Stock Market Today: Growth Stocks Gashed

A stingier stimulus measure, conflicting news on the COVID front and upward creep in interest rates helped send growthier stocks to the cleaners Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The "great rotation" was in full swing yet again Wednesday, with a wide disparity between the market's value- and growth-oriented sectors.

Dragging on stocks broadly were reports that President Joe Biden and moderate Senate Democrats had reached a deal to reduce the number of Americans eligible for the next round of stimulus checks, with individuals being cut off at $80,000 in income instead of $100,000.

Projections by the Biden administration that the U.S. will have enough COVID vaccine doses to immunize all American adults by the end of May were blunted by measures in Texas and Mississippi to pull back from mask-wearing and social-distancing mandates, at odds with CDC recommendations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Institute for Supply Management's February services index reading declined in February, to 55.3 – a slower rate of expansion affected by last month's winter storms, as well as higher input costs.

"February's 3.4pt decline in the services PMI came as a surprise to our at-consensus (58.7) forecast, which had anticipated that January's strong conditions would carry into February on the tailwind of December's renewed income relief and steady improvements on the pandemic front," says Jonathan Millar, deputy chief U.S. economist at Barclays Investment Bank. "In the event, the pattern of readings across categories seems broadly consistent with disturbances from the extreme cold snap."

Particularly plaguing growth stocks was a rebound in interest rates as inflation worries persist.

"Year-over-year comparisons in headline inflation data will show a sharp increase over the coming months, which may spook markets," says Rod von Lipsey, managing director, UBS Private Wealth Management, though he expects those numbers to be "short-lived."

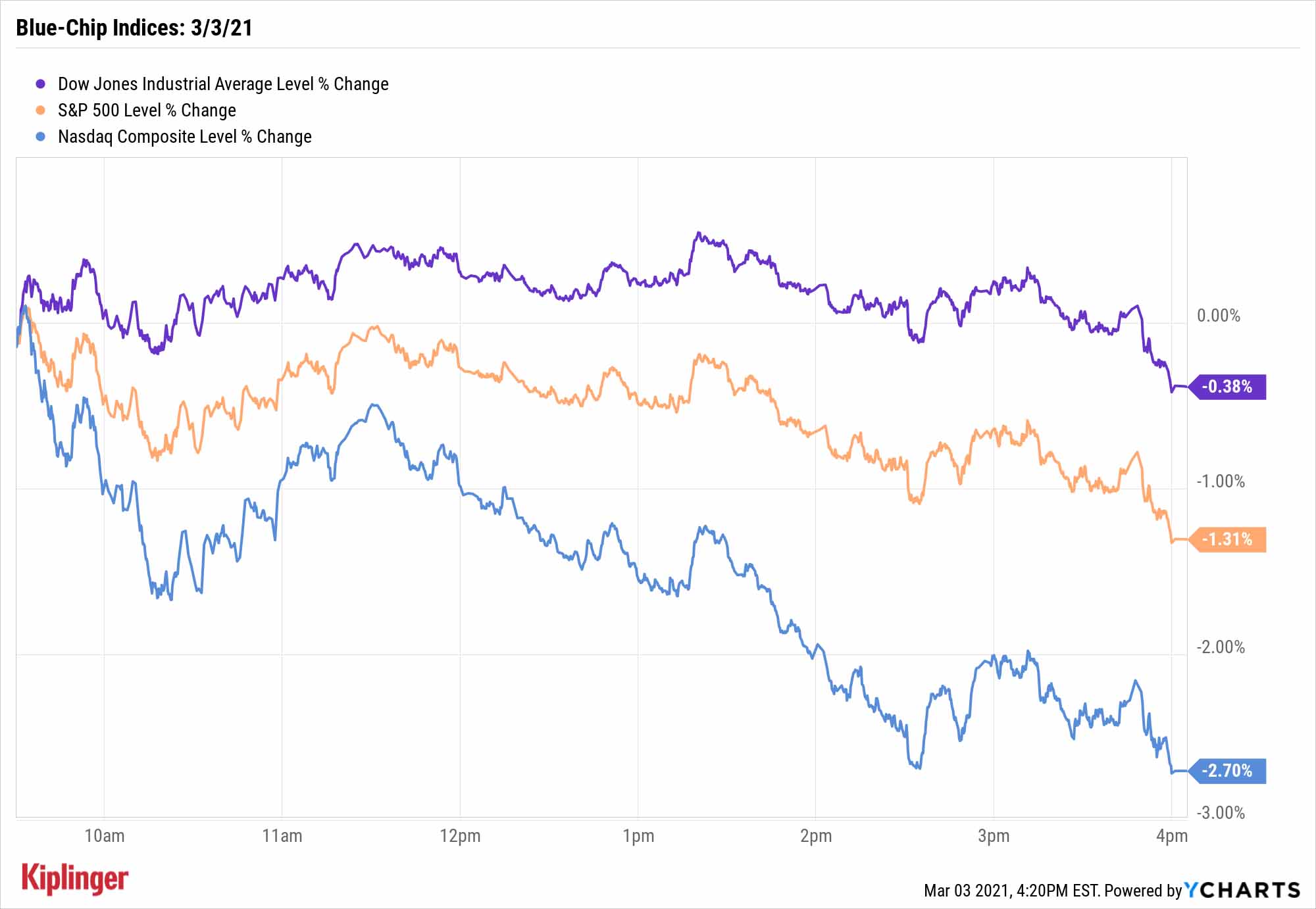

Mega-cap tech and communications stocks such as Microsoft (MSFT, -2.7%) and Alphabet (GOOGL, -2.6%) dragged the Nasdaq Composite 2.7% lower to 12,997. But financial stocks such as American Express (AXP, +2.5%) and industrials including Boeing (BA, +2.4%) helped the Dow Jones Industrial Average escape with a modest 0.4% dip to 31,270.

Other action in the stock market today:

- The S&P 500 dropped 1.3% to 3,819.

- The small-cap Russell 2000 finished 1.1% lower, to 2,207.

- Gold futures declined 1.0% to $1,715.80 per ounce.

- U.S. crude oil futures rebounded 2.6% to hit $61.28 per barrel amid a jump in inventories, as well as uncertainty over whether OPEC+ nations would curb production cuts as planned in April, or extend them.

- Bitcoin prices jumped back up above the $50,000 level, improving by 6.5% to $50,980. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What's Trending? Your Portfolio, Maybe.

Weeks ago, we talked about the Reddit/GameStop phenomenon, whereby investors took to social media in a successful attempt to "squeeze" heavily bet-against stocks higher.

That original wave has come and gone, but the spirit persists, in more ways than one.

For instance, Rocket Cos. (RKT, -32.7%) – the company behind Rocket Mortgage and other businesses – plunged today after a roughly one-week short squeeze that saw the stock more than double. But that quick ascent is evidence that plenty of retail (and smart-money) investors are still monitoring heavily shorted stocks for a quick trade.

And then there's the growing desire to track the sentiment behind how companies and stocks are being talked about on social media. Believe it or not, this isn't a new trend: Hedge fund managers and institutional investors have monitored the "wisdom of the crowd" for some time.

But this notion is about to solidify in a new VanEck exchange-traded fund launching tomorrow – one with a tie to controversial sports media tycoon (and more recently, day trader) David Portnoy, no less. We've taken a dive into this potentially polarizing fund ahead of its Thursday market debut, and one thing is for sure: This "buzzy" ETF is probably not what you think it is.

Kyle Woodley was long BA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.