Stock Market Today: Red-Hot June CPI Cools Off Stocks

U.S. inflation raced ahead in June at its fastest clip since 2008, prompting at least a short pause in stocks' recent ascent to new heights.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Investors on Tuesday received the latest update on America's inflation situation, and a wobbly day for stocks indicated they were having issues with it.

U.S. consumer prices in June easily outstripped expectations by jumping 0.9% month-over-month and 5.4% year-over-year – both the largest such moves since 2008. A 0.9% MoM rise in the so-called core consumer price index was even headier.

"Stripping away food and energy, it was the highest print since November 1991 on a year-over-year basis," says Cliff Hodge, chief investment officer for Cornerstone Wealth. "However, moving forward, we expect these inflation numbers to begin to cool. June 2020 was the absolute low for core CPI during the pandemic shutdown, so the comparisons get tougher from here."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But just how much of this inflation is truly transitory is still up for debate.

"Businesses are currently passing along their higher input costs (for supplies, products, labor) down to their customers," says Jennifer Lee, senior economist for BMO Capital Markets. "Earlier this morning, the NFIB's latest survey for June showed that 44% of businesses were planning to raise their selling prices, the biggest share since 1979. Producer prices for May were up over 5% from 2019's levels, while import prices are 4% higher."

"The transitory debate is far from over," she adds. "In fact, it got a little hotter."

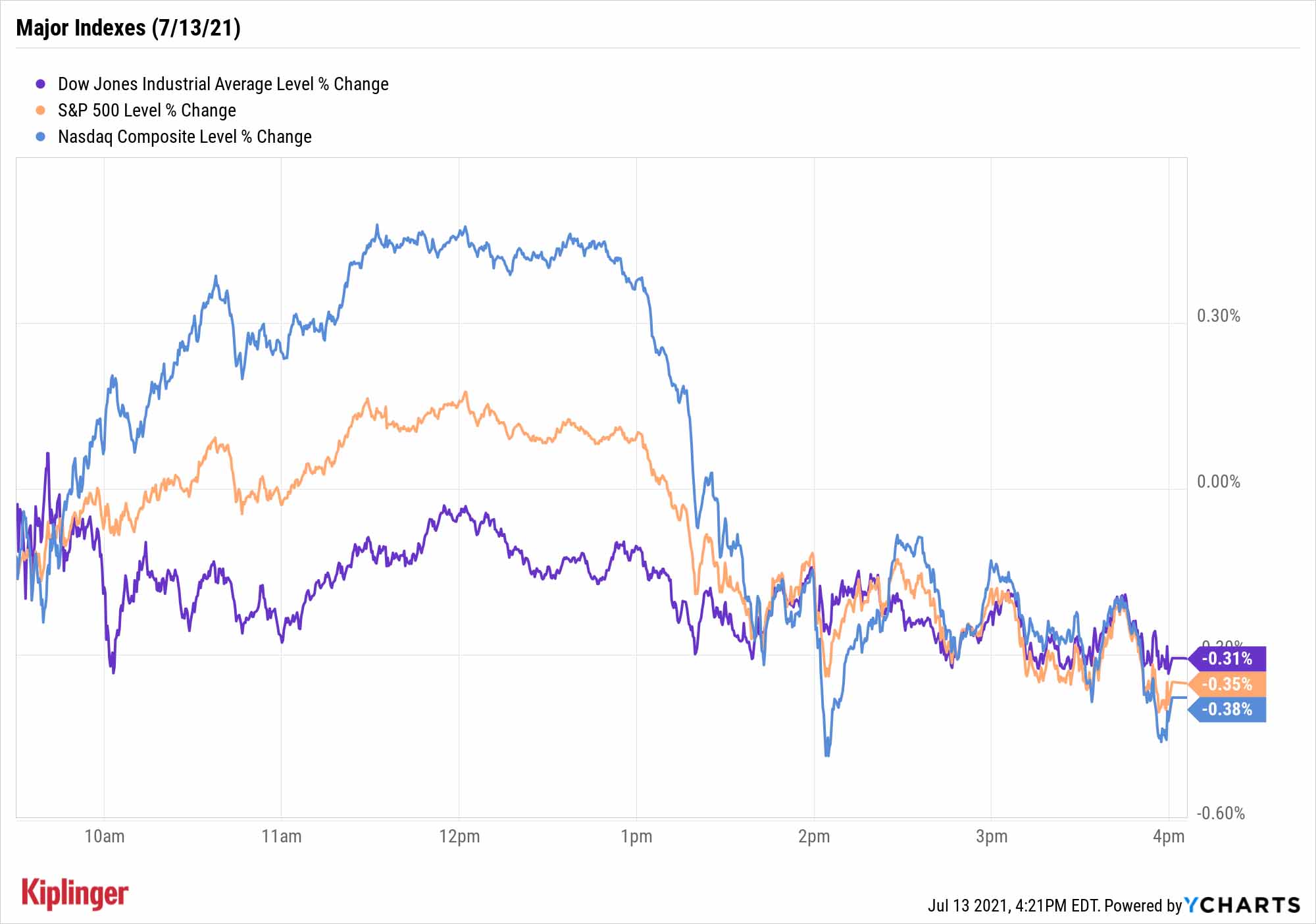

The major indexes swung between small gains and losses before finishing in the red. The Dow Jones Industrial Average ended Tuesday off 0.3% to 34,888, the S&P 500 finished 0.4% lower to 4,369, and the Nasdaq Composite closed with a 0.4% decline to 14,677.

Other action in the stock market today:

- The small-cap Russell 2000 lurched 1.8% lower to 2,240.

- Second-quarter earnings season kicked off with a bang for soft drink specialist PepsiCo (PEP, +2.3%). The company brought in adjusted earnings per share (EPS) of $1.72 on $19.2 billion in revenues over the three-month period, handily outstripping analysts' consensus expectations. PEP also raised its full-year adjusted EPS forecast, citing rising demand as many restaurants and venues reopen.

- Several big banks also reported earnings today. Goldman Sachs (GS) reported EPS of $15.02 on $15.4 billion in revenue, well above expectations, as revenues in its investment banking unit soared amid a surging initial public offering (IPO) market. JPMorgan Chase (JPM) also beat estimates in its second quarter, unveiling earnings of $3.78 per share on $31.4 billion in revenues, due in part to the financial firm releasing $3 billion in loan loss reserves. The results failed to impress investors, though, with GS slipping 1.0% and JPM ending the day down 1.4%.

- U.S. crude oil futures rose 1.6% to end at $75.25 per barrel – their highest settlement since October 2018.

- Gold futures edged up 0.2% to $1,809.90 an ounce.

- The CBOE Volatility Index (VIX) gained 6.3% to 17.18.

- Bitcoin declined 1.7% to $32,302.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

All Eyes on Healthcare

While certain inflationary pressures, such as sky-high used car prices, do seem destined to retreat, some rising prices are expected to persist for years – such as in healthcare.

Back in 2019, the Centers for Medicare & Medicaid Services projected healthcare spending would grow by 5.3% annually through 2028, which includes expectations for 2.4% annual growth in healthcare prices – higher than the 2.2% five-year rate of overall inflation expected by the bond market, according to Federal Reserve Economic Data.

"Although the pandemic caused people to defer care throughout much of 2020, a rebound and then continuation of the trends beyond 2021 would drive health care spending to historic levels in the coming years," says consulting and advisory firm Deloitte.

Investors have numerous options at their disposal for leveraging this long-term spending trend to their advantage. Income hunters will often flock to blue-chip pharma stocks that throw off ample cash. Those with a nose for growth will naturally gravitate toward often-explosive biotech stocks, but remember: You can still reap the benefits of this cutting-edge industry while paring back risk through the use of these nine exchange-traded funds (ETFs).

Importantly, a rising tide in healthcare spending should lift numerous boats. And investors looking to put their money to work both for the rest of the year, as well as the rest of the decade, can find a starting point with this list of healthcare opportunities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.