Stock Market Today: Stocks Fall as Fed Lays Out Tightening Plans

Fed minutes show tentative plan for reducing the central bank's balance sheet, some officials' willingness to raise rates 50 basis points at a time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

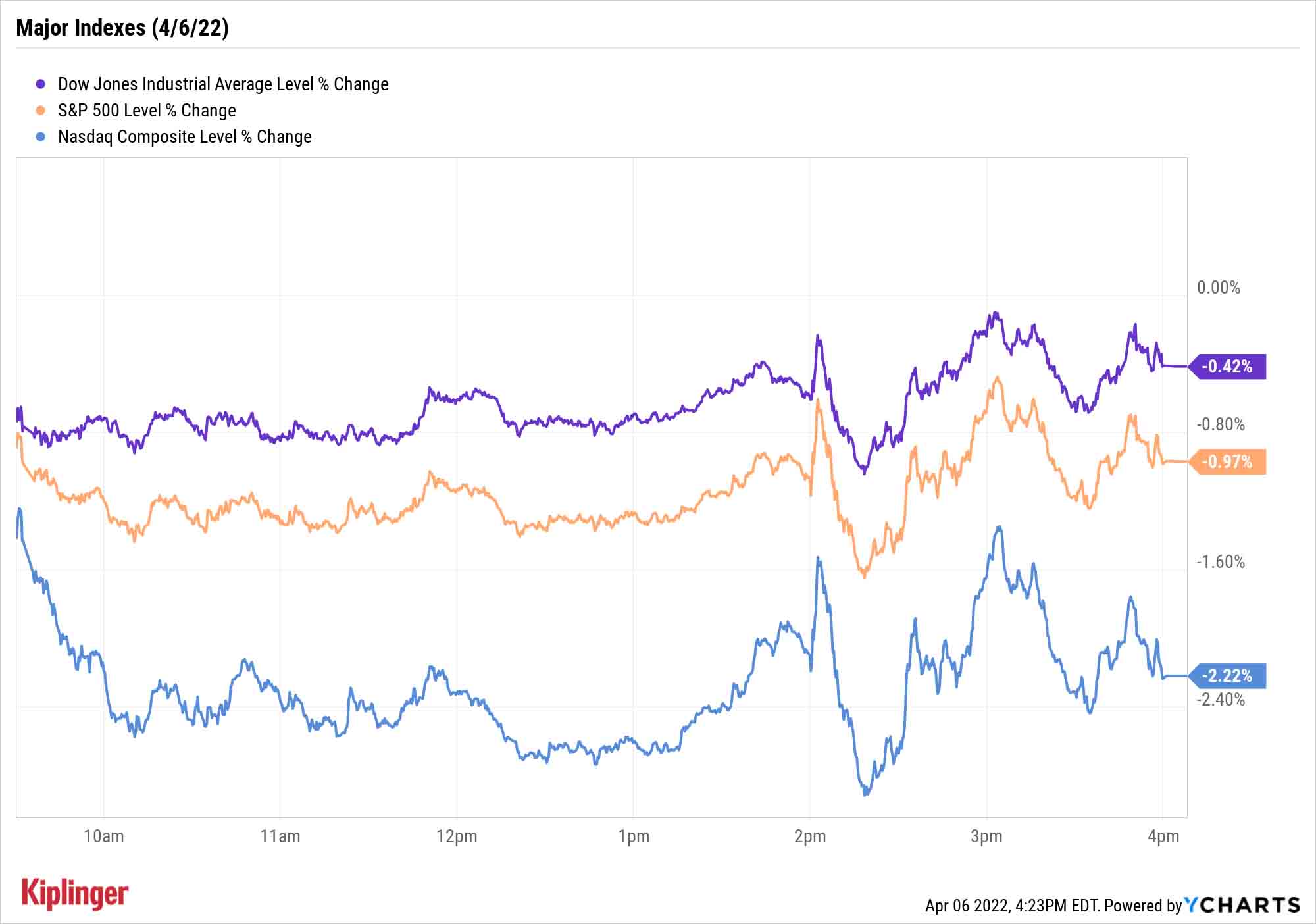

The major U.S. indexes continued to radiate anxiety on Wednesday heading into and after the afternoon release of the Federal Open Market Committee's most recent minutes.

At last month's meeting, Fed officials tentatively agreed to a quantitative tightening plan that would see the central bank sell off $95 billion in assets each month – $60 billion in Treasuries and $35 billion in mortgage-backed securities. Also, several FOMC members said 50-basis-point hikes to the Fed funds rate could be on the table to help curb inflation.

Stocks, which had largely headed lower all day, turned volatile after the minutes. While they ultimately finished in the red, they did so off the session's lows.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Mega-cap technology (-2.4%) and consumer discretionary (-2.6%) names including Microsoft (MSFT, -3.7%), Amazon.com (AMZN, -3.2%) and Tesla (TSLA, -4.2%) weighed heaviest on the Nasdaq Composite (-2.2% to 13,888). The S&P 500 (-1.0% to 4,481) and Dow Jones Industrial Average (-0.4% to 34,496) also finished lower.

"While the market has taken a bit of a breather anticipating an aggressive Fed posture, some fears may have been put to ease with the release of the minutes," says Mike Loewengart, managing director of investment strategy at E*Trade. "Half-point-basis point hikes are on the table, but that's where the buck stops – it's not guaranteed that half-point increases are the new norm.

"And most predicted that a balance sheet plan would be rolled out, so the market might have already priced that piece in."

Other news in the stock market today:

- The small-cap Russell 2000 slid 1.4% to 2,016.

- Reports the International Energy Agency (IEA) will release 120 million barrels of crude oil from its reserves and data from the Energy Information Administration (EIA) that showed domestic inventories unexpectedly rose last week sent U.S. crude futures tumbling below the $100 per-barrel mark (ending down 5.6% at $96.23 per barrel).

- Gold futures fell 0.2% to settle at $1,923.10 per ounce.

- Bitcoin plunged 4.9% to $43,755.65. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- JetBlue Airways (JBLU) tumbled 8.7% after the airline made an unsolicited bid to buy fellow travel stock Spirit Airlines (SAVE, -2.4%) for $3.6 billion in cash. This comes after SAVE in February said it was merging with carrier Frontier Group (ULCC, -11.0%) in a deal valued at $6.6 billion – and one that was approved by both companies' boards of directors. In reaction, Raymond James analyst Savanthi Syth downgraded JBLU to Market Perform from Outperform (the equivalents of Hold and Buy, respectively). "While there may be longer term merits to the deal, execution risk is greater than that of the proposed Spirit-Frontier merger with dis-synergies likely to precede any meaningful synergy benefits," Syth writes in a note.

- Rivian Automotive (RIVN) slid 5.0% even as the electric vehicle maker said it is on track to meet its annual production goal of 25,000 vehicles this year. This comes as the company delivered 1,227 vehicles in the first quarter, more than the 929 it delivered in all of 2021. "Given that its production rate should continue to increase in the coming months, we think investors might view its 2022 production guidance of 25,000 units as more achievable than they were previously, which suggests that perhaps the worst of Rivian's operational challenges are behind it," says CFRA Research analyst Garrett Nelson (Hold).

Retail Stocks Could Sing

Inflation might be hot, but so is the money burning a hole through consumers' pockets. The retail industry has been met with more than its fair share of difficulties, including rocketing input costs and supply-chain disruptions, which have only gotten worse amid Russia's invasion of Ukraine.

And yet, retail sales were up nearly 18% year-over-year in February. And the National Retail Federation's outlook for 2022 is for retail sales growth of between 6% and 8%.

"Despite all that's been thrown at them including inflation, supply-chain constraints, market volatility and significant geopolitical events, consumers remain able and willing to spend," says NRF chief Matthew Shay.

Broadly speaking, investors can get access to many of the retailers benefiting from this trend in the consumer discretionary and (to a lesser extent) consumer staples sectors.

But for a short list of some of the current top plays, consider these five retail stocks, each of which boasts a crowded Wall Street analyst bull camp and share-price upside of between 25% and 80%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.