Stock Market Today: Stocks Retreat After Amazon Revenue Miss

The major indexes all logged solid July gains, though, with the S&P 500 bringing its monthly win streak to six.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

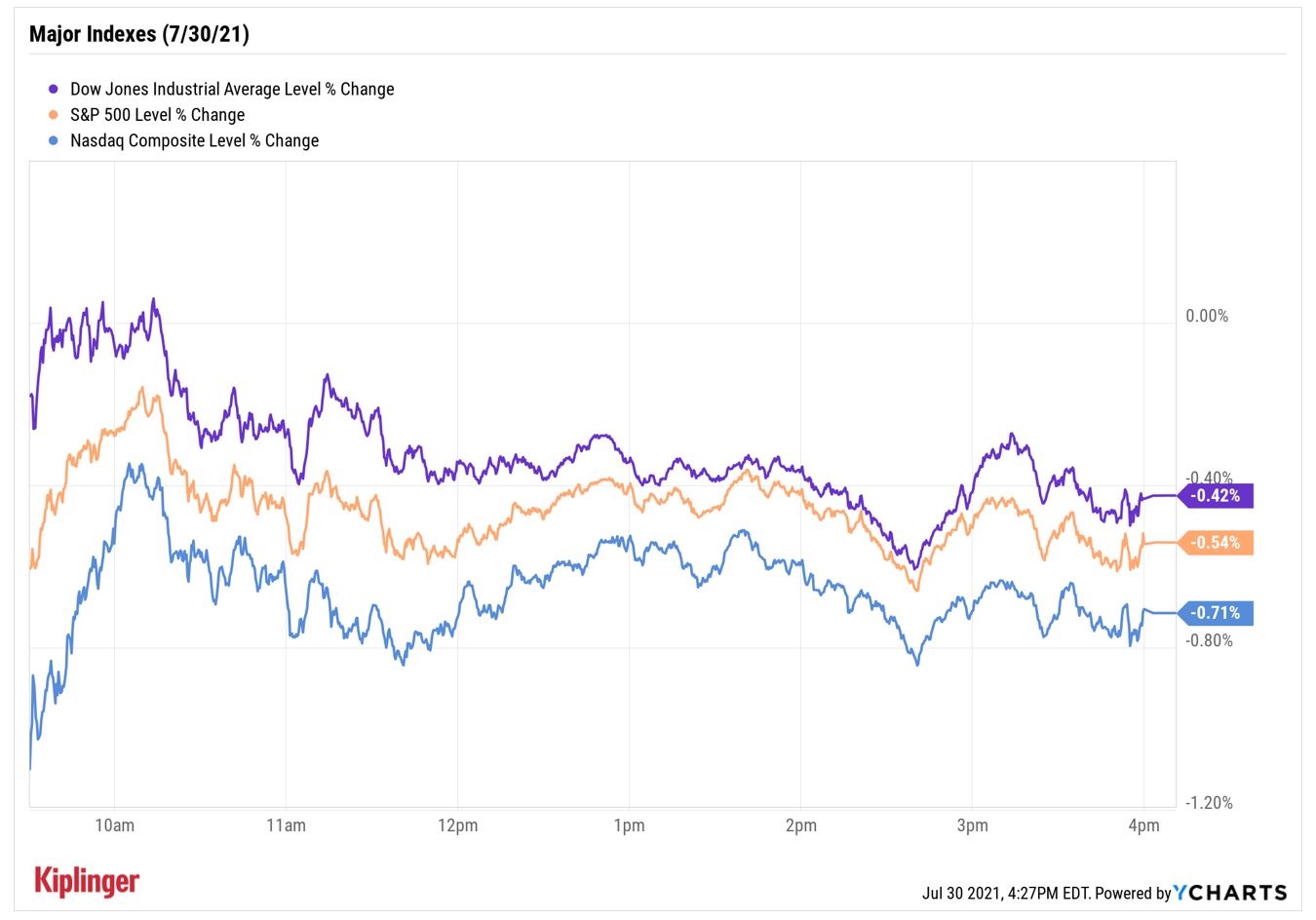

The major market indexes ran out of steam on the last day of a strong month, dragged down by a second-quarter revenue miss from e-commerce giant Amazon.com (AMZN, -7.6%) and rising concerns over the spread of the delta variant of COVID-19.

Wall Street also weighed the latest round of economic data, which showed personal income and spending rebounding in June (+0.1% and 1.0%, respectively), while the personal core expenditures (PCE) index – the Federal Reserve's preferred measure of inflation – rose a slimmer-than-expected 0.4% month-over-month.

"Core prices are still running hot but have decelerated in the past two months," says Sal Guatieri, senior economist at BMO Capital Markets. "This will give the Fed some comfort in its transitory story."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At the close, the Dow Jones Industrial Average was down 0.4% at 34,935, the S&P 500 Index gave back 0.5% to 4,395 and the Nasdaq Composite shed 0.7% to 14,672. For all of July, though, the three indexes notched solid gains – Dow +1.3%, Nasdaq +1.2%, S&P +2.3% – with the latter nabbing its sixth straight monthly advance.

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.6% to 2,226.

- Pinterest (PINS) slumped 18.2% after earnings. For its second quarter, the do-it-yourself (DIY) social media firm posted stronger-than-expected adjusted earnings of 25 cents per share on $613 million in revenues. But monthly active users came in at a lower-than-anticipated 454 million, which was also 5% below what the company reported in the first quarter.

- Capri Holdings (CPRI) was a big earnings winner, ending the day up 12.5%. In its second quarter, the apparel maker formerly known as Michael Kors reported adjusted earnings per share of $1.42 on $1.3 billion in revenue. Both figures were above what analysts were expecting.

- U.S. crude oil futures gained nearly 0.5% to end at $73.95 per barrel. For the week, black gold added 2.6%, and finished the month up roughly 0.7%.

- Gold futures shed 1% to settle at $1,817.20 an ounce. The malleable metal gained 0.9% on the week and 2.6% for the month.

- The CBOE Volatility Index (VIX) rose 3.1% to 18.24.

- Bitcoin was a hair lower at $39,729.29. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

It's Not Time to Get Complacent

This is according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. With the Cboe Volatility Index close to the bottom of its 52-week range and interest rates near record lows, there's certainly the feeling that the market can only go up from here.

However, "Whether it's a growth scare, a reaction to the Federal Reserve's taper plan or a less obvious catalyst, the market is likely to drop sharply before the end of the year," he warns. "The key is to remain calm when the drop comes and to take the time now to make sure your portfolio is in good shape."

Investors who want to add more safety and stability to their portfolios may want to explore this list of high-quality stocks with dividends of over 4%, which can provide a cushion against any potential market pullbacks.

Additionally, real estate investment trusts (REITS) and consumer staples stocks are often considered yield-friendly safety plays, while buy-and-hold investors may want to check out this list of high-return stocks that have a history of delivering outsized gains. These picks come from a wide variety of sectors and have compelling bull cases indicating they could continue to be high-return investments for those willing to wait out any possible short-term bumps in the road.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.