Stock Market Today: Fed Fuels Second Day of Stout Stock Surge

Markets rallied for a second straight session Thursday amid optimism over Fed messaging and China's most recent involvement in the Evergrande situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

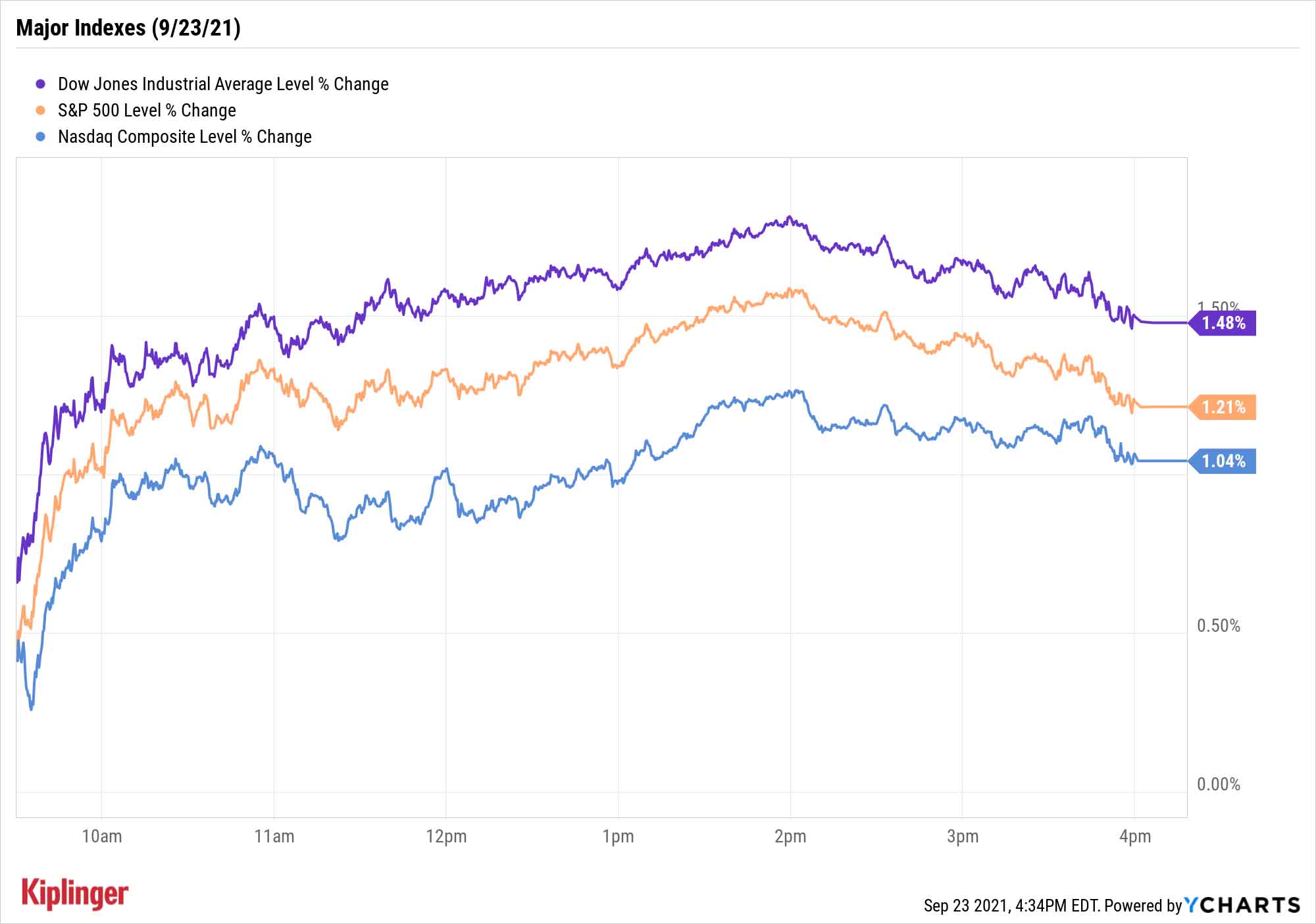

Thursday's Wall Street action started right where Wednesday's left off, with investors driving the major stock indexes to another day of broad and sizable advances.

At least some of the day's gains were chalked up to the Federal Reserve, which several strategists said yet again threaded the messaging needle with yesterday's announcement.

"The Fed has done a very good job telegraphing its intentions and the numbers that it is watching to make decisions," says Andy Kapyrin, co-head of investments at wealth management firm RegentAtlantic, adding that yesterday's statement "leaves little room for big surprises down the line."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also encouraging was a new development for Chinese developer Evergrande (EGRNY, -13.1%), whose liquidity issues have sent shock waves well beyond China.

Anu Gaggar, global investment strategist for Commonwealth Financial Network, explains: "Evergrande has been instructed by the Chinese government to not default on the interest payments on the USD-denominated bond that are due today even as local officials have been ordered to step in should Evergrande's unwinding become disorderly."

To some investors, even those modest measures suggest the Chinese government wants to prevent a sudden collapse of the deeply indebted real estate firm, which left unchecked could rattle both China's economy and global stock markets.

The Dow Jones Industrial Average improved by 1.5% to 34,764, led by a 7.2% jump in Salesforce.com (CRM) after the cloud software firm raised its current-year revenue forecasts and provided better-than-expected sales guidance for its next fiscal year. The S&P 500 (+1.2% to 4,448) and Nasdaq (+1.0% to 15,052) also finished significantly higher.

Indeed, stocks even managed to overlook a surprise increase in initial unemployment claims. Jobless-benefits filings for the week ended Sept. 18 grew by 16,000 to a seasonally adjusted 351,000.

Other news in the stock market today:

- The small-cap Russell 2000 was propelled 1.8% higher to 2,259.

- Darden Restaurants (DRI) was a big post-earnings winner, jumping 6.1% in the wake of its fiscal first-quarter report. For the three-month period, the Olive Garden parent brought in earnings of $1.75 per share on $2.3 billion in revenues, while same-restaurant sales surged 47.5%. All three metrics were higher than analysts were expecting ($1.63; $2.2 billion; 44.0%, respectively), as was DRI's full-year forecast .

- BlackBerry (BB, +10.9%) also got a boost from its quarterly results. The former smartphone maker turned cybersecurity and software firm reported an adjusted second-quarter loss of 6 cents per share on $175 million in revenues – better than the 8-cent-per-share loss on $161.9 million in sales that Wall Street expected. Nevertheless, CFRA analyst Angelo Zino kept his Hold rating on the stock. "BB's lackluster performance in its cybersecurity segment amid a healthy industry backdrop is of concern to us," he says, but adds that "efforts to expand its sales force and new product launches could support growth ahead and we like its ability to generate positive free cash flow."

- U.S. crude oil futures jumped 1.5% to $73.30 per barrel.

- Gold futures retreated 1.6% to settle at $1,749.80 an ounce.

- The CBOE Volatility Index (VIX) dropped another 10.5% to 18.68.

- Bitcoin improved by 3.2% to $44,805.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Another Shot at Buying Value?

A few rays of sunshine are starting to peek through the COVID clouds, too.

Nationally, coronavirus cases and hospitalizations are starting to inch lower – hardly enough to declare us out of the woods, especially with winter on the way, but enough to see reasons for optimism.

"As expected, vaccination against Covid has been effective in curbing hospitalization and mortality," says global asset manager Research Affiliates. "We expect renewed economic growth as the emerging markets and other regions slow to vaccinate their populations make significant progress on that front. The cyclical sectors of the economy, and consequently value investors, should benefit."

As we've previously discussed, plenty of value stocks exist even in this generally overpriced market – whether they're big, blue-chip names or underappreciated small caps.

And as for so-called recovery plays? Some are bargain priced, some aren't, but most of them could get a second wind if and when the world turns the next corner on COVID.

Among the most sensitive to such an event are airline stocks, which are dependent on both travelers feeling comfortable enough to pack themselves into a jet – and governments feeling confident enough in their COVID progress to lift travel bans. Even then, the whole industry doesn't necessarily become a buy. Read on as we explore nine airline stocks to determine which ones are the best bets from here.

Kyle Woodley was long CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.