Stock Market Today: Stocks Sluggish as Wall Street Weighs Delta Threat

Concerns about the Delta variant's effects on the economic recovery weighed on wide swaths of the market Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors returned to their desks Tuesday for a holiday-shortened week of trading stocks with little to guide them. No major U.S. economic data releases were slated for today (and few are on deck this week). And the Q2 earnings slate is thinning out.

However, BMO Capital Markets Senior Economist Sal Guatieri notes that this week, "there will be plenty of Fed chatter to mull over, with no less than eight officials hitting the podium."

"Recent talk has landed on the positive side of the ledger, including from the Chair," he adds. "Any fading optimism would push a taper announcement to later this year."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So what influenced stocks on Tuesday?

The predominant driver seemed to be a slew of U.S. GDP estimate downgrades in the wake of last week's jobs report and rising concerns about the COVID-19 Delta variant. BMO shaved its forecasts for both Q3 growth (to 5.0% from 6.0%) and Q4 (to 4.0% from 5.0%). Other analyst firms, such as Morgan Stanley and Goldman Sachs, also lowered their expectations.

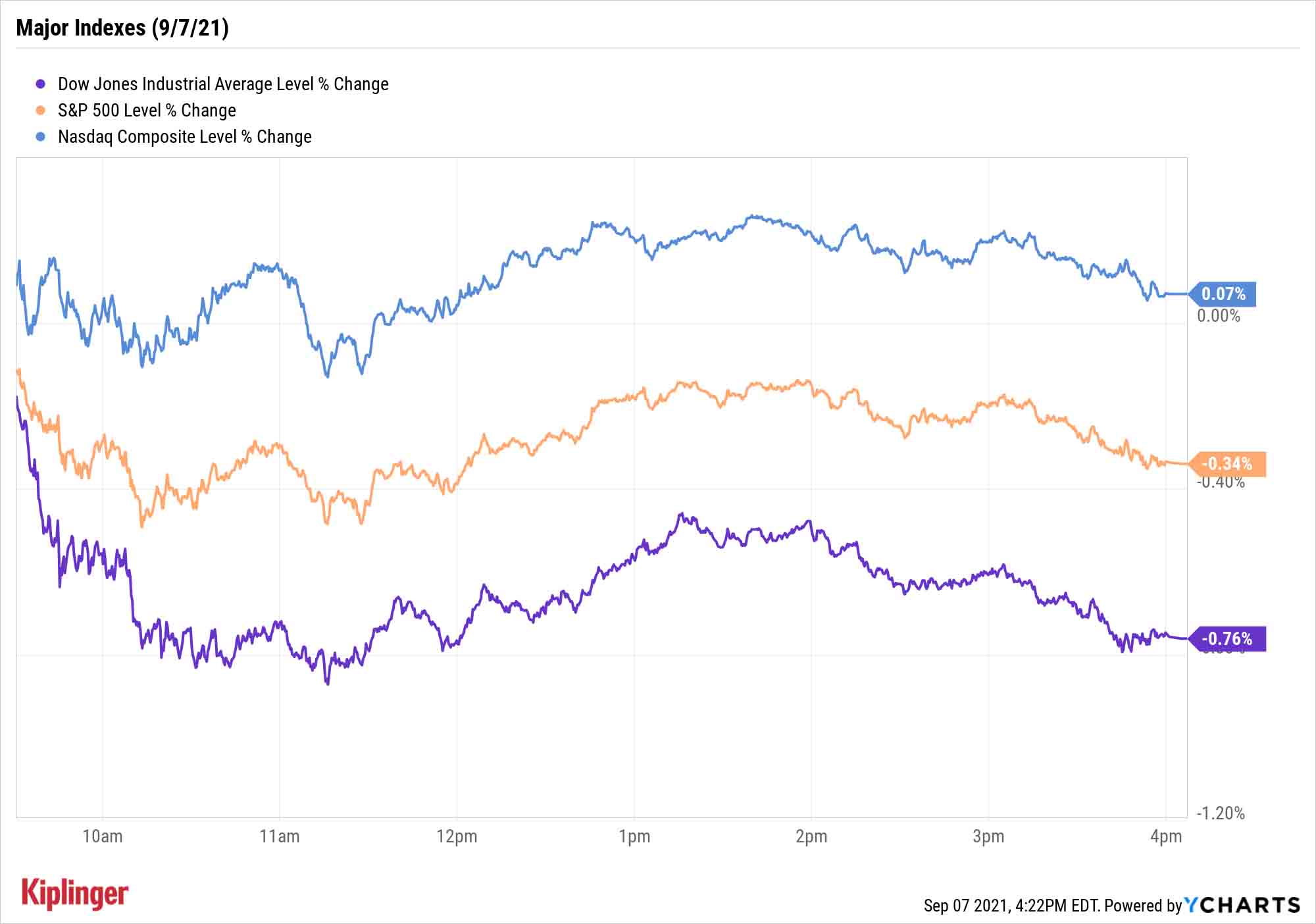

The industrial sector (-1.8%) led the way lower, with Dow Jones Industrial Average components 3M (MMM, -4.5%) and Honeywell (HON, -2.4%) contributing to the DJIA's 0.8% decline to 35,100. The S&P 500 finished with a thinner loss, off 0.3% to 4,520.

However, the Nasdaq Composite managed to squeeze out its fourth consecutive record close – a marginal gain to 15,374. It was helped by Apple (AAPL, +1.6%), which hit another all-time high after announcing a Sept. 14 event where it's widely expected to reveal the iPhone 13 and other product updates.

Other news in the stock market today:

- The small-cap Russell 2000 dipped 0.7% to 2,275.

- Moderna (MRNA, +4.7%) shares recorded their fifth consecutive gain in the wake of a massive price-target upgrade from Morgan Stanley analyst Matthew Harrison. “We continue to see COVID-19 revenues declining over time, but we do not see that starting to happen until 2023/2024 versus our prior estimate of 2022,” says Harrison, who raised his price target to $337 per share from $190 previously. “We have also added in the potential for a combination COVID/respiratory vaccine.”

- U.S. crude futures declined 1.4% to $68.35 per barrel.

- Gold futures also retreated amid a strong U.S. dollar, settling 1.8% lower to hit $1,800.40 per ounce.

- The CBOE Volatility Index (VIX) jumped 9.6% to 17.98.

- Bitcoin, in what might have been a "buy the rumor, sell the news" event, took a big intraday dive on Tuesday as it became legal tender in El Salvador. Bitcoin, which dropped below $43,000 at one point, finished at $46,709.91 – still a 7.4% decline from Friday's levels. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Be Cautious on Recovery Plays, But Don't Shun Them

"Delta is a material wild card." So says a team of JPMorgan Securities global equity strategists reflecting on the current environment for stocks.

Consider the situation here in the U.S.: Vaccination rates continue to crawl higher, but only 53% of the population (and 64% of adults) is fully immunized against COVID. Medical resources are being stretched thin again, with the country recently surpassing 100,000 COVID-related hospitalizations every day. But at the same time, Wall Street analysts largely agree there will be no return to 2020-esque shutdowns.

From an investing standpoint, this means so-called "recovery stocks" could still deliver additional rewards down the road – though some patience might be required. That's especially true in the travel sector.

"The rise in COVID cases attributed to the Delta variant has weighed on the spending in categories such as restaurants, lodging and airlines," say JPMorgan's strategists. "However, we expect consumer spending in these sectors to rebound strongly as things stabilize."

If you think you have the stomach for it, here are five travel stocks that could make the wait worth it. Each of these picks offers something to set them apart, whether that's a business model that's right for the times, a bulletproof balance sheet to help them wait out more COVID turbulence, or other competitive advantages. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.