Stock Market Today: Dow Drops as Brief Boost From CPI Data Fades

A morning jolt from an August cooldown in inflation proved ephemeral Tuesday, with early gains fizzling into widespread declines.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A slower-than-expected measure of inflation released Tuesday morning provided stocks with a quick but ultimately fleeting lift.

The Labor Department reported that August's headline consumer price index grew 0.3% month-over-month (0.4% expected) and 5.3% year-over-year (5.3% expected); both figures came in slightly slower than July's consumer-price growth.

Core CPI, which backs out the volatile measures of energy and food, also came in under estimates, at 4.0% growth in August versus 4.2% expected

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Last month's consumer price index included notable drops in items such as airline tickets and used cars – a couple of key inflation drivers in 2021 that have been considered "transitory" in nature.

"The debate over whether inflation is transitory (i.e. temporary) or gaining a foothold in consumer – and producer – psychology is just starting to pick up steam, and the outcome of that debate will likely determine the timeline with which the Fed will begin raising interest rates, and thus will be a major market event," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

Rick Rieder, BlackRock's chief investment officer of global fixed income, points to another potential inflation risk:

"We think it's hard to see a case for the recent levels of elevated inflation turning into '1970s-style' runaway price increases, but in the near-term supply shortages, including in labor, are dulling the potential growth of the economy and migrating prices in the near- to intermediate-term somewhat higher," he says. "In the context of a solidly expanding economy, these higher wages and supply-chain shocks will allow companies to achieve higher levels of pricing power for at least the next couple of quarters, if not next couple of years.

"That could risk the development of a more undesirable level of inflation to persist for a time, complicating the risk/reward of excessive monetary policy accommodation.

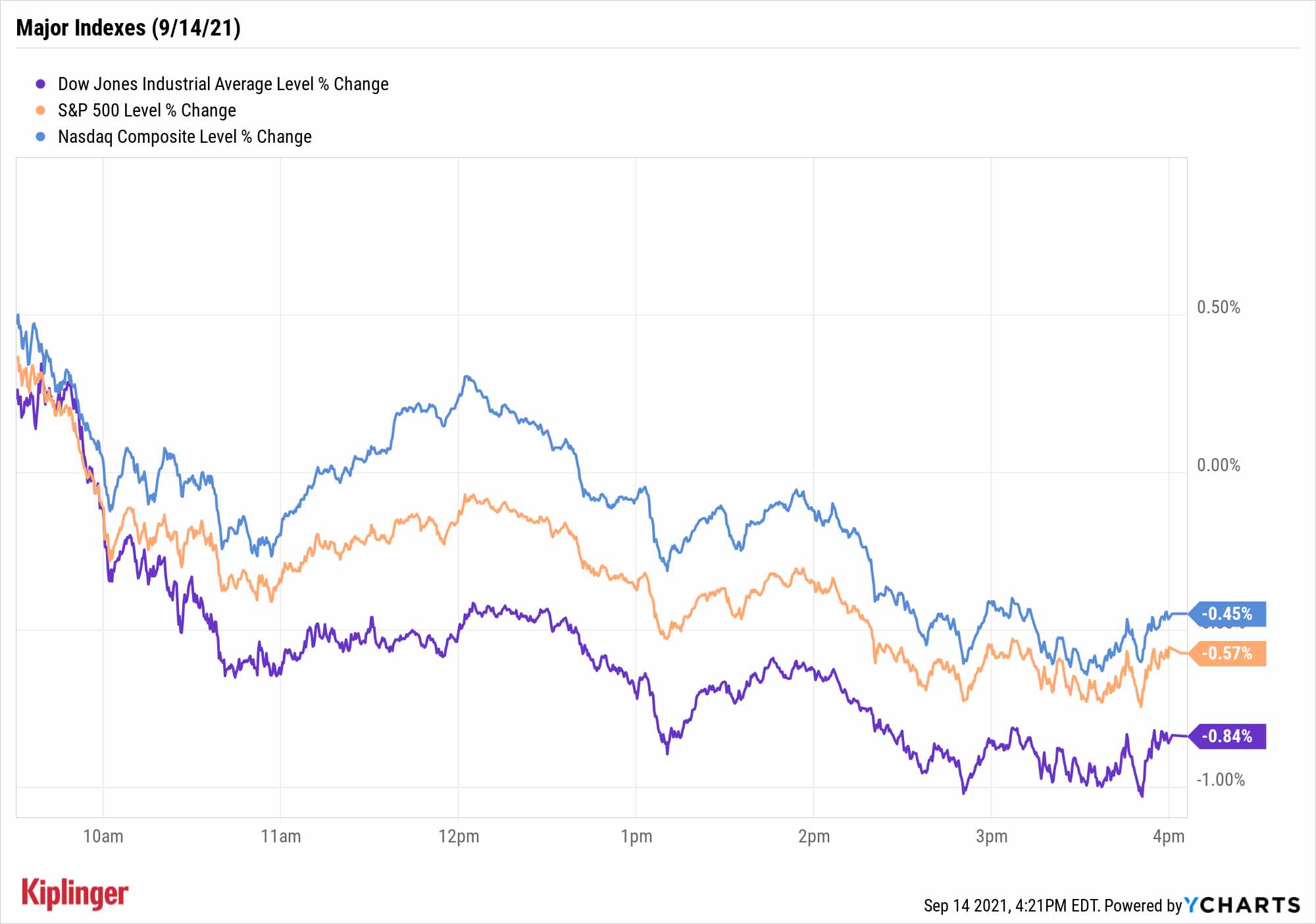

The major indexes initially opened in the green but quickly gave up their gains in a broad-based downturn that saw every market sector finish in the red. The Dow Jones Industrial Average (-0.8% to 34,577) and S&P 500 (-0.6% to 4,443) couldn't build on yesterday's gains, while the Nasdaq Composite (-0.5% to 15,037) extended its losing streak to five sessions.

Weighing on all three was Apple (AAPL, -1.0%), which received a less-than-enthusiastic reaction to its latest product event revealing the iPhone 13, Apple Watch Series 7 and other updates.

Other news in the stock market today:

- The small-cap Russell 2000 sank by 1.4% to 2,209.

- Is Microsoft (MSFT) due for a dividend hike? That's what Morgan Stanley analyst Keith Weiss believes. The mega-cap tech giant has consistently raised its quarterly dividend payment in mid-to-late September for the last 11 years, and Weiss is predicting a roughly 10% increase this time around. However, considering MSFT reported a 32% year-over-year rise in its fiscal 2021 operating income in July, the analyst – who has an Overweight (Buy) rating on the stock – sees the "capacity for a larger dividend increase." Currently, MSFT issues a quarterly payment of 56 cents per share, which translates to a 0.8% yield. The speculation was enough to lift the shares 0.9% today, making Microsoft the best Dow stock today (and one of just two to close in positive territory).

- Herbalife Nutrition (HLF, -21.1%) got knocked around after the dietary supplements specialist cut its guidance for both the third quarter and the full year. Citing "lower than expected levels of activity amongst its independent distributors," HLF says it now expects current-quarter net sales to contract between 3.5% and 6.5% from Q3 2020, while sales for all of 2021 are expected to improve 4.5% to 8.5% on a year-over-year basis. The company also lowered its adjusted earnings per share and EBITDA (earnings before interest, taxes, depreciation, and amortization) forecasts for 2021.

- U.S. crude futures gained a penny to end at $70.46 per barrel.

- Gold futures rose 0.7% to settle at $1,807.10 an ounce.

- The CBOE Volatility Index (VIX) rose 1.3% to 19.63.

- Bitcoin rebounded by 3.9% to $46,486.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A Haven for Yield Hunters

The market's struggles this month have done little to ease the pressure on income investors looking for fresh opportunities. The S&P 500's yield remains at a paltry 1.3% – roughly on par with 10-year Treasuries after a drop in yields today.

Sure, you can secure higher future yields by targeting dividend growth – these five highly rated Dividend Aristocrats are a good place to start – but sources of high current yields are few and far between.

One place to start is real estate investment trusts (REITs), which are required to deliver at least 90% of their taxable profits to shareholders in the form of dividends.

"A pretty common question that we get asked is, 'Where do we find yields?'" says James Ragan, director of wealth management research at investment banking firm D.A. Davidson. "It's hard to just chase the highest yield; that doesn't lead to the best outcomes. We are looking for high-quality companies that have been able to raise their dividends through the pandemic. And the REIT sector has some high-quality areas that are fairly attractive yields in the current environment."

Investors can easily invest in dozens of REITs at once via these seven real estate funds. But if you prefer to make more concentrated bets on some of the sector's top opportunities, consider this shortlist of appealing REITs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.