Stock Market Today: Stocks Slip Further as Sanctions Mount

The U.S. and U.K. announced additional sanctions as the Russia-Ukraine crisis continued to ramp up, sending the major indexes further into the red Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The S&P 500 dipped deeper into correction territory Wednesday amid additional fallout of Russia's attacks on Ukraine.

A U.S. official told NBC News that Russia has "nearly 100 percent of all the forces we anticipated [Russian President Vladimir Putin] would need" to launch a full-scale invasion of Ukraine, which has declared a state of emergency and called up its military reserves.

Meanwhile, a day after announcing sanctions targeting two of Russia's largest banks, President Joe Biden announced new measures against Nord Stream 2 AG, a company responsible for the Nord Stream 2 natural gas pipeline stretching from Russia to Germany. And U.K. Prime Minister Boris Johnson promised military support (including weapons) for Ukraine.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"If Russia goes deeper into Ukraine, the conflict could be longer and the West's reaction could be more severe. As a result, sanctions could be more biting," says Lauren Goodwin, economist and portfolio strategist at New York Life Investments. "Higher commodity prices and slower growth could have a meaningful impact on the global economy, including emerging-market economies and by making the Fed's job even more difficult."

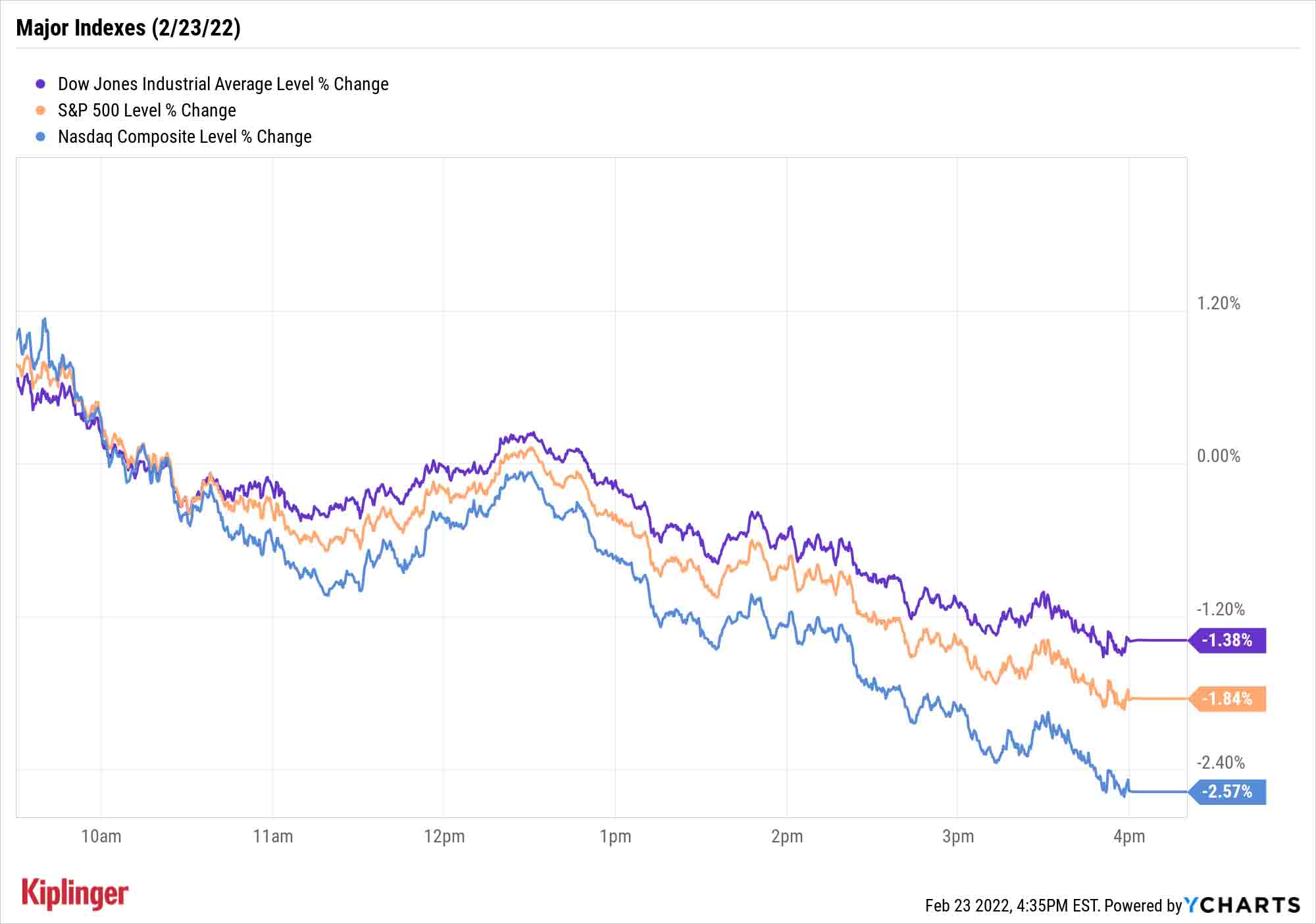

Stocks teased investors by opening in the green, but the trap door quickly opened. The S&P 500 (-1.8% to 4,225) suffered its fourth consecutive decline, while the Dow Jones Industrial Average (-1.4% to 33,131) and Nasdaq Composite (-2.6% to 13,037) each posted their fifth straight losses.

Other news in the stock market today:

- The small-cap Russell 2000 sank 1.8% to 1,944.

- U.S. crude oil futures gained 0.2% to end at $92.10 per barrel.

- Gold futures rose 0.2% to settle at $1,910.40 an ounce.

- Bitcoin slid modestly, off 0.6% to $37,702.21. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- TJX (TJX) stock slipped 4.2% after the off-price retailer reported earnings. In its fourth quarter, TJX reported earnings of 78 cents per share on revenue of $13.9 billion, falling short of the 91 cents per share and $14.2 billion analysts were expecting. The TJ Maxx parent also reported a 10% jump in same-store sales for the three-month period and hiked its dividend by 13%. "Although this was a disappointing quarter in our view, nothing has changed in our 12-month thesis, as we see TJX outperforming as the consumer weakens and becomes more aware of higher costs across all aspects of retail," says CFRA Research analyst Zachary Warring (Strong Buy). "We see more and more consumers returning to off-price retailers over the next 12-months as stimulus fades, and we expect TJX to be the biggest beneficiary."

- In its fourth quarter, Lowe's (LOW, +0.2%) reported earnings of $1.78 per share – up 34.8% year-over-year and coming in well above analysts' consensus estimate for earnings of 71 cents per share. Revenue was up 4.8% from the year prior to $21.3 billion, also exceeding forecasts for $20.9 billion in sales. "LOW is improving its processes to enhance store product offerings, operational improvement, and widen margins," writes CFRA Research analyst Kenneth Leon (Buy). "We think the PRO segment will outperform the Do-It-Yourself (DIY) segment in fiscal 2023, given affluent households boosting remodeling contracts with PRO customers, and DIYs face inflation pressures and reduce disposable income."

The Coming Days, Weeks Are Pivotal

Bluntly speaking, the market is now at a "put up or shut up" moment.

More specifically, says Sam Stovall, chief investment strategist at independent research firm CFRA, now is a point at which a garden-variety correction either begins to sort itself out … or signal a bear market is nigh.

"For corrections, the S&P 500 posted average price gains of 1.1%, 1.8%, 2.9% and 4.7% one, seven, 30 and 60 days later, respectively," he says. "Conversely, price changes and frequencies of advance continued to slide under declines that eventually became bear markets. Specifically, while the market was typically flat in the day after falling into a correction, the S&P 500 continued to record price declines averaging 0.4%, 2.9% and 4.8% seven, 30 and 60 days later."

More simply put, if the market shows signs of recovery in the coming days and weeks, the correction might be over. If not, "the worst is yet to come."

While we're stuck in something of a Schrodinger's stock market, most investors are better off focusing on long-term quality rather than speculative upside. You can start with the best-rated blue chips of the S&P 500 or the Dow's most promising dividend-yielding stocks.

And those able to fix their eyes far down the horizon might be best off reviewing these 22 retirement-minded stocks – a group of companies that deliver secure, high-yielding dividends backed by ample cash flow and bulletproof balance sheets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

These Small Money Habits Really Can Plant Roots

These Small Money Habits Really Can Plant RootsFebruary gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.