Stock Market Today: Stimulus Clears Congress, Sends Dow to New Highs

The House sent a $1.9 trillion stimulus bill to President Joe Biden on Wednesday, putting more upward pressure on the Dow.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

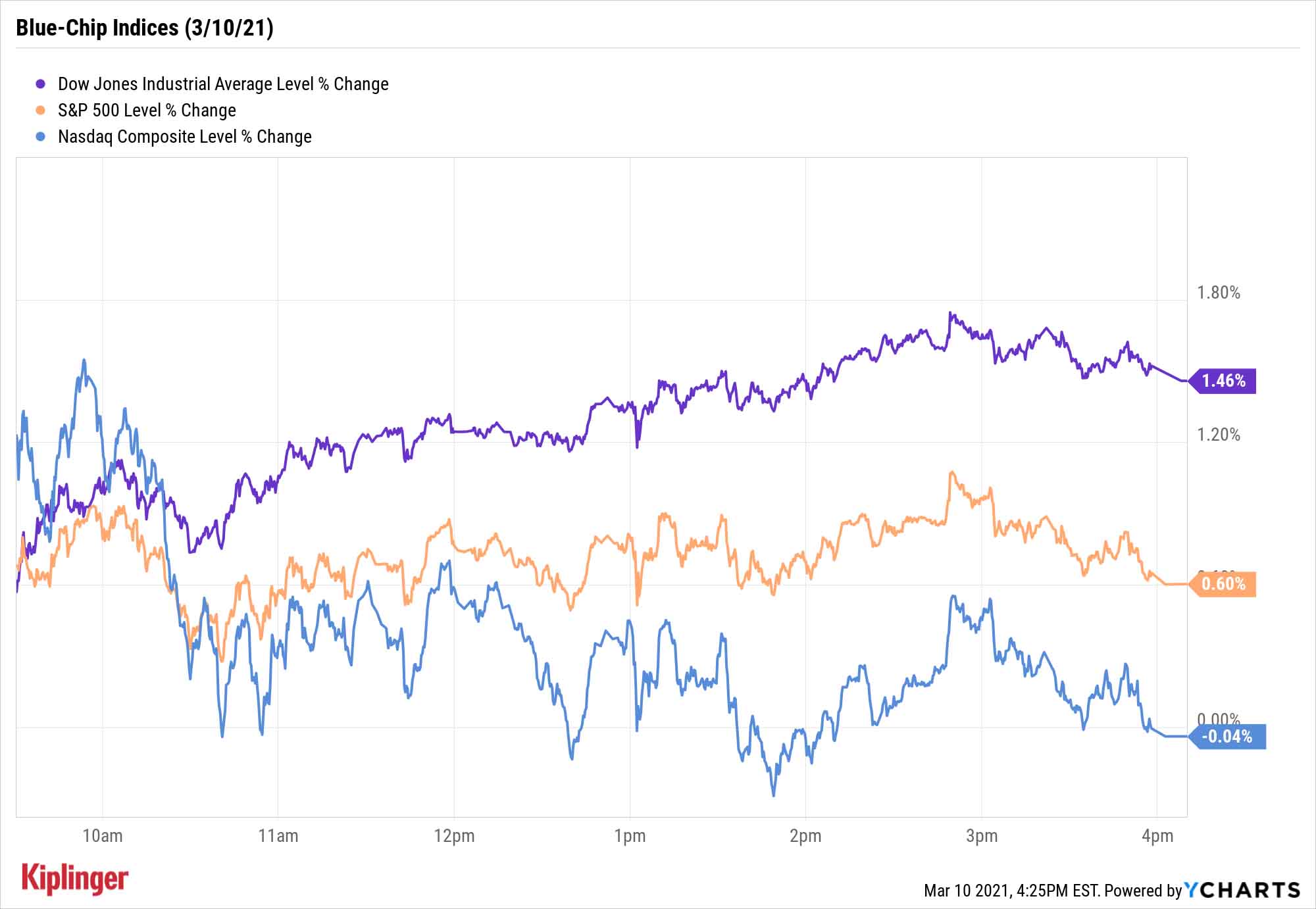

The Dow Jones Industrial Average zipped to fresh heights Wednesday, and stocks broadly enjoyed a strong session, on the imminent signing of a $1.9 trillion COVID relief bill.

Technology stocks still lagged despite little evidence of near-term inflation in the government's latest consumer price index (CPI) reading, which showed a tepid 0.1% rise in "core" CPI during February.

But investors likely were thinking about inflation to come, as the House passed a third stimulus bill on to President Joe Biden, who is expected to sign it into law Friday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"We believe spending will add to consumer-led economic growth already headed for its strongest pace in over 35 years," says Gary Schlossberg, global strategist at Wells Fargo Investment Institute. Indeed, Kiplinger has raised its GDP estimates in anticipation of this latest stimulus bill's passage.

The Dow jumped at the open and kept rising throughout the day, gaining 1.5% to a new all-time high of 32,297. The S&P 500 also finished higher, climbing 0.6% to 3,898. But the tech-heavy Nasdaq Composite finished with a marginal decline to 13,068.

Other action in the stock market today:

- The small-cap Russell 2000 cruised 1.8% higher to 2,285.

- U.S. crude oil futures improved by 0.7% to settle at $64.44 per barrel.

- Gold futures edged 0.3% higher to close at $1,721.80 per ounce.

- Kids gaming app Roblox (RBLX) debuted on public markets today via a direct listing. The New York Stock Exchange set a reference price of $45 per share; RBLX opened at $64.50 and closed at $69.50, a 54.4% opening-day surge.

- Bitcoin prices improved yet again, gaining 3.5% to $56,316. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Play the Spending Boom

Wall Street's eyes are firmly fixed on the horizon, as Americans are expected to open the spending floodgates over the next few months.

"Disbursements also are coinciding with the economy's accelerated reopening due to increased COVID-19 vaccinations, declining COVID-19 caseloads, and the return of warmer weather," Schlossberg adds. "If that isn't enough, we believe consumers also are in unusually good financial shape. Ample 'dry powder' is available from a personal saving rate nearly triple its long-term norm."

This is all expected to spur a continuation of the "reflation" trade – a rapid, corrective move higher in inflation that's expected to buoy the likes of bank stocks and industrial firms, among others.

This economic pivot is the biggest thing on the minds of portfolio managers and other institutional money minds. But it's not the only thing, and they don't all see eye to eye when it comes to investing in it.

We recently reached out to professionals from the likes of Vanguard, Nuveen and ProShares to discuss their investing strategies across the rest of 2021. Read on as we share the various areas of the stock and bond markets they're monitoring for opportunities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.