Stock Market Today: Dow, S&P 500 Muscle to New Highs After Data Dump

The producer price index and weekly jobless claims were among the economic reports in focus today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

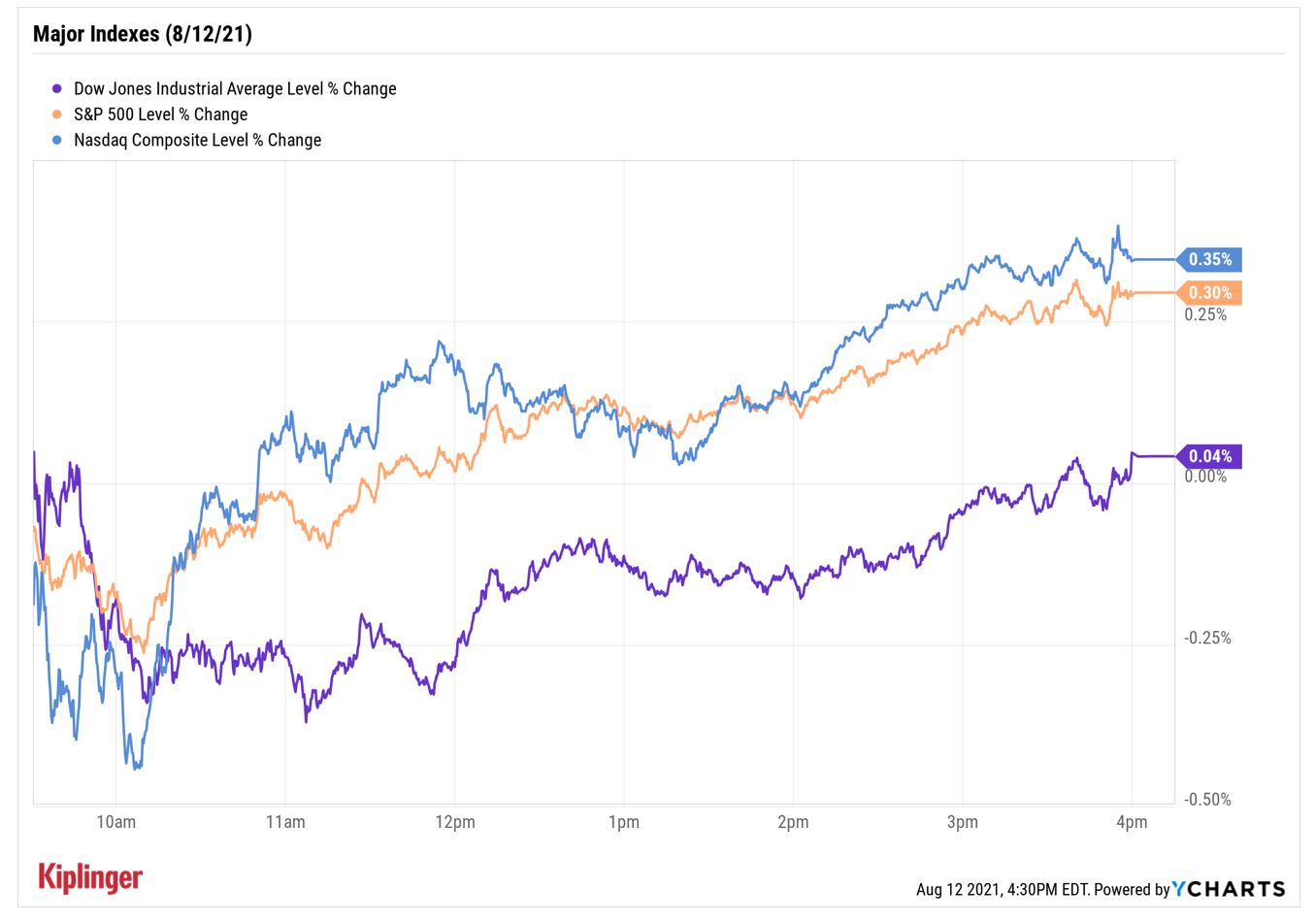

Wall Street processed an onslaught of economic data today, and while the stock market's reaction was relatively muted, two of the major indexes managed to post new highs.

Among the data in front of investors today was the producer price index (PPI), which rose by 1% month-over-month in July.

"Yesterday's consumer price index (CPI) data gave the 'transitory' crowd a little something to latch onto," says Michael Reinking, senior market strategist for the New York Stock Exchange. "However, that has been tempered by today's PPI data that came in hotter than expected. Unlike CPI, the PPI data didn't show a deceleration of the recent trend, increasing some fears that this could ultimately bleed into the CPI as companies raise prices to offset the rising costs (which has been ongoing)."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While most of the increase in wholesale prices was in services (airfare, lodging, etc.), there was one silver lining in the report: food costs fell 2.1%.

Weekly jobless claims also hit this morning, with the number of first-time filers falling to 375,000 last week. Also of note, continuing claims dropped to 2.8 million, the lowest point since mid-March 2020.

"The trend in continuing claims is the positive takeaway," says Sean Bandazian, investment analyst for Cornerstone Wealth. "These numbers should continue to improve as more pandemic assistance programs expire next month."

At the close, the S&P 500 Index was up 0.3% to 4,460 and the Dow Jones Industrial Average added 0.04% to 35,499 – new record highs. The Nasdaq Composite also managed a win, gaining 0.4% to 14,816.

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.3% to 2,244.

- Palantir Technologies (PLTR) got a jolt after earnings, closing the day up 11.4%. While the data analytics specialist's second-quarter adjusted earnings of 4 cents per share matched analysts' consensus estimate, revenues of $376 million were more than expected. Plus, it was the second quarter in a row the company reported top-line year-over-year growth of 49%.

- Bumble (BMBL) was another post-earnings winner, gaining 6.6%. The online dating app recorded an unexpected per-share loss of 6 cents in its second quarter, but revenues of $186.2 million came in above the consensus estimate. The company also increased its current-quarter and full-year guidance.

- U.S. crude oil futures shed 0.2% to end at $69.09 per barrel.

- Gold futures settled marginally lower at $1,751.80 an ounce.

- The CBOE Volatility Index (VIX) fell 2.9% to 15.59.

- Bitcoin prices fell 4.4% to $44,433.35. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How Worried Should We Be About the Delta Variant?

While most experts remain confident that stocks will continue with their upward trajectory, they are keeping one eye trained on COVID-19.

New cases in the U.S. are at their highest since February, largely due to the very contagious delta variant. But while this strain could cause some market volatility in the short term, "We believe the S&P 500 is still likely to see more gains through the end of the year," says Barry Gilbert, asset allocation strategist at LPL Financial.

As such, "any meaningful dip in equity markets should still be viewed as an opportunity to add risk for appropriate investors, and may also provide opportunities to rebalance portfolios toward reopening beneficiaries," he adds.

For conservative investors, consider these stocks that could benefit from a longer-term economic recovery or these tried-and-true blue chips to strengthen your portfolio. But for opportunists who may be looking to get a short-term boost, there are these six stocks that are best suited for another COVID flare-up. Not only are these positioned to thrive as delta variant cases spike, but they're also well-liked by the pros. Check them out.

Karee Venema was long PLTR as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.