Time to Book Some Travel Stocks

Many travel companies will revive and even thrive, so take advantage of some exceptional bargains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

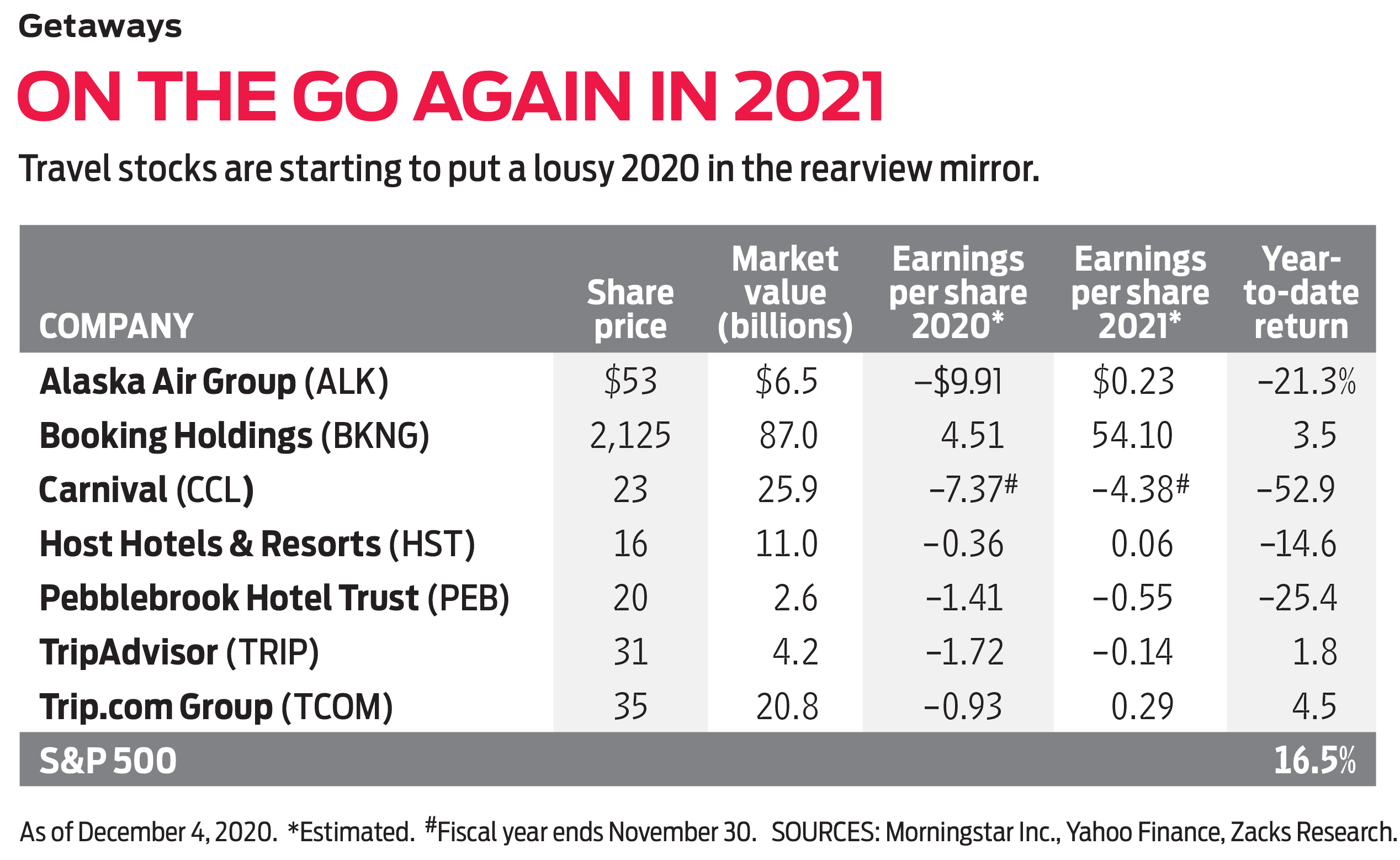

With people staying home for safety, the travel sector has been devastated by the COVID pandemic. As of late November, Americans could not vacation in European Union countries, Japan or Canada even if they wanted to. The Centers for Disease Control and Prevention issued a seven-month no-sail order for cruise lines; hotels are operating at less than half-occupancy; and American Airlines, the world’s largest air carrier, reported that third-quarter revenues were down 73% compared with the same period in 2019.

Most travel stocks have been devastated, too, despite a surge when promising test results were reported for three COVID vaccines. Of course, other businesses have been hurt badly by the pandemic as well, but in many of those cases, investors are looking over the horizon toward recovery, and shares have risen smartly for the year—even in retail. Gap (symbol GPS), for example, suffered a 20% decline in revenues over the three quarters ending October 31 compared with the same period in 2019, and a profit of $535 million during that 2019 time frame became a loss of $899 million. Yet the stock has returned 22.8% for 2020. (Stocks I like are in bold; prices and returns are through December 4.)

The market seems to be saying that travel is not coming back anytime soon. But that is too pessimistic. If you believe, as I do, that many travel companies will revive and even thrive, then you should take advantage of some exceptional bargains.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Pent-up demand. By the end of 2021, vaccine use, at least in the U.S., should be widespread, and the danger of infection low. Some practices developed during the pandemic will be slow to change, if they ever do. I expect we’ll continue to shop more on the internet, and many of us will never return to an office for work. But we will be eager to return to live sports events and concerts, gamble at casinos, and dine in restaurants. And travel. In fact, traveling may benefit from pent-up demand. Instead of taking one vacation a year, Americans may indulge in two. If you haven’t seen your customers face-to-face in ages, you’ll want to travel more often to cement business connections.

Before investing in a travel stock these days, you should look at the balance sheet and determine whether the company has enough cash to ride out the storm. Consider Alaska Air Group (ALK, $53), the nation’s fifth-largest airline, with a strong presence on the West Coast. At the end of September, the most recent reporting period, Alaska had $3.7 billion in cash and short-term investments, and debt coming due over the next 12 months of $1.4 billion. The firm says it was burning cash at a rate of $4 million a day in the third quarter, when revenues were down 71% from a year earlier. Alaska Air, then, has easily enough cash to survive even if this dire state of affairs continues for two years.

I have never been a fan of airline stocks in general. The sector is too capital-intensive, and air service is a commodity, with brands competing almost exclusively on price. But Alaska Air is a standout. It has excellent, innovative management and a cost structure that’s lower than established airlines. Plus, the stock is trading at about half of its 2017 high. In 2019, the company earned $6.19 a share. If it could get back to that level, then, based on its current stock price, the stock is cheap.

Hotel stocks come in two varieties: real estate investment trusts, which own the real estate, and operating companies with famous brand names, which manage the properties. The 17 publicly traded lodging REITs have been clobbered. Shares in Braemar Hotels and Resorts (BHR), of Dallas, and Service Properties Trust (SVC), of Newton, Mass., for example, are down by about half since the pandemic began. REITs are yield plays, and many dividends have been cut or eliminated.

Stronger REITs, however, appear attractive—and with good reason. They have enough cash to grow by snatching up properties at low prices from smaller and weaker owners. The biggest lodging REIT is Host Hotels & Resorts (HST, $16), which owns nearly 80 hotels and partners with brands such as Ritz-Carlton and Westin. Revenues in the third quarter of 2020 were just $198 million, compared with $1.3 billion a year earlier, with overall occupancy of a mere 17%. But, with $2.4 billion in cash and no debt maturing before 2023, Host is in good shape.

Host’s strength is no secret, and shares are down less than 15% for 2020. A riskier play whose shares have fallen more is Pebblebrook Hotel Trust (PEB, $20), with a market cap of $2.6 billion and a portfolio of 53 hotels, only 39 of which are open. Still, monthly cash burn is just $15 million, and it has $570 million in liquidity on the books with “no meaningful debt maturities,” says the firm, until November 2022.

Hotel operating companies offer no screaming bargains. If, like me, you have always wanted to own Marriott International (MAR, $136), the largest in the sector with 5,700 hotels, my advice is to wait for another big dip.

A riskier bet. Before the pandemic, I was drawn to Carnival (CCL, $23), a cruise behemoth with more than 100 ships. But COVID-19 quickly shut Carnival down, and shares lost three-fourths of their value in two months. Although vaccine progress led to a rebound, shares still trade nearly 70% below their 2018 high. Pre-COVID, the cruise business was white-hot, but, even if the pandemic comes to an end within a year, many vacationers will continue to view ships as seafaring petri dishes. Carnival must keep its ships in working order even if they aren’t carrying passengers—one reason the company is burning cash at a rate of $650 million a month. Meanwhile, Carnival is obligated to reduce its debt load by $2.6 billion over the next five quarters. It may be a tight squeeze, but the cruise line probably has enough cash to hold out another year.

Some of the best bets in travel are companies that don’t own boats, planes or hotels, but instead make money online through commissions and ad sales. TripAdvisor (TRIP, $31), billing itself as the “world’s largest travel site,” owns dozens of other websites in 28 languages, from SeatGuru.com to HolidayLettings.co.uk. In the third quarter, revenues were down 65% from the same period in 2019, but the balance sheet looks solid, with $446 million in cash, a large untapped borrowing facility, and the sale in July of $500 million in five-year notes. The stock price fell by about half from January to May, bounced back with the vaccine, but is still more than three-fourths below its all-time high.

Booking Holdings (BKNG, $2,125) has a market value of $87 billion—more than the four largest U.S. airlines combined. It owns not only Booking.com but also OpenTable, Priceline, Kayak and Rentalcars.com, among others. Revenues fell 48% in the quarter ending September 30, compared with the previous year, but Booking still made a profit. Don’t forget Trip.com Group (TCOM, $35), a similar firm based in China and a longtime favorite of mine.

I haven’t found a worthwhile fund in the sector. Fidelity Select Leisure (FDLSX) has performed well, but the top three stocks in the portfolio, representing about half of assets, are restaurant chains. Stay away from U.S. Global Jets (JETS), an exchange-traded fund that owns airlines. Invesco Dynamic Leisure and Entertainment (PEJ) is heavy on TV, movies, music and food. The best way to play the revival in travel is through a careful examination of individual stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

What's the Difference Between a Bond's Price and Value?

What's the Difference Between a Bond's Price and Value?bonds Bonds are complex. Learning about how to trade them is as important as why to trade them.

-

Bond Basics: U.S. Agency Bonds

Bond Basics: U.S. Agency Bondsinvesting These investments are close enough to government bonds in terms of safety, but make sure you're aware of the risks.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: U.S. Savings Bonds

Bond Basics: U.S. Savings Bondsinvesting U.S. savings bonds are a tax-advantaged way to save for higher education.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.