Stock Market Today: Fed's Smooth Talking Sends Dow Above 33K

The Federal Reserve struck the right tone with Wall Street on Wednesday, signaling higher growth expectations but staying pat on its benchmark rate.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

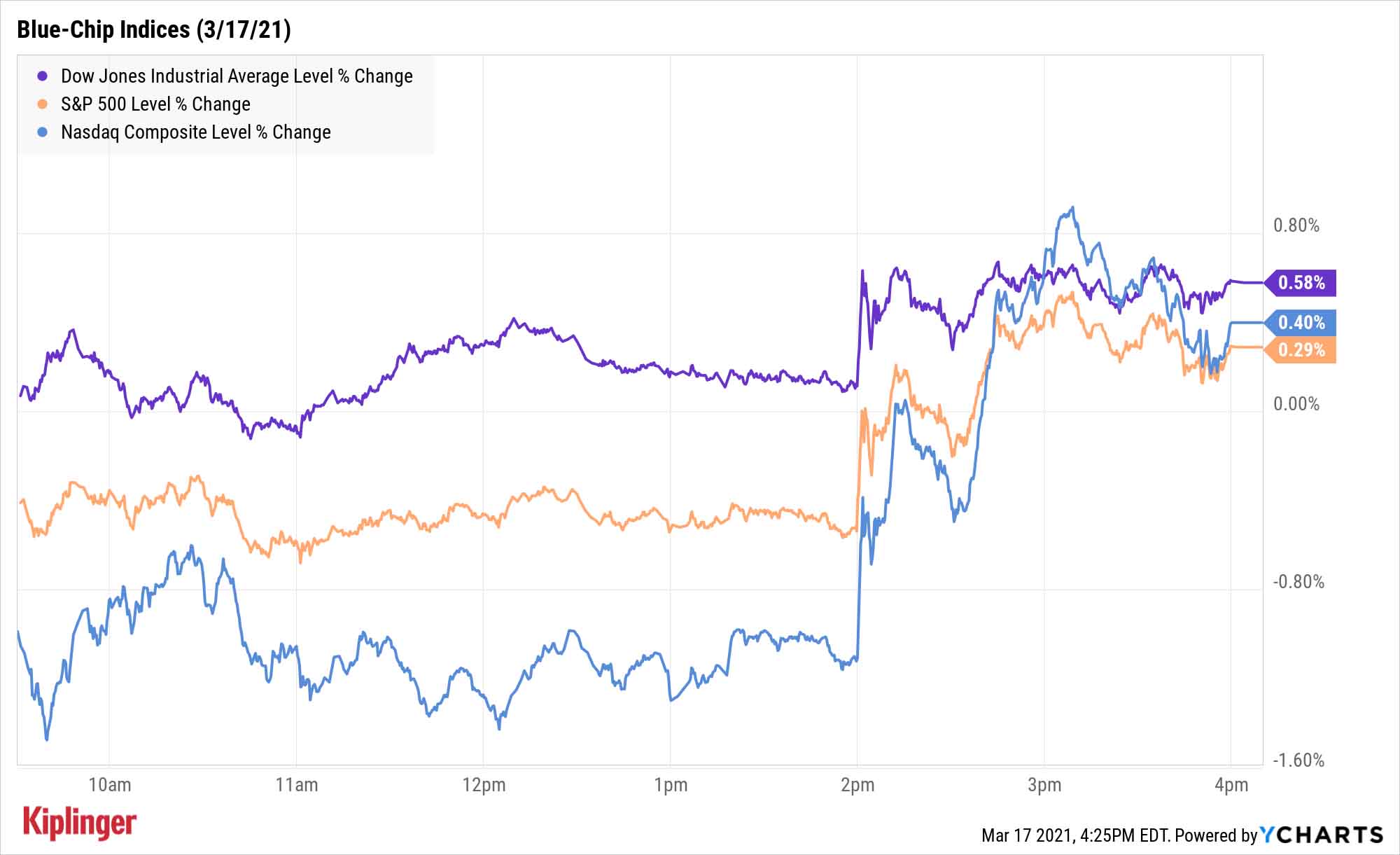

Federal Reserve Chair Jerome Powell and the rest of the U.S. central bank deftly walked the expectations tightrope in their post-FOMC meeting commentary Wednesday – at least, that's what the afternoon jump in stocks indicated.

The Fed upgraded its expectations for 2021 GDP growth to 6.5%, from 4.2% back in December – while also lifting its projections for core inflation, which it now sees hitting 2.2% (up from its previous forecast of 1.8%).

But the Fed's interest-rate policy remained unchanged, and while a few members signaled that interest-rate hikes might come sooner than they believed a few months ago, the mean "dot plot" still indicates no changes in the benchmark rate until 2023.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"As expected, the Fed made no changes to the Fed funds rate and the bond buying program. That was the easy part," says Anu Gaggar, senior global investment analyst for Commonwealth Financial Network. "Many on the Street were looking for a hawkish Fed, in so far as dots at least. With the 2023 median plot still hugging the floor, stocks and bonds are rising again,"

"This is like a Goldilocks market – strong economic growth, moderately higher inflation, rebounding earnings, and very easy monetary conditions."

"The Fed gave the stock market what it wanted to hear," adds Ryan Detrick, chief market strategist for LPL Financial. "The economy is quickly improving, yet they don't plan on removing the punchbowl anytime soon and rates will likely stay low for the intermediate future."

All of the major indices flipped from earlier-day losses to gains by the close. The Dow Jones Industrial Average eclipsed 33,000 for the first time, climbing 0.6% to a record 33,015 thanks to moves higher Dow (DOW, +4.5%), Boeing (BA, +3.3%) and Caterpillar (CAT, +3.2%).

The S&P 500 also set a new high, up 0.3% to 3,974. And the Nasdaq Composite improved by 0.4% to 13,525.

Other action in the stock market today:

- The Russell 2000 was tops among the major indices, gaining 0.7% to 2,336.

- U.S. crude oil futures declined for a fourth consecutive session, off 0.3% to $64.60 per barrel.

- Gold futures cheered the Fed's announcement, gaining 0.6% to $1,741.00.

- Bitcoin prices rebounded with the market, jumping 3.6% to $57,756. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Is "Infrastructure Week" Nigh?

We mentioned yesterday that the market's biggest risk is shifting from COVID-19 to inflation. But what about its next driver? President Joe Biden's $1.9 trillion stimulus package is technically in the market's rear-view mirror, after all, even if stimulus checks are just starting to go out.

There are certainly plays to be made in the economic recovery and the reflation trade, but many analysts are increasingly focused on the possibility of a long-awaited infrastructure bill.

"Expect lawmakers to quickly turn to a recovery/infrastructure package with the goal of having a draft bill around late spring," Raymond James analysts wrote earlier this month. "President Biden held another bipartisan meeting with lawmakers ... and House Democrats introduced new climate legislation, portions of which (such as hundreds of billions of dollars for clean energy transitions and a national green bank) are likely to be key parts of Biden's infrastructure plan."

Pay special attention to that last part. While an initiative targeting things such as America's aging roads and bridges would surely help traditional materials and industrial plays, your world of infrastructure plays to target might need to include green-energy and even telecommunications-focused plays.

Read on as we explore 12 of the best infrastructure stocks to benefit from a bipartisan infrastructure plan from Washington, including conventional and outside-the-box selections alike.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market Today

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market TodayThe Nasdaq Composite and Dow Jones Industrial Average led today's declines as investors took profits on high-flying tech stocks.