Stock Market Today: Nasdaq Spirals as Big Tech Sells Off

Facebook led a selloff in FAANG stocks after a scathing "60 Minutes" report and site outage.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks ended the day deep in the red as investors weighed several worries.

Under the shadow of the rapidly approaching Oct. 18 deadline by which Congress must raise or suspend the debt ceiling so that the U.S. does not default on its financial obligations, the 10-year Treasury yield briefly topped 1.50% before ending up 1.5 basis points (a basis point is one one-hundredth of a percentage point) at 1.482%.

This rise in bond yields sparked a selloff in Big Tech, with Facebook (FB, -4.9%) the most notable decliner.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Last night's "60 Minutes" episode on CBS in which a former FB employee accused the company of misleading the public on the negative effects of its platform put the FAANG stock in Wall Street's sights, while a major outage across all three of its properties – Facebook, Instagram and WhatsApp – did it no favors.

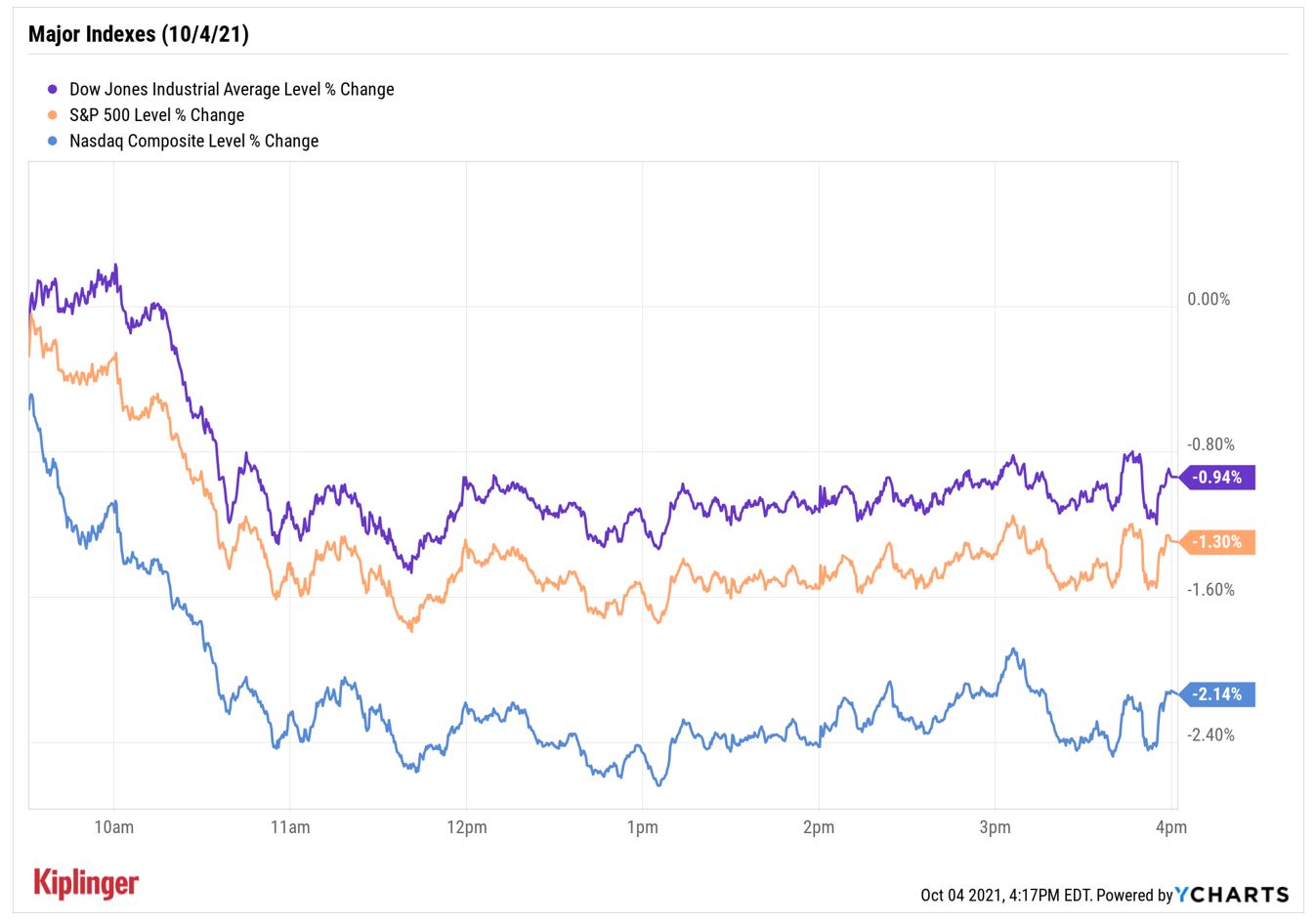

As such, the Nasdaq Composite was by far the day's biggest loser, slumping 2.1% to 14,255. The S&P 500 Index gave back 1.3% to 4,300 and the Dow Jones Industrial Average shed 0.9% to 34,002.

Other news in the stock market today:

- The small-cap Russell 2000 fell 1.1% to 2,217.

- Tesla (TSLA, +0.8%) managed a win today after the electric vehicle (EV) maker said it delivered a higher-than-expected 241,300 vehicles in the third quarter. In its report, TSLA also noted it produced 237,823 cars in the three-month period, the bulk of which were its mid-range Model 3 and Y offerings. Oppenheimer analyst Colin Rusch weighed in on Tesla after the report, saying he remains "bullish on TSLA shares on its continued strong execution in a challenging environment and clear technology leadership." Rusch has an Outperform (Buy) rating on the stock.

- General Motors (GM, +1.6%) was also in focus today on news impact investment group Engine No. 1 – which made waves earlier this year when it led a successful effort to gain seats on oil major Exxon Mobil's (XOM) board – took a stake in the automaker. Speaking on CNBC's "Squawk Box," the hedge fund's founder Chris James said, "GM, with the support of a really strong management team and a great board, has decided that they're going to embrace the future."

- U.S. crude oil futures jumped 2.3% to $77.62 per barrel, their highest settlement since November 2014. Today's spike came after the Organization of the Petroleum Exporting Countries (OPEC) and its allies chose to stand pat on its current plan to gradually increase crude oil production by 400,000 barrels a day in November.

- Gold futures edged up 0.5% to $1,767.60 an ounce.

- The CBOE Volatility Index (VIX) surged 8.6% to 22.96.

- Bitcoin prices rose 2.8% to $49,399.90. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Worried About Volatility? Read On.

With volatility running high, the case for dividend stocks is as strong as ever.

"Dividend strategies have gained a foothold with market participants seeking potential outperformance and attractive yields," notes Tianyin Cheng, senior director of Strategy Indices at S&P Dow Jones Indices. "Stocks with a history of dividend growth could present a compelling investment opportunity in an uncertain environment."

And while there's no shortage of stocks offering dividends these days – with the regular payouts allowing investors to ride out the market's zigs and zags with a little less stress – not all of them are worth your investment.

To that end, we've compiled several lists of the best dividend growers, including these top Dow dividend stocks. All of the names listed here have yields of at least 2%, above the blue-chip benchmark's average, and are highly rated by the pros on Wall Street.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.