Stock Market Today: Nasdaq's Plunge Overshadows Dow's Flirtation With 35K

The Nasdaq suffered its worst decline in roughly two months Monday as investors continued their rotation out of growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

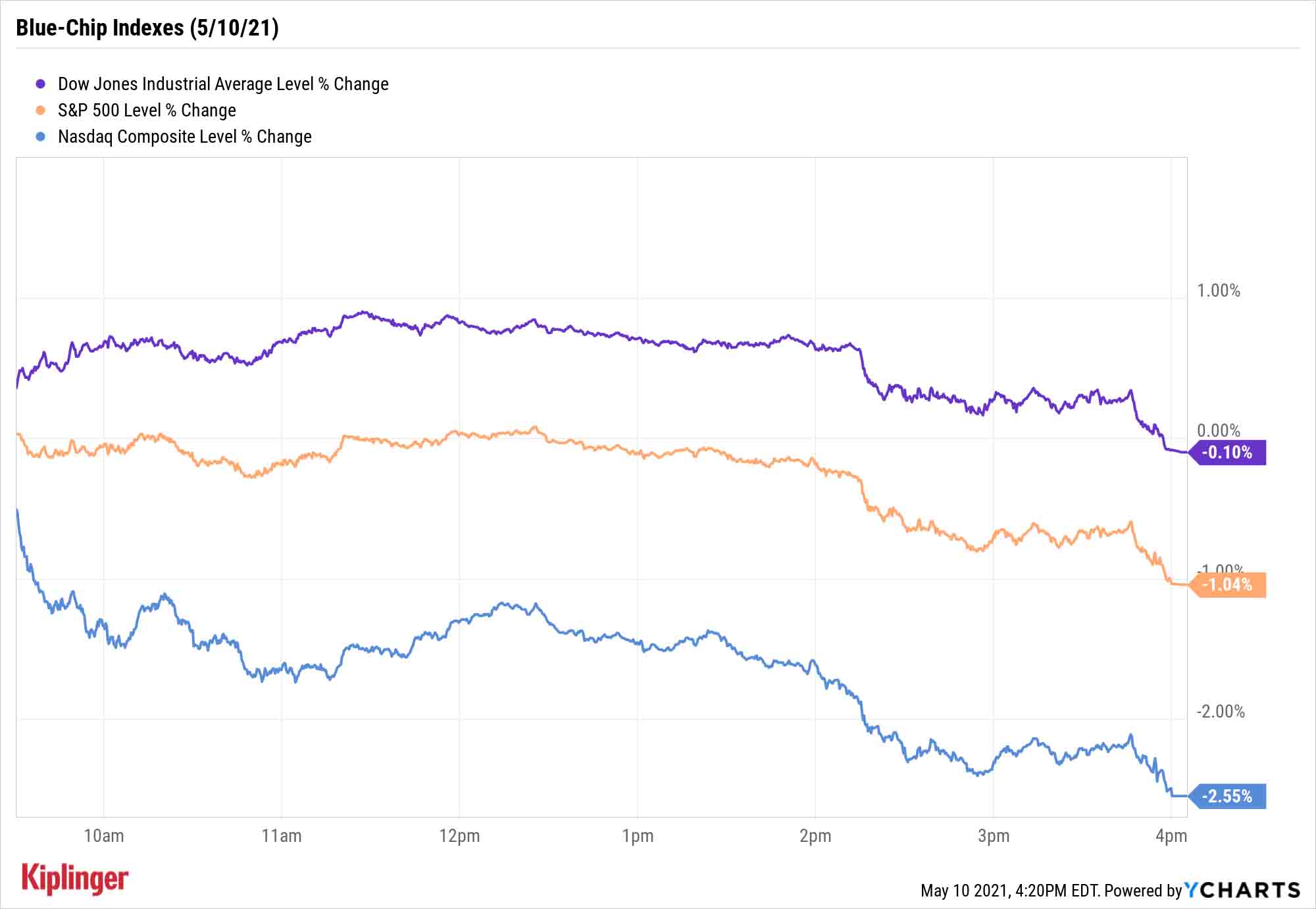

The Dow Jones Industrial Average momentarily climbed over the 35,000 mark Monday for the first time in the industrial average's long history. But that accomplishment took second billing to the Nasdaq Composite's nastiest dip in a couple of months.

"Last week there was significant volatility in the growth/tech basket and Friday's disappointing jobs report gave a brief respite to some of this weakness," says Michael Reinking, senior market strategist for the New York Stock Exchange. "However, that has been short lived as these stocks are getting hit very hard again today."

Some were hit for good reason: Facebook (FB, -4.1%) and Alphabet (GOOGL, -2.6%), for instance, were both downgraded by Citi analysts who felt investors' expectations for ad growth at the firms were too optimistic. But the likes of Apple (AAPL, -2.6%), Nvidia (NVDA, -3.7%), Tesla (TSLA, -6.4%) and more were swept up in a selloff in growth names that sent the Nasdaq 2.6% lower to 13,401 – its worst drop since March 18.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Cyclical and value plays continued to exhibit relative strength, however.

The Dow, which briefly had its head above the 35,000 level, managed to escape with a mere 0.1% loss to 34,742; 3M (MMM, +2.1%) and Procter & Gamble (PG, +1.9%) prevented the industrial average from suffering deeper declines.

Other action in the stock market today:

- The S&P 500 declined 1.0% to 4,188.

- The small-cap Russell 2000 was dinged up with a 2.6% decline to 2,212.

- Marriott International (MAR, -4.1%) was another notable decliner today after the hotel operator reported earnings. For its first quarter, MAR banked a better-than-anticipated adjusted per-share profit of 10 cents, but revenues of $2.32 billion for the three-month period fell short of expectations.

- Chipotle Mexican Grill (CMG, -2.4%) finished in the red today, too. The burrito chain unveiled several employee compensation incentives as it looks to hire 20,000 domestic workers. Included in the company's initiatives are wage hikes for both hourly and salaried employees, as well as new opportunities to help workers climb the corporate ladder.

- Following a ransomware attack on Colonial Pipeline, which forced that company to temporarily shut down its system that transports fuel along the East Coast, U.S. crude oil futures rose 2 cents to end at $64.92 per barrel.

- Gold futures gained 0.3% to finish at $1,837.60 an ounce, marking their fourth straight win.

- The CBOE Volatility Index (VIX) jumped 16.9% to 19.51.

- Bitcoin prices dipped 3.1% to $55,850.51. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Sleep on the Rotation

Experts continue to suggest that investors take the hint.

"The outperformance in mega-cap tech stocks has likely nearly run its course as valuations in these stocks have moved up considerably in recent weeks, thanks to better-than-expected earnings and a retreat in bond yields," says Andrea Bevis, senior vice president, UBS Private Wealth Management. "Investors should diversify beyond mega-cap tech companies and rotate into cyclical and value-oriented areas of the market that should continue to benefit from higher yields and a broadening economic recovery."

That's a continued green light for the "reflation trade" and other recovery-themed stocks that have already done well so far in 2021 ...

... at least, broadly speaking.

A few individual stocks in "preferred" sectors, such as industrials and consumer discretionaries, are throwing off far more warning signs than their peers. With markets feeling just a bit toppy across the board, we've dug around to see where the deepest pockets of risk lie – and we've come across 10 stocks that, at the moment, look a bit rough. Watch your step.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.