Stock Market Today: Nasdaq's Plunge Overshadows Dow's Flirtation With 35K

The Nasdaq suffered its worst decline in roughly two months Monday as investors continued their rotation out of growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

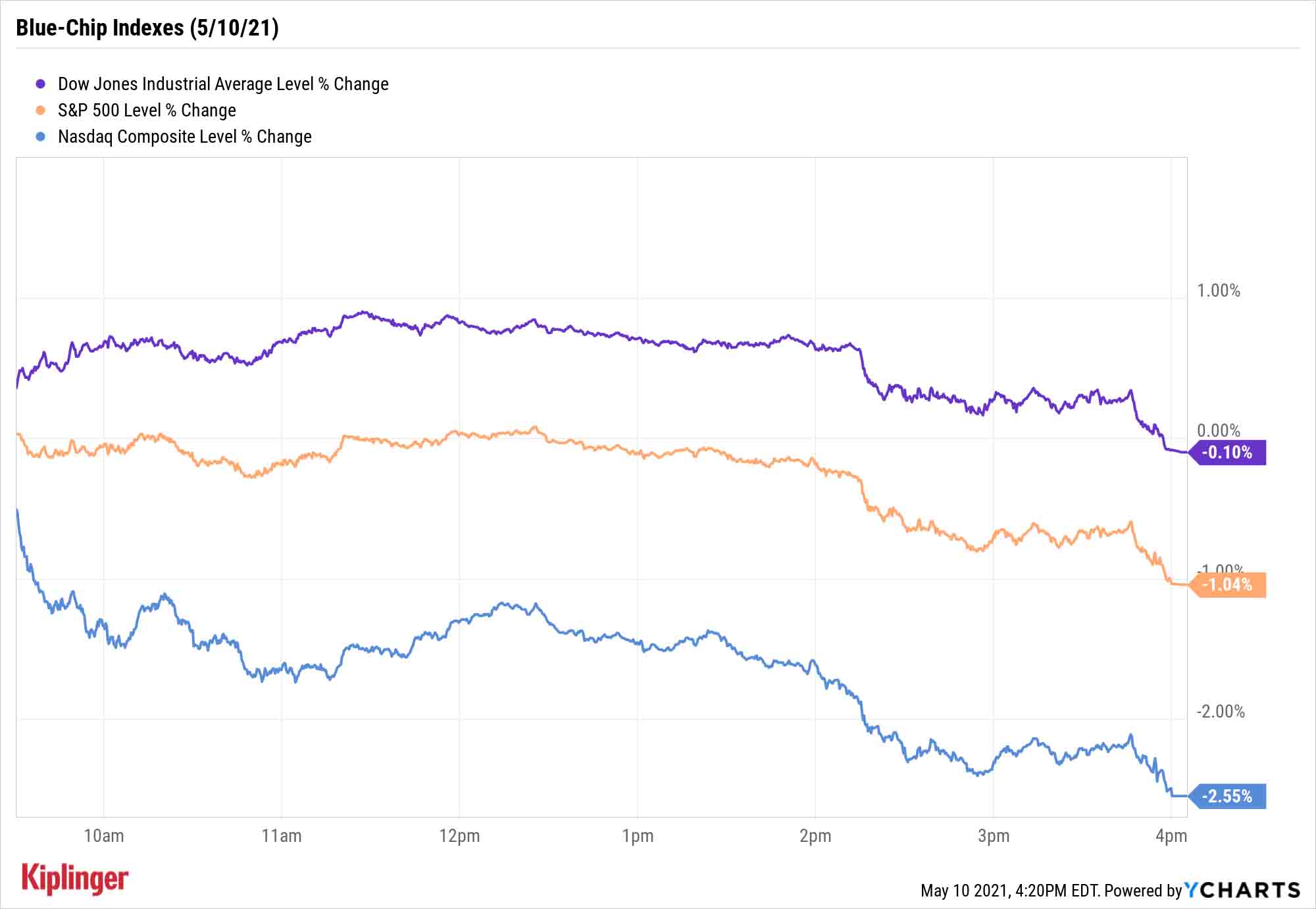

The Dow Jones Industrial Average momentarily climbed over the 35,000 mark Monday for the first time in the industrial average's long history. But that accomplishment took second billing to the Nasdaq Composite's nastiest dip in a couple of months.

"Last week there was significant volatility in the growth/tech basket and Friday's disappointing jobs report gave a brief respite to some of this weakness," says Michael Reinking, senior market strategist for the New York Stock Exchange. "However, that has been short lived as these stocks are getting hit very hard again today."

Some were hit for good reason: Facebook (FB, -4.1%) and Alphabet (GOOGL, -2.6%), for instance, were both downgraded by Citi analysts who felt investors' expectations for ad growth at the firms were too optimistic. But the likes of Apple (AAPL, -2.6%), Nvidia (NVDA, -3.7%), Tesla (TSLA, -6.4%) and more were swept up in a selloff in growth names that sent the Nasdaq 2.6% lower to 13,401 – its worst drop since March 18.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Cyclical and value plays continued to exhibit relative strength, however.

The Dow, which briefly had its head above the 35,000 level, managed to escape with a mere 0.1% loss to 34,742; 3M (MMM, +2.1%) and Procter & Gamble (PG, +1.9%) prevented the industrial average from suffering deeper declines.

Other action in the stock market today:

- The S&P 500 declined 1.0% to 4,188.

- The small-cap Russell 2000 was dinged up with a 2.6% decline to 2,212.

- Marriott International (MAR, -4.1%) was another notable decliner today after the hotel operator reported earnings. For its first quarter, MAR banked a better-than-anticipated adjusted per-share profit of 10 cents, but revenues of $2.32 billion for the three-month period fell short of expectations.

- Chipotle Mexican Grill (CMG, -2.4%) finished in the red today, too. The burrito chain unveiled several employee compensation incentives as it looks to hire 20,000 domestic workers. Included in the company's initiatives are wage hikes for both hourly and salaried employees, as well as new opportunities to help workers climb the corporate ladder.

- Following a ransomware attack on Colonial Pipeline, which forced that company to temporarily shut down its system that transports fuel along the East Coast, U.S. crude oil futures rose 2 cents to end at $64.92 per barrel.

- Gold futures gained 0.3% to finish at $1,837.60 an ounce, marking their fourth straight win.

- The CBOE Volatility Index (VIX) jumped 16.9% to 19.51.

- Bitcoin prices dipped 3.1% to $55,850.51. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Sleep on the Rotation

Experts continue to suggest that investors take the hint.

"The outperformance in mega-cap tech stocks has likely nearly run its course as valuations in these stocks have moved up considerably in recent weeks, thanks to better-than-expected earnings and a retreat in bond yields," says Andrea Bevis, senior vice president, UBS Private Wealth Management. "Investors should diversify beyond mega-cap tech companies and rotate into cyclical and value-oriented areas of the market that should continue to benefit from higher yields and a broadening economic recovery."

That's a continued green light for the "reflation trade" and other recovery-themed stocks that have already done well so far in 2021 ...

... at least, broadly speaking.

A few individual stocks in "preferred" sectors, such as industrials and consumer discretionaries, are throwing off far more warning signs than their peers. With markets feeling just a bit toppy across the board, we've dug around to see where the deepest pockets of risk lie – and we've come across 10 stocks that, at the moment, look a bit rough. Watch your step.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.