Stock Market Today: China's Evergrande Crisis Knocks 614 Points Off Dow

A possible debt default for a Chinese real estate giant sent shockwaves across global markets and put a dent in U.S. stocks Monday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most global investors' eyes were fixated on China on Monday, as the looming debt default of a real estate titan there could have worldwide implications – indeed, such fears served the Dow its worst single-session loss since July.

We break down the situation in more detail here, but in short: Chinese property developer Evergrande (EGRNY, -22.1%) currently has about $15 billion in cash versus some $300 billion in liabilities, and several analysts believe that it could default on debt payments as soon as this week. A worst-case scenario could theoretically spark a credit crisis, hammer large firms with significant exposure to Evergrande debt and cause economic distress across the numerous other businesses that Evergrande is invested in.

How China plans on dealing with the issue is a pivotal question to be answered.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Our China strategists believe that the government wants to make an example out of Evergrande to impose some discipline on investors and developers," says Doug Peta, chief U.S. investment strategist at BCA Research. "Some onshore investors may be bailed out, but party officials will have no qualms about leaving offshore investors holding the bag."

Also of increasing worry is the Sept. 30 deadline to address the debt-ceiling limit; Treasury Secretary Janet Yellen wrote in the Wall Street Journal that not raising the limit would "precipitate a historic financial crisis."

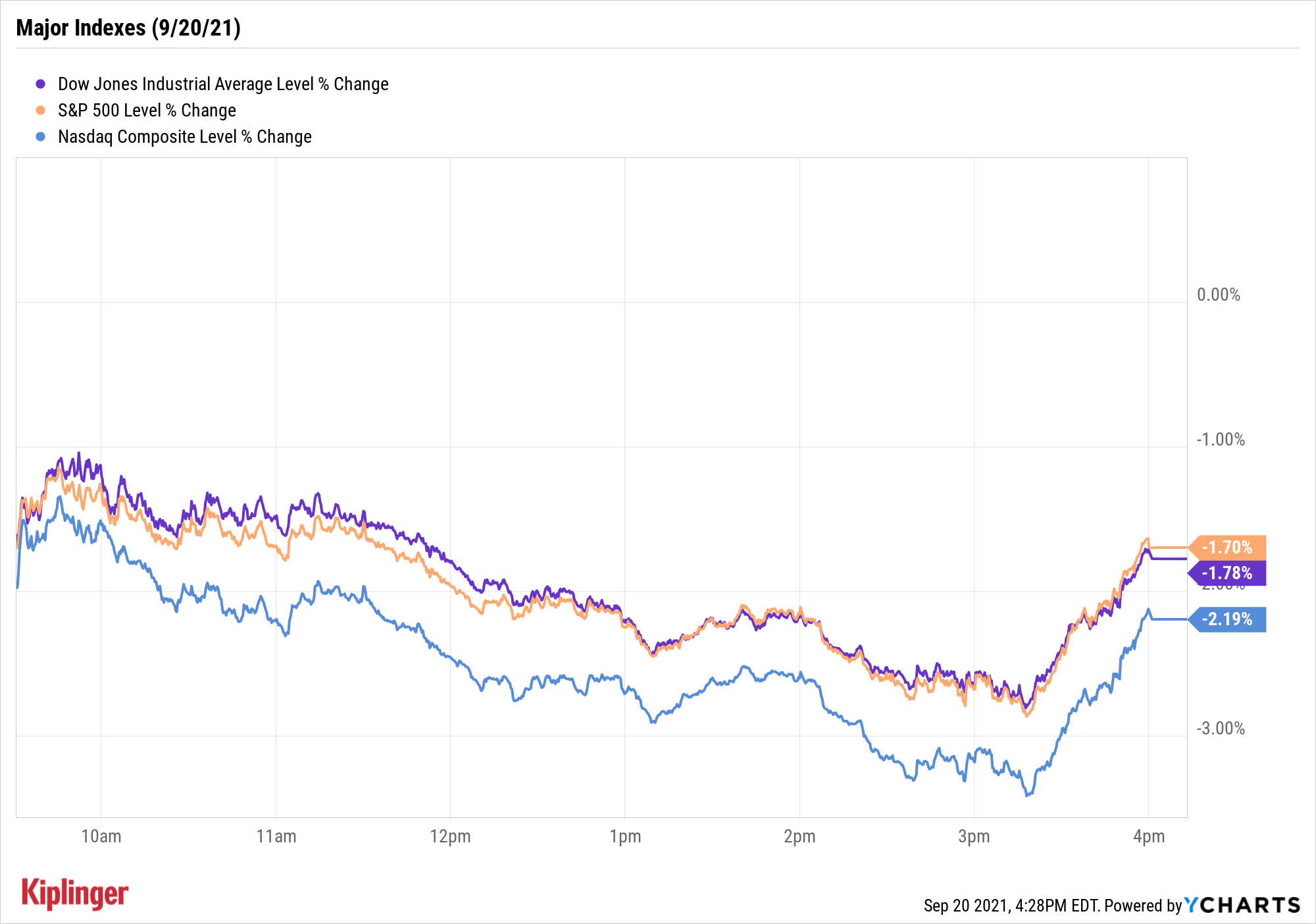

The Dow Jones Industrial Average – led lower by the likes of Caterpillar (CAT, -4.5%), Goldman Sachs (GS, -3.4%) and JPMorgan Chase (JPM, -3.0%) – sank 614 points, or 1.8%, to 33,970. It could have been worse: The industrial average was off as much as 971 points at its intraday low, but it regained some ground in the afternoon.

The S&P 500 was slightly better at 1.7% declines to 4,357, while the Nasdaq Composite dropped 2.2% to 14,713.

Other news in the stock market today:

- The small-cap Russell 2000 closed 2.4% lower to 2,182.

- Just one Dow stock finished in positive territory today: Merck (MRK, +0.4%). This impressive feat came after the Committee for Medicinal Products for Human Use of the European Medicines Agency recommended MRK's blockbuster oncology drug Keytruda for approval to treat breast cancer. Earlier this summer, the drug was approved by the U.S. Food and Drug Administration to treat high-risk, early-stage, triple-negative breast cancer in combination with chemotherapy.

- In other drug news, Pfizer (PFE, +0.7%) and BioNtech (BNTX, -5.6%) released highly anticipated COVID-19 vaccine data today. The companies said the two-dose regimen they co-developed showed a positive response during a clinical trial of kids 5 to 11. PFE and BNTX plan to submit the data to the FDA "as soon as possible," with hopes the vaccine will be granted Emergency Use Authorization (EUA) at some point over the next several weeks.

- U.S. crude oil futures slumped 2.3% to settle at $70.29 per barrel.

- Gold futures tacked on 0.7% to finish at $1,763.80 an ounce.

- The CBOE Volatility Index (VIX) jumped 19.8% to 24.93, its highest level sincce May.

- Bitcoin wasn't immune from the selling pressure, with prices off 7.8% from Friday levels to $43,821.48. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Lose Your Head

Investors are understandably on red alert. Comparisons to the Lehman Brothers disaster of 13 years ago (they've been made) are bound to rattle nerves – and even if this Evergrande situation doesn't deteriorate nearly so badly, it can still act as a sell trigger for investors concerned about other market metrics.

"While there is concern about the Evergrande situation infecting global markets, for the long-term investor, this situation may just be noise," says Lindsey Bell, chief investment strategist for Ally Invest. "Stories like Evergrande's can be tough to digest, and it may take time to understand the true risk related to this type of event."

But she also acknowledges the argument that the market has seemed long due for a pullback – and sees the sunny side of that possibility.

"If you're a long-term investor complaining about an expensive market, this may be your opportunity to bargain hunt," she says.

You can start your hunt in these 16 top value stocks, though if you prefer small firms, consider these 11 small-cap deals instead.

Investors more concerned with simply navigating yet another market hiccup in a calmer fashion in the market might instead gravitate toward low-volatility funds, but if so, here's a tip: Many low-volatility ETFs are designed to reduce volatility over the longer term but might not protect you against quick market shocks. This list of low-volatility ETFs covers some of each.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.