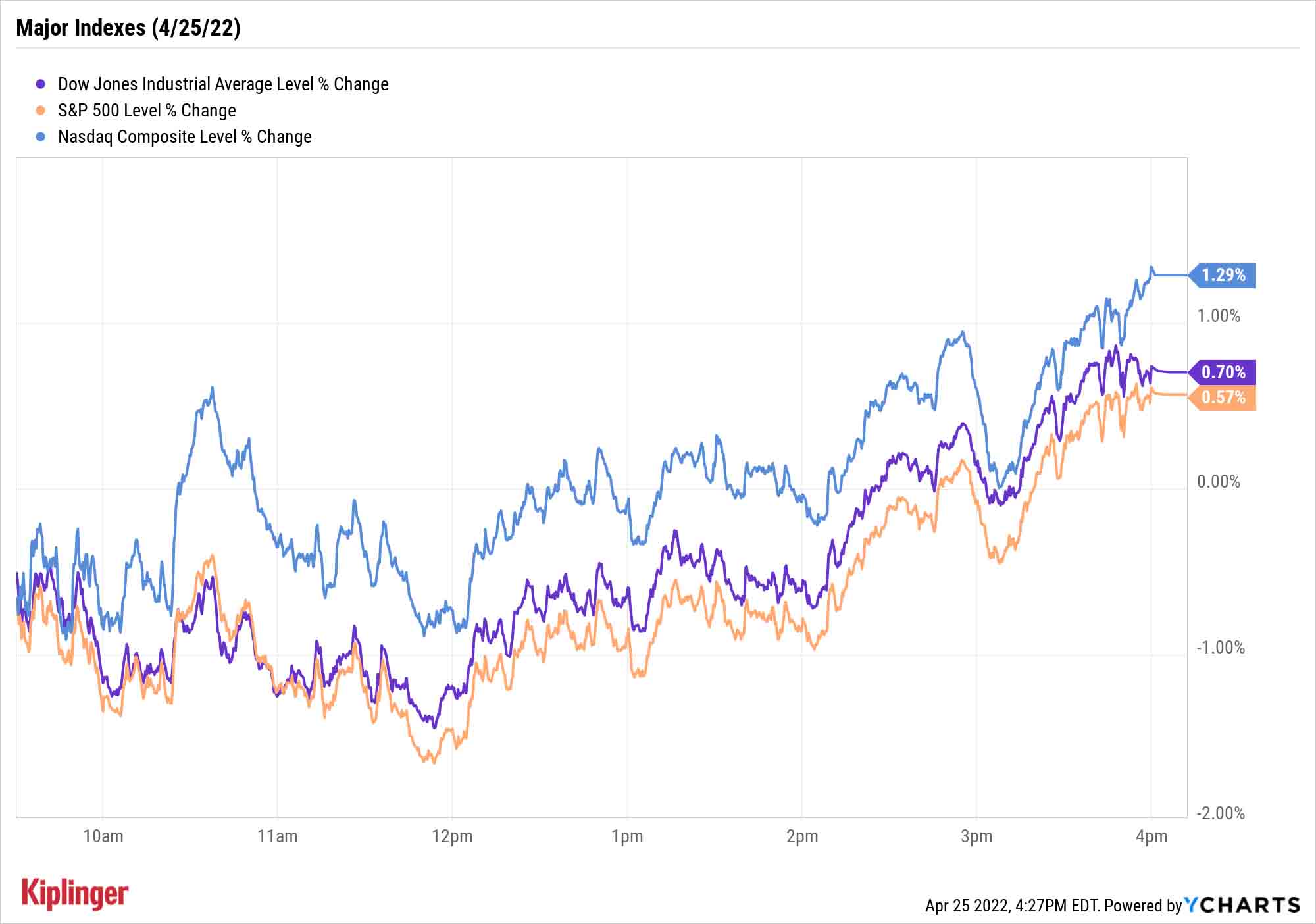

However, after opening considerably in the red, stocks rebounded in the afternoon, led by the technology (+1.5%) and communication services (+1.4%) sectors. The Nasdaq Composite gained 1.3% to 13,004, the Dow Jones Industrial Average was up 0.7% to 34,049, and the S&P 500 finished 0.6% to 4,296.

Monday's most significant headline, however, was the juice behind the communication sector's move: a jump in Twitter (TWTR, +5.7%), which has agreed to Tesla (TSLA, -0.7%) CEO Elon Musk's buyout offer of $54.20 per share – a deal worth $44 billion.

Prior to Monday, TWTR shares hadn't traded close to the offer price amid questions about how serious the offer was and how Musk would pay for the transaction. But recent reports that he had financing, as well as Monday reports that Twitter's board had warmed to – and, later in the day, accepted – Musk's overtures to take the social platform private sent shares up to a close of $51.70. (You can check out our report for more about Musk's deal for Twitter.)

While most social media companies didn't move much on what would be the world's biggest leveraged buyout ever, Digital World Acquisition Corp. (DWAC) – the company behind Donald Trump-backed Truth Social – plunged 12.9%.

Other news in the stock market today:

- The small-cap Russell 2000 improved by 0.7% to 1,954.

- Gold futures shed 2% to settle at $1,896 an ounce.

- Bitcoin also joined in the afternoon rally, advancing 2.0% to $40,278.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Coca-Cola (KO) gained 1.1% after the soft drink maker reported first-quarter earnings of 64 cents per share on $10.5 billion in revenue, both figures higher than analysts were expecting. The company also reiterated its full-year forecast for revenue growth of 7% to 8% and earnings-per-share growth of 5% to 6%, even as Coca-Cola suspended operations in Russia. "We think KO's strong results reflect its brand power and ability to thrive in an inflationary environment, as top line improvement was entirely driven by price and mix," says CFRA Research analyst Garrett Nelson, who reiterated a Buy rating on the Dow Jones stock.

- Snowflake (SNOW) – another member of the Berkshire Hathaway equity portfolio – spiked 7.6% after Wolfe Research analyst Alex Zukin intiated coverage on the cloud-based data platform with an Outperform (Buy) rating and $250 price target, a roughly 34% premium to today's close. Zukin believes SNOW could be a major player in the cloud computing space alongside Microsoft (MSFT), Alphabet (GOOGL) and Amazon.com (AMZN), and he sees significant opportunity in replacing legacy data warehouse systems as more customers migrate to the cloud.

Is a Recession Coming? (And If So, Should You Do Anything?)

While the rest of us gawk at a major social platform falling under the control of the world's richest man, market strategists remain fixated on the economy. Linda Kitchens, director in wealth management at Aspiriant, is among those who sees a greater chance of the U.S. economy falling into recession.

"We think recession probabilities for the next 18-24 months are in the 25%-30% range, which is meaningfully higher than where we were at the end of 2021 (probably less than 10% chance of recession then)," she says. "Economically, things like slowing growth, increasingly higher inflation and elevated commodity prices are important things to watch."

But she warns about making any major moves in anticipation.

"While the likelihood of recession has certainly increased, it's important to remind investors to stay focused on having a long-term time horizon, remaining fully invested and avoiding any market timing. As has often been said, 'far more money has been lost by investors trying to anticipate a recession than lost in recessions themselves.'"

To that end, the best thing you can do is position yourself in investments built for the long haul. For some, that means large, blue-chip companies that have been deemed worthy enough for inclusion in the Dow Jones Industrial Average (and we rank all 30 of these mega-cap names here). For others, that means companies that have proven they can not only profit – but share those profits – for decades on end (like the Dividend Aristocrats).

And for still others, one of the best ways to keep calm and steady, regardless of what the economy throws our way, is to hand over the keys. Investors can do quite well by allowing seasoned fund managers who charge reasonable fees to manage the stocks and bonds they want to hold. That's the idea behind the Kip 25: our 25 favorite low-cost mutual funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.