Stock Market Today: Crash? Not Today. But Stocks Still Feel Pain.

A small rise in weekly jobless claims and comments from Fed Chair Jerome Powell sparked a scare in stocks Thursday, though the losses could've been worse.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You never want to see "#stockmarketcrash" trending on Twitter, but that's the kind of day Thursday was – or at least, the kind of day it looked like it was shaping up to be.

Selling started with an initial unemployment claims report that showed last week's claims rise to 745,000, though Anu Gaggar, senior global investment analyst for Commonwealth Financial Network, reminds us to "take it with a grain of salt as there is some impact of the winter storm in Texas here."

"Despite the rise and upward revisions, the four-week moving average in initial claims ticked lower to 791k, from 808k previously," adds Barclays' Michael Gapen and Pooja Sriram. "Initial jobless claims backed up in December and January following reductions in mobility and additional restrictions on activity that went into place in November to counter the rise in new COVID-19 cases last fall."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the drop-off accelerated after Federal Reserve Chair Jerome Powell told a Wall Street Journal webinar audience that although he acknowledged inflation could pick up further, the central bank was likely to stand pat on policy.

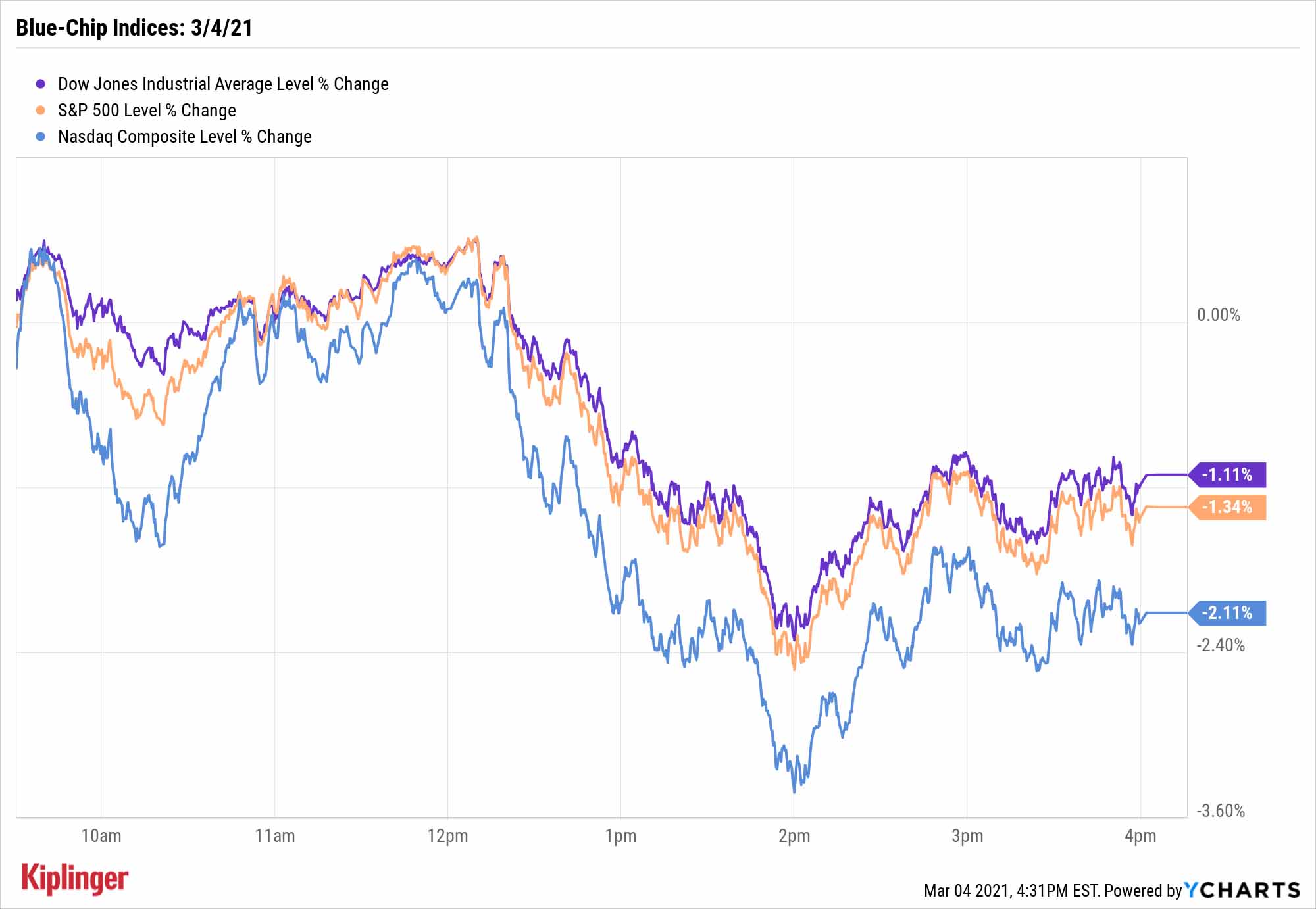

The Nasdaq Composite plunged by as much as 3.4%, and in fact fell into correction territory (a 10% decline from a previous high) on an intraday basis, before recovering a little. It still closed off 2.1% to 12,723, on the back of large declines from Tesla (TSLA, -4.9%) and Nvidia (NVDA, -3.4%), among others.

The Dow Jones Industrial Average (-1.1% to 30,924) and S&P 500 (-1.3% to 3,768) also finished in the red, though well off their lows.

Other action in the stock market today:

- The small-cap Russell 2000 dropped 2.8% to 2,146.

- Gold futures were off 0.9% to $1,700.70 per ounce.

- U.S. crude oil futures jumped by 4.2% to $63.83 per barrel after OPEC+ nations agreed to continue their production cuts into next month.

- That helped the energy sector lead again today, as evidenced by a 2.4% gain in the Energy Select Sector SPDR Fund (XLE), helped by a 3.9% surge in Exxon Mobil (XOM). The XLE is now up 35% year-to-date.

- Bitcoin prices, like the rest of the market, dipped but finished off their lows, declining 5.4% to $48,329. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Smart Money Says to Keep Calm

Inflation worries certainly have the market's reins at the moment, but the tone from many market experts is: patience.

"Listen, the S&P 500 gained more than 75% and has started to weaken recently. Yes, the Nasdaq is nearly in correction territory, but the truth is this is how it works. Stocks are allowed to take a break," says Ryan Detrick, chief market strategist for LPL Financial. "The bright side is the economy continues to improve and leadership from financials and energy is something that suggests this isn't a 'sell everything' moment."

"There's a growing worry that the economy may be running away from the Fed. We understand that change can be nerve-wracking. And higher yields tend to hit high-flyers harder," adds Lindsey Bell, chief investment strategist for Ally Invest. "Keep calm for now. We don't think this drop is the beginning of something bigger, especially considering the strong trends in earnings and the economy. This might just be a healthy step back for a market that's rallied strongly since November."

Indeed, Bell suggests that if you've been raising a little cash, now might be the time to put some of that to work on suddenly discounted stocks – a strategy we've suggested investors take with these 10 growthy S&P 500 stocks, as well as these five travel stocks that might have gotten a little ahead of themselves.

You could also do the same in companies that are just a little farther afield. Many emerging markets such as China and Taiwan are also pulling back after a red-hot recovery rally, offering better prices on attractive names there.

If you're looking for pullback plays and want the added benefit of a little geographical diversification, consider these five large-cap emerging markets stocks that still have lots of upside to spare.

Kyle Woodley was long NVDA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.