Stock Market Today: Markets Tumble, But 'Reddit Stocks' Story Isn't Over

The major indices delivered significant losses Wednesday; spared were stocks such as GameStop and AMC, which soared amid a push from a corner of the internet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Today, let's start with the elephant in the news feed: GameStop (GME) and a number of other momentum stocks commanded most of Wall Street's attention on Wednesday even as the major indices took a considerable skid.

If you need to catch up on exactly what's been happening, check out our primer on this sudden battle between hedge funds and traders from the social app Reddit. (In short, individual traders are flooding into heavily bet-against stocks to make them explode higher.)

GameStop shares surged another 134.8% on Wednesday to bring their year-to-date gains to roughly 1,730%, while theatre chain AMC Entertainment (AMC) jumped 301.2% in a single day. Nokia (NOK, +40.2%), BlackBerry (BB, +32.7%) and Bed Bath & Beyond (BBBY, +43.5%) were among others that were ginned up.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The movement in GME and AMC specifically was so wild that TD Ameritrade and Schwab restricted certain trades in those shares. And in fact, White House press secretary Jen Psaki admitted that Secretary Janet Yellen was "monitoring the situation" with GME and some of these other stocks.

Most of the rest of the market? Not so lucky.

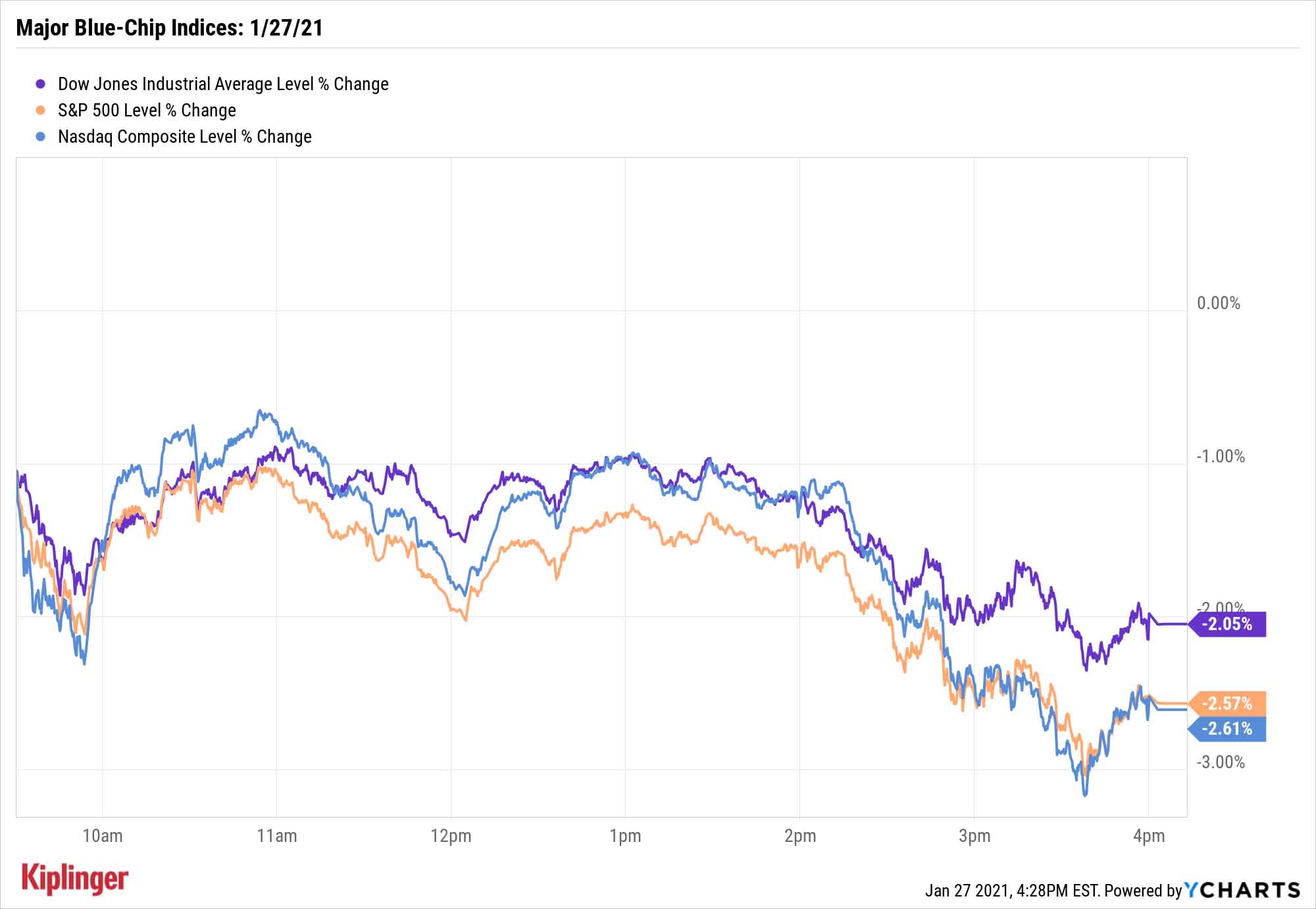

The Dow Jones Industrial Average (-2.1% to 30,303), S&P 500 (-2.6% to 3,750) and Nasdaq Composite (-2.6% to 13,270) all finished well off their recent highs, dogged by losses from the likes of Boeing (BA, -4.0%), Alphabet (GOOGL, -4.7%) and Disney (DIS, -4.0%).

Other action in the stock market today.

- The Russell 2000 plunged 1.9% to 2,108.

- Gold futures fell yet again, declining 0.2% to $1,844.90 per ounce.

- U.S. crude oil futures improved by 0.5% to $52.85 per barrel.

- Bitcoin prices, at $31,981 on Tuesday, edged 0.1% lower to $31,629. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

What's Weighing on the Markets?

The Federal Reserve left its benchmark interest rate near zero, though "(Fed Chair Jerome) Powell reiterated the Fed's accommodative policy stance and pointed out that the economy is still in the early stages of recovery," says Charlie Ripley, Senior Investment Strategist for Allianz Investment Management. "Moreover, the committee acknowledged that downside risks still remain as the progress on vaccinations could determine the pace of the recovery in the coming months."

The continued spread of mutant COVID strains worldwide is a constant reminder of what the economy needs to overcome, too.

But the problem might also be technical in nature.

"Some areas of the market are now very extended / overbought on the charts – this leaves them vulnerable to quick and violent pullbacks over the short-run," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott, who adds that "broader market breadth has started to deteriorate – this is a notable divergence and serves as a mild warning that we may see more elevated volatility ahead."

At the moment, it's difficult to tell whether this is a big blip, or the start of a deeper short-term trench that some analysts have been calling for.

Buy-and-holders: Keep watching the show. Opportunists: Many of these value stocks went on sale today. Those seeking safety: You'll often find it in yield-friendly equity sectors such as consumer staples and utilities, or fixed-income funds.

No matter which direction you turn, low-cost ETFs are the tool to reach for – take your pick from the best ETFs for 2021. Whether you want to use this dip to build your core or jump into aggressive positions or protect yourself against additional downside, this "Swiss Army list" of funds has something for everyone.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.