Bed Bath & Beyond (BBBY): Will Earnings Spark This Meme Stock?

Our preview of the upcoming week's earnings reports includes Bed Bath & Beyond (BBBY), Micron (MU) and Walgreens (WBA)

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Will Bed Bath & Beyond (BBBY, $30.25) be the belle of the meme-stock ball yet again?

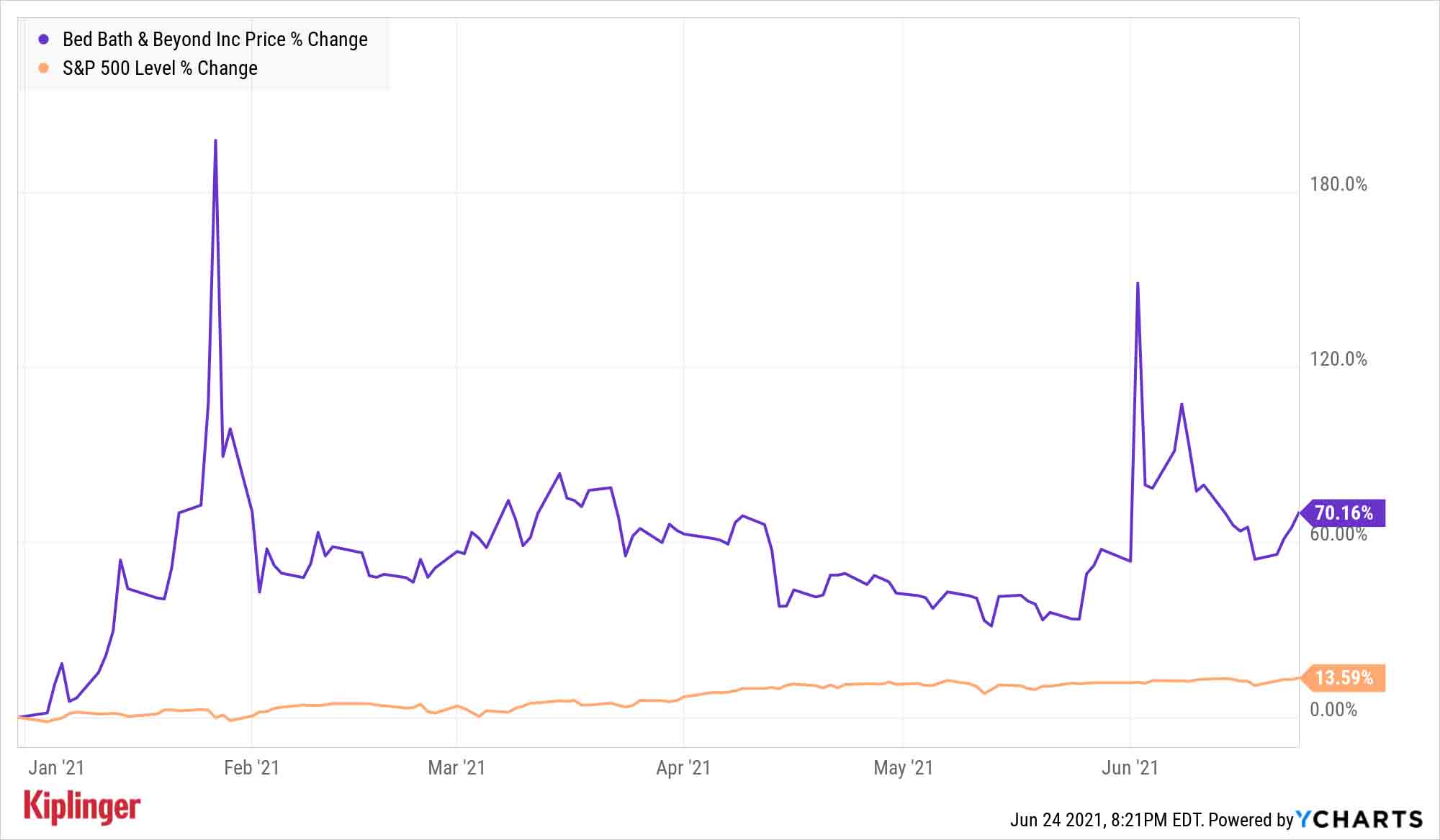

The troubled retailer takes the spotlight on the earnings calendar on June 30, and it does so by having one of its best first halves in recent memory ... at least on a share-price basis. BBBY stock is up 70% so far in 2021, though it has been a wild ride that has seen the stock double at a couple of points this year, and even triple.

Why the red-hot action in BBBY shares?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In part, simply a better operational environment. An explosion in homebuying has meant good things for the home-furnishings retailer. And several new initiatives have given hope to investors that the struggling chain might possibly be on the verge of a real turnaround.

CFRA analyst Kenneth Leon recently upgraded shares to Hold from Sell, saying, "Our rating upgrade is based on our confidence management can execute major brand transformation that will accelerate the digital experience, ration stores by closing low demographic locations, remodel most stores, and bring on new stores all in the new store layout and website that showcases eight new brand product categories recently introduced."

But BBBY has also been caught up in the recent trend of day traders piling into heavily shorted stocks with the (often successful) goal of triggering short squeezes that send shares soaring.

Not everyone is hyped about BBBY, however.

UBS's Michael Lasser (Sell) notes the possibility that irons in the fire such as its branding campaign and private-label products could breathe life into Bed Bath. And he also thinks BBBY should make progress on things such as its supply chain and store remodels.

However, "While these initiatives should help over the LT, we believe the retailer will face stiff headwinds from consumers shifting wallet share away from home furnishings," Lasser says. "This will likely materialize as consumers head back to the office (data from Kastle shows that only 31.5% of workers have returned to the office)."

"When demand slows, discounting & promos will likely increase, offsetting some of the idiosyncratic potential that BBBY has," adds Lasser.

As far as Bed Bath's upcoming report: The pros are looking for a 34.9% year-over-year jump in revenue to $1.87 billion. That will fuel a swing from a loss of $1.96 per share in the year-ago quarter to an 8-cent-a-share profit.

Earnings Spotlight: Micron Technology

Micron Technology (MU, $80.58) is a prime example of how easy year-over-year comparisons are already baked into share prices.

The chipmaker will report fiscal third-quarter earnings after the June 30 close. The pros, on average, are looking for $7.2 billion in revenues (+35.5% YoY) and earnings of $1.70 per share, or more than double the year-ago figure.

However, shares have rocketed 62% over the past year already, despite slowing-down over the past couple of months. At the same time, MU stock is underperforming the market, with just a 7% gain for the year-to-date -- and that's after investors digested a positive earnings pre-announcement just a few weeks ago.

"We don't expect many surprises with F3Q (May) results," says Deutsche Bank's Sidney Ho, who rates the stock at Buy. "We still think F4Q (Aug) guidance will point to solid sequential revenue and EPS growth on continued pricing strength, but we do note more mixed data points recently related to end market strength and pricing trends."

However, the analyst adds that in the near term, "investor sentiment on MU has turned more conservative, and hence we believe an in-line F4Q guide with DB estimates should be enough to lead MU's shares higher."

Earnings Spotlight: Walgreens Boots Alliance

Walgreens Boots Alliance (WBA, $52.10), like many other stocks, enjoyed a robust rally to start the year but has since flattened out over the past couple months. To wit, WBA shares are up 30% so far in 2021 but are virtually breakeven since late March.

Will Walgreens' Thursday morning quarterly report inject some life back into shares?

Analysts appear to be all over the place on the subject. On average, they're looking for a 2.5% decline in revenues to $33.76 billion, but a 64.8% jump in profits to $1.17 per share. However, Argus Research analyst Christopher Graja points out that "there are a wide range of estimates from $0.80 to $1.35 for fiscal 3Q, which includes the months of March, April, and May." And his own estimate of $1.07 per share is below the consensus.

Even then, Graja, who has a Hold rating on shares, sees some reason for optimism.

"We like the company's emphasis on healthcare with the ramp-up of VillageMD primary care clinics and the sale of most of the former Wholesale division," he says. "We also think that Rosalind Brewer is a perfect pick as the company's new CEO."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.

-

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today

'Humbug!' Say Consumers, Despite Hot GDP: Stock Market Today"The stock market is not the economy," they say, but both things are up. Yet one survey says people are still feeling down in the middle of this complex season.

-

Cooler Inflation Supports a Relief Rally: Stock Market Today

Cooler Inflation Supports a Relief Rally: Stock Market TodayInvestors, traders and speculators welcome much-better-than-hoped-for core CPI data on top of optimism-renewing AI earnings.