Stock Market Today: Stocks' Gains Erased as Omicron Reveals Itself in U.S.

The major benchmarks swung sharply lower after first U.S. case of the omicron variant of COVID-19 was identified.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Some solid economic data sent stocks higher at the open, but the bounce lost steam as investors continued to fret over the omicron variant of COVID-19.

ADP this morning reported November private payrolls rose by 534,000 – led by an increase in leisure and hospitality hirings (+136,000) – exceeding expectations for 525,000 jobs added.

Additionally, the Institute for Supply Management's (ISM) manufacturing purchasing managers index (PMI) improved to 61.1 in November over its October reading of 60.8, in line with economists' consensus estimate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The internals of the survey were positive, with new orders remaining robust while prices improved," says Michael Reinking, senior market strategist for the New York Stock Exchange. Plus, "there were some signs that supply chain issues were easing as delivery times were lower."

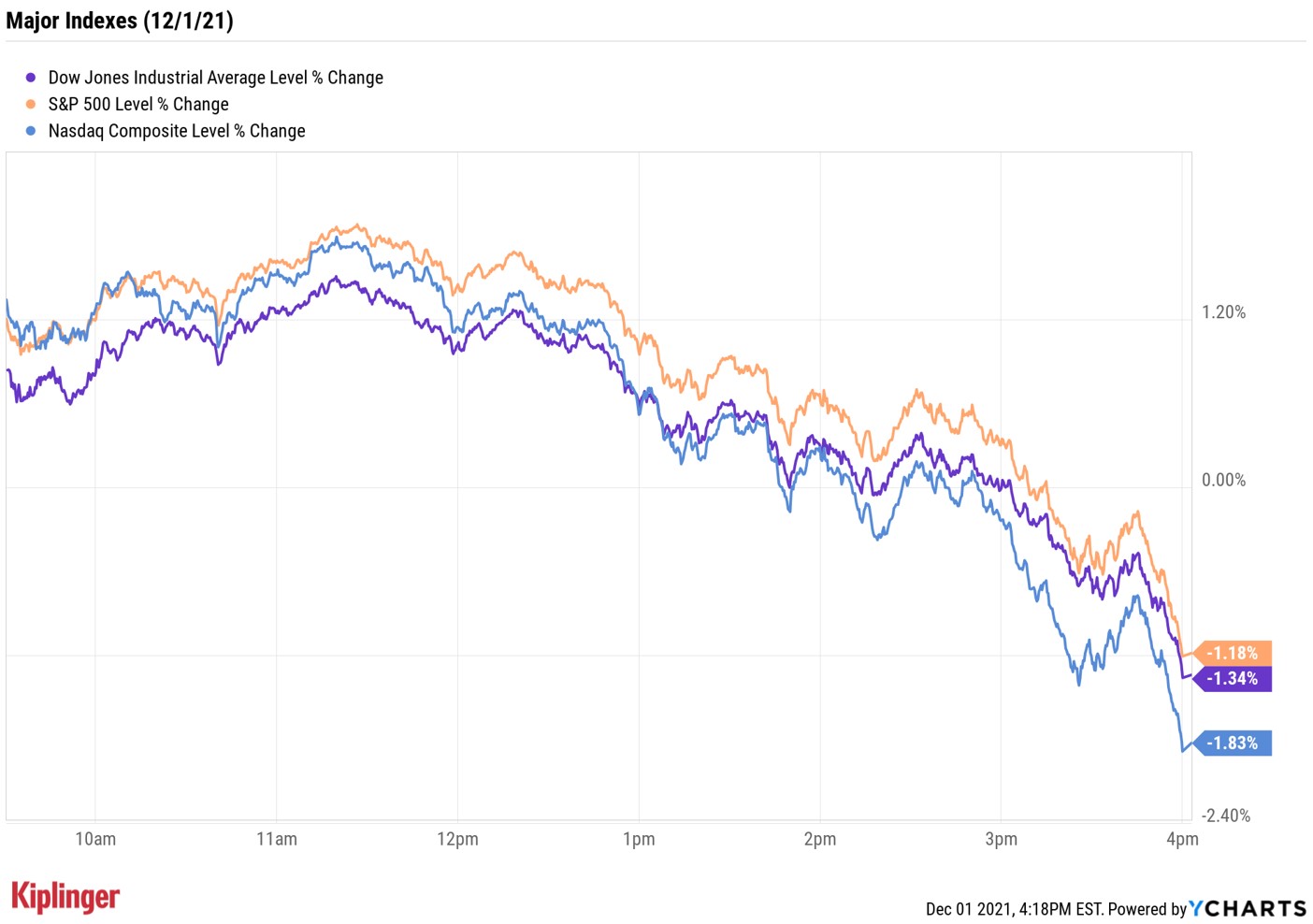

But the market giveth and the market taketh away, and while the major benchmarks were all sporting gains above 1% just before lunchtime, they swung into the red mid-afternoon on news the U.S. had confirmed its first case of the omicron variant, in California.

At the close, the Dow Jones Industrial Average was down 1.3% at 34,022, the S&P 500 Index was off 1.2% at 4,513 and the Nasdaq Composite was 1.8% lower at 15,254.

Other news in the stock market today:

- The small-cap Russell 2000 sank 2.3% to end at 2,147.

- U.S. crude futures also reversed course, dipping 0.9% to $65.57 per barrel.

- Gold futures improved by 0.4% to $1,784.30 per ounce.

- Bitcoin retreated 1.5% to $56,709.46. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Salesforce.com (CRM) was the heaviest weight on the Dow on Wednesday. CRM, which is the industrial average's fifth-largest weight by virtue of its share price, plunged 11.7% after beating third-quarter estimates for both the top and bottom lines, but issuing disappointing Q4 guidance. Salesforce is looking for 72 to 73 cents per share in profit, shy of estimates for 81 cents per share; its revenue forecast of $7.22 billion to $7.23 billion was slightly higher than Wall Street's views at the midpoint. Salesforce also announced that Chief Operating Officer Bret Taylor will become co-CEO alongside current chief Marc Benioff. "We see this a positive," says Jefferies analyst Brett Thill, who maintained a Buy rating on CRM shares. "Bret has been at the company for five years and has a strong product focus. We do not expect there to be a significant change in course but will be watching to see how the co-CEO strategy plays out this time around."

- Meta Platforms (FB, -4.3%) declined on what was expected to be the Facebook parent's first day of trading under the new ticker "MRVS." However, Facebook announced after Monday's close that it would be postponing the transition until the first quarter of 2022.

- Vertex Pharmaceuticals (VRTX, +9.7%) was one of a few standout winners Wednesday. The company said its VX-147 drug candidate, being tested for a genetic kidney disorder, "led to a statistically significant, substantial and clinically meaningful mean reduction in proteinuria of 47.6% at 13 weeks compared to baseline and was well tolerated." The company plans to advance VX-147 into "pivotal development" in Q1 2022.

Welcome to December

December is a historically strong month for stocks. Just how strong? Ryan Detrick, chief market strategist at LPL Financial, offers up some impressive data points.

"Historically, the S&P 500 has gained 1.5% on average in December, which is the third best month of the year with only April and November better," he says. What's more, the index has been positive 74.3% of the time in December, going back to 1950. And slow starts are typical, with stocks historically picking up steam in the latter half of the month, he says.

Detrick adds that he's "optimistic that stocks will sidestep the new variant worries, but we recommend investors buckle up their seatbelts, as the end of 2021 could be a bumpy one."

While we can't tell what will happen over the next several weeks, one of the best ways to cushion your portfolio against market uncertainty is with dividend stocks.

There are lots to choose from right now, including these dividend doublers or the Dividend Aristocrats – companies with a track record of increasing shareholder payouts for at least 25 consecutive years.

But for those looking for the cream of the crop, consider these high-yielding dividend stocks. Each of the names featured here have yields north of 4% – well above the S&P 500's current 1.3% yield – and have received bullish ratings from the analyst crowd.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.