Stock Market Today: Tech Takes Off as Bond Yields Taper Off

The Nasdaq's mega-caps take flight as Treasury yields pull back, and Tesla joins in amid another vote of confidence from Ark Invest's Cathie Wood.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

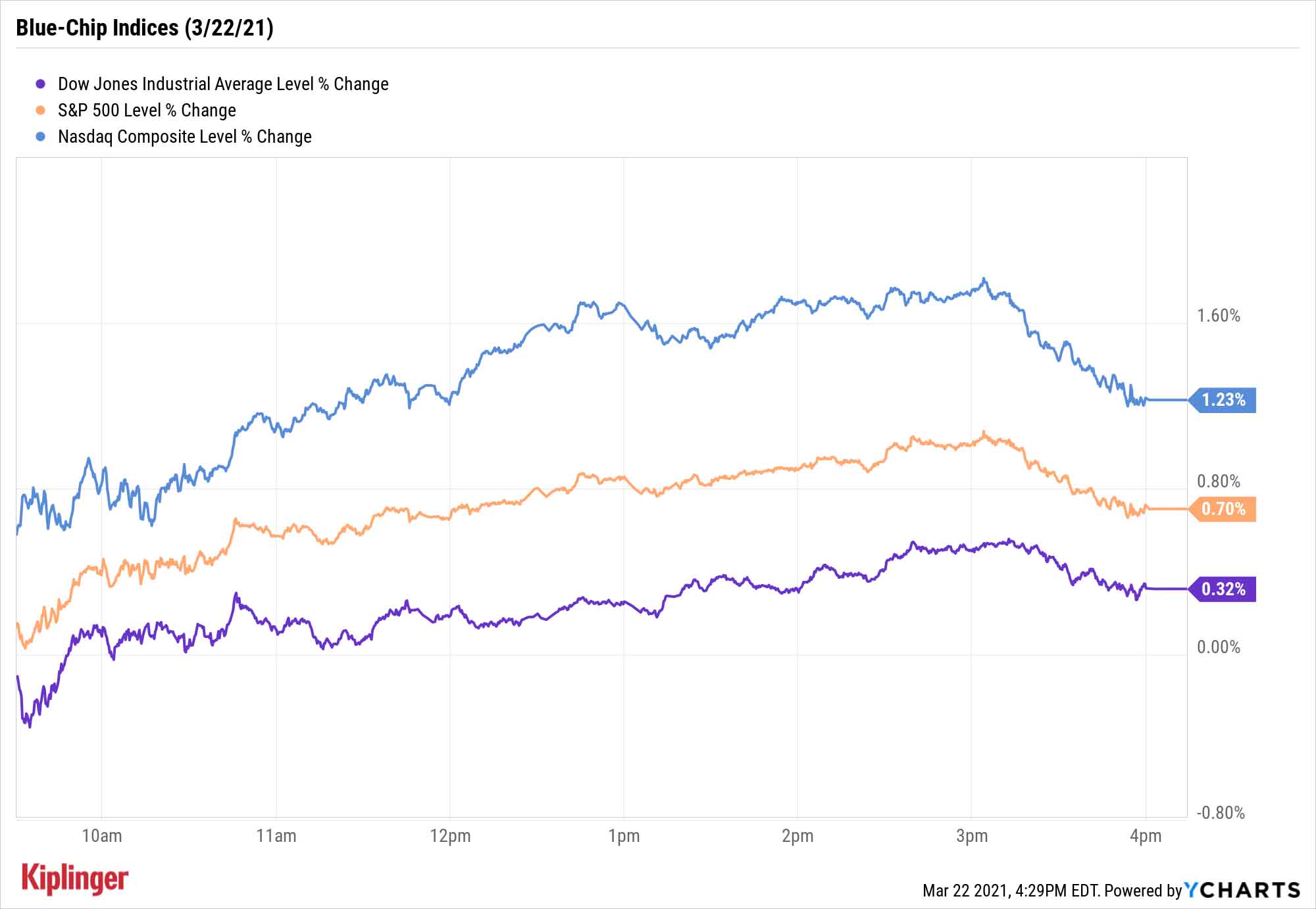

The Nasdaq Composite kicked off the trading week by taking its cue from the bond market yet again, with the tech-heavy index outpacing its peers Monday as Treasury yields stepped back.

A number of mega-cap tech stocks put up solid gains, including Apple (AAPL, +2.8%), Facebook (FB, +1.2%) and Nvidia (NVDA, +2.7%), powering a 1.2% gain in the Nasdaq to 13,377.

Electric vehicle maker Tesla (TSLA, +2.3%) headed higher too, though you can also chalk that up to an exuberant statement from Cathie Wood. The Ark Invest CEO said over the weekend that TSLA shares, which fetched almost $655 at the end of last week, would reach $3,000 by 2025.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Tesla also likely was reacting well to CEO Elon Musk's response to China, which restricted use of its EVs by state personnel after a Chinese security review revealed vehicle sensors could record images of their surroundings. Musk said Tesla "would never provide" the U.S. with such data.

"We believe this statement (while assumed) was important for Tesla and Musk to make directly to the Chinese and the government in Beijing given the strategic importance of its EV ambitions within China," says Wedbush analyst Daniel Ives, who rates TSLA at Hold.

The other major indices put up slightly smaller gains Monday, with the Dow Jones Industrial Average up 0.3% to 32,731, and the S&P 500 up 0.7% to 3,940.

One factor potentially weighing on more economically sensitive stocks in the short term? While vaccinations are being administered at a rapid pace, COVID-19 cases are rising across more than half of the U.S. – likely the result of both the introduction of more contagious variants and the phasing-out of various social distancing restrictions.

Other action in the stock market today:

- The Russell 2000 bucked the trend, dropping 0.9% to 2,266.

- Kansas City Southern (KSU) jumped 11.1% after fellow railroad operator Canadian Pacific Railway (CP, -5.8%) offered to buy the firm out for $25 billion.

- U.S. crude oil futures slipped 0.2% to $61.55 per barrel.

- Gold futures finished with a similar decline, off 0.2% to $1,738.10 per ounce.

- Bitcoin prices slumped 6.0% from their Friday levels, reaching $55,853 on Monday. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Is Infrastructure About to Take Off?

Still, the market is trending up, and another emerging bullish driver could help sustain that momentum.

The New York Times, citing people familiar with the plans, say the Biden administration is prepping pitches for $3 trillion in spending across several initiatives, including (and likely starting with) a massive infrastructure bill.

This effort would reportedly "spend heavily on infrastructure improvements, clean energy deployment and the development of other 'high-growth industries of the future' like 5G telecommunications" – key themes behind our top "Biden" stocks and potential catalysts for these 12 infrastructure-minded stocks.

An infrastructure push also would be yet more wind in the sails of commodity prices and, by extension, the companies that help produce them.

A wide variety of commodities, from metals to oil to timber, have rallied for several months on the prospects of a global economic rebound – and, by and large, Wall Street believes many of them still have more room to run.

Read on as we look at five commodity stocks that stand out right now.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.