Stock Market Today: Stocks Tank as Interest-Rate Fears Persist

The 10-year Treasury yield cleared 1.5% today for the first time in a year, sparking a broad, deep selloff across the stock market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The stock market is starting to resemble a student driver, alternating between a heavy foot on the gas pedal and hard stomps on the brakes.

Investors suffered the latter Thursday, as Wall Street largely ignored a large drop in last week's initial unemployment filings (by 111,000 claims to 730,000) and improvement in January's durable goods orders.

Instead, attention was directed toward a continued rise in interest rates, with the 10-year Treasury yield climbing above 1.5% for the first time in roughly a year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Until recently, market participants have been able to digest the upward drift in long-term rates," says Charlie Ripley, Senior Investment Strategist for Allianz Investment Management, "but it appears that the next leg up in interest rates is a bigger bite to chew."

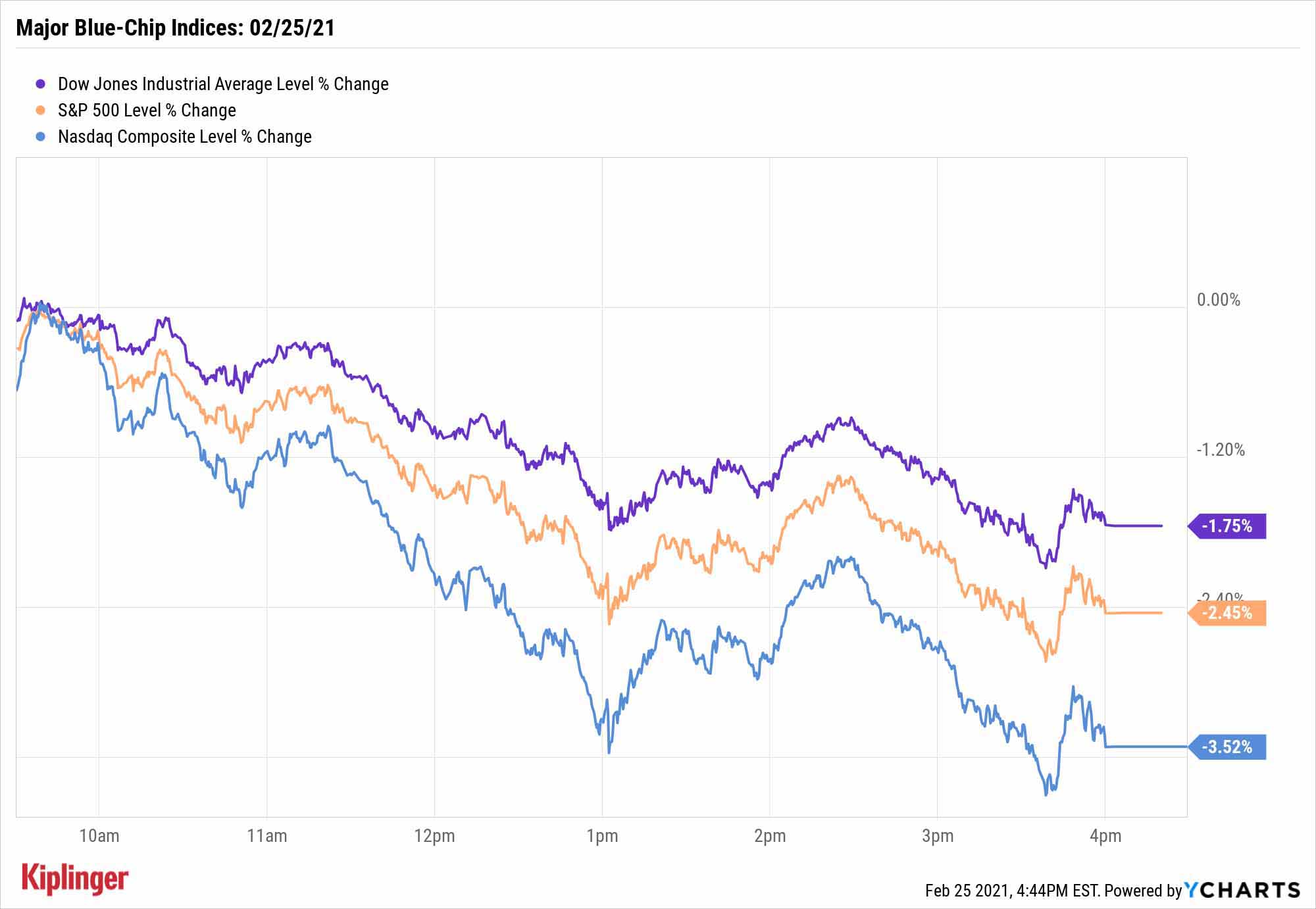

The major indices finished with deep gashes. Declines in Boeing (BA, -5.5%), Intel (INTC, -4.4%) and Salesforce.com (CRM, -3.9%) helped drag the Dow Jones Industrial Average 1.8% lower from its record high to 31,402. Meanwhile, Apple (AAPL, -3.5%), Facebook (FB, -3.6%) and Tesla (TSLA, -8.1%) weighed on the Nasdaq Composite, which sank 3.5% to 13,119.

James McDonald, CEO and chief investment officer of alternative investment manager Hercules Investments, explains the continued pain in tech: "Unlike other stock sectors like cyclicals, stocks in the tech sector are valued on longer-term earnings. If bond yields and borrowing costs are rising, a company's longer-term earnings may be negatively affected."

Other action in the stock market today:

- The S&P 500 declined by 2.5% to 3,829.

- The small-cap Russell 2000 was the worst of the major indices, plunging 3.7% to 2,200.

- GameStop (GME), which went on a roller-coaster trip courtesy of Reddit traders several weeks back, was at it again, surging 18.6% after more than doubling Wednesday. However, even that was well off the 101% gains it was tracking at Thursday's highs.

- U.S. crude oil futures improved by 0.5% to settle at a 13-month high of $63.53 per barrel.

- Gold futures declined by 1.3% to $1,775.40 per ounce.

- Bitcoin prices, at $48,712 on Wednesday, finished 0.3% higher to $48,870. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Silver Lining to Big Down Days

It's hard to sugarcoat a day that saw every last S&P sector decline, most by more than 1%. But Jamie Cox, managing partner for Harris Financial Group, gives it a go:

"I'm glad to see yields rise because markets can see an end to the pandemic," he says. "However, people forget that rates are still low, we still have structural unemployment, and that technical moves in bonds do not equal inflation."

Also, for optimists – more specifically, optimists who still have a little cash waiting on the sideline for better prices – days like this provide a silver lining in the form of slightly less elevated valuations.

For instance, a number of the S&P 500's best long-term bets are just too darn pricey, but strong pullbacks like these start to alleviate those excessively high valuations. Even value stocks, heavily favored by analysts in 2021, have been driven plenty higher in the year's early innings; Thursday's action helped cool them off a little bit.

The same goes for many COVID-recovery plays – travel and leisure stocks, battered in 2020, were popular picks heading into 2021 and have come roaring back as investors anticipate America's economy eventually reopening. Downdrafts like today, however, provide better opportunities to get in on some of these travel names before most Americans are vaccinated and start spending their money on experiences they were denied during COVID shutdowns.

Here are five such travel stocks worth looking into.

Kyle Woodley was long BA, CRM and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.