Stock Market Today: Dow, S&P 500 Back Atop the Mountain

More stellar earnings and a glass-is-half-full view of GDP and unemployment data helped drive stocks to fresh highs Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

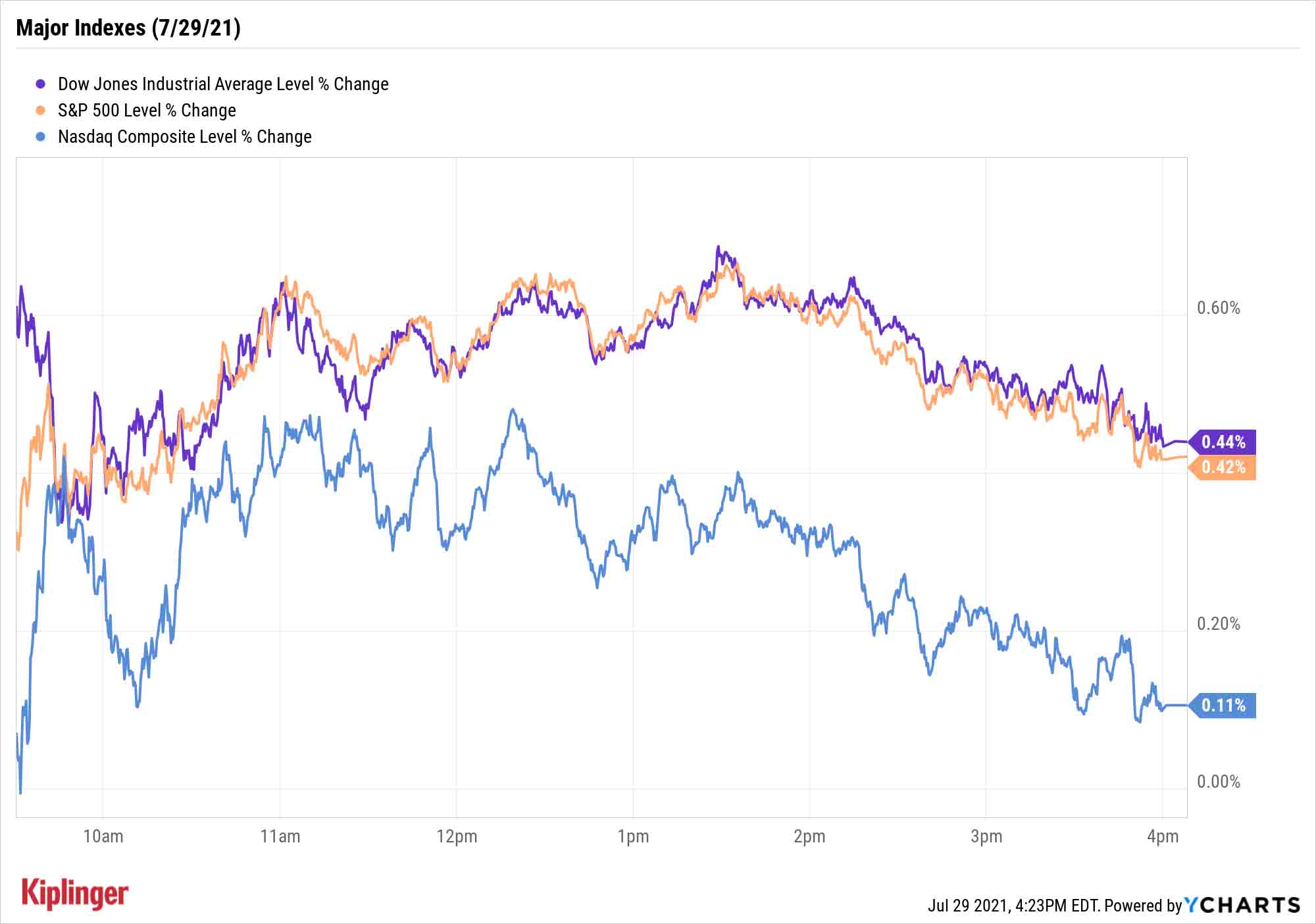

A pair of the major stock indexes registered record closes on Thursday, and they did so in the face of middling economic signals.

The Commerce Department revealed that U.S. gross domestic product grew by an annualized 6.5% rate during the second quarter – a figure that Barclays economists deemed "solid, but unspectacular and below expectations [of 8.4%]."

"Private consumption surged 11.8%, yet bottlenecks held back production and inventories were a drag on growth," they add. "Chip shortages restrained motor vehicle output and rising home prices likely crimped demand for housing."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unemployment-benefits filings for the week ended July 24 were lower than the week prior, but only by about 24,000 claims to 400,000 – 15,000 claims higher than expected. And pending home sales for June declined by 1.9% month-over-month, disappointing economists who collectively were looking for a 0.3% improvement.

The Q2 earnings calendar was a bright spot yet again, however.

Qualcomm (QCOM, +6.0%) reported that profits more than doubled in its most recent quarter. Mastercard (MA, +1.4%) beat earnings and revenue forecasts, and Ford (F, +3.8%) announced a surprise quarterly profit that allowed the automaker to boost its full-year guidance.

The Dow Jones Industrial Average closed up 0.4% to a record 35,084, while the S&P 500's 0.4% gain brought it to an all-time high of 4,419. The Nasdaq Composite improved by 0.1% to 14,778, 59 points shy of its July 23 highwater mark.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.7% to 2,240.

- Robinhood (HOOD) began trading today after pricing its initial public offering (IPO) at $38 per share last night – the low-end of its expected range – which valued the investing platform at $26.7 billion. HOOD shares opened at their IPO price before falling all the way down to $33.35. They eventually climbed up to $40.22, but closed well below here at $34.82. One aspect of HOOD's market debut that made it unique is that it set aside 20% to 35% of its IPO shares for its own clients, which "will likely represent the first IPO experience for many individual investors," says David Keller, chief market strategist at StockCharts.com. "Given the influx of inexperienced investors in this particular IPO, that means an environment ripe for behavioral biases such as overconfidence and confirmation bias. I would focus on where HOOD trades relative to its listing price of $38, because if the price starts to dip below that level, I could see investors reacting emotionally and irrationally when they realize IPOs can go down!"

- Nikola (NKLA) was also in focus today after a federal grand jury indicted Trevor Milton, founder of the electric vehicle (EV) company, on two counts of securities fraud and wire fraud, saying he "brazenly and repeatedly used social media, and appearances and interviews on television, podcasts and in print, to make false and misleading claims" about the company. He was also hit with fraud charges from the Securities and Exchange Commission (SEC). Milton resigned as chairman of Nikola last September, and a statement from his legal team says he is being "wrongfully accused." NKLA shares slumped 15.2%.

- U.S. crude oil futures surged 1.7% to settle at $73.62 per barrel – their loftiest close in more than two weeks.

- Gold futures jumped 1.7% to finish at $1,835.80 an ounce. It was the malleable metal's highest settlement since mid-June.

- The CBOE Volatility Index (VIX) declined again, by 3.3% to 17.70.

- Bitcoin prices slid 1.4% to $39,730.22. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Second Verse, Not as Great as the First

One troubling undercurrent among these positive earnings reports, however: Suggestions that the second half of the year won't be so explosive.

Apple (AAPL) reported Street-beating earnings on Tuesday, yes, but it also warned of slower growth throughout the rest of 2021. This happened with Facebook (FB, -4.0%) too: It topped expectations on both the top and bottom lines, but CFO David Wehner said year-over-year revenue growth will slow because the second half of 2020 was so strong.

While this problem won't extend across the entire market, it could be felt by many of the largest, most widely held stocks – yet another reason why it pays to diversify.

There are few cheaper and easier ways to do that than buying a handful of exchange-traded funds (ETFs). But which ones?

Chances are you don't have the time to dig through each of the 2,000-plus ETFs that trade in the U.S. alone, so we're here to help with a short list of funds that serve a wealth of purposes and are downright inexpensive to buy: Our recently refreshed Kip ETF 20. Whether you're looking for a buy-and-hold-forever bond fund, sector-specific funds to ride Wall Street's top trends, or something in between, this list is among the best places you can start.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.