Stock Market Today: No Stimulus Deal? No Big Deal to Stocks, Apparently

President Trump balked at Congress' COVID rescue package late Tuesday, but several major indices still managed to finish in the black Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The stock market continued to stubbornly press forward Wednesday in the face of numerous headwinds, including a surprising development in Washington.

Congress on Tuesday passed a $900 billion stimulus package on to President Donald Trump, who was widely expected to sign it but instead lambasted the bill for its $600 direct payments, demanding a higher level ($2,000) than even Democrats had previously pushed for. He didn't directly threaten to veto the existing bill, however.

"President Trump’s demand for revisions to the COVID relief bill to raise the individual payment amount to $2,000 significantly raises uncertainty for the days ahead, but our base case remains that the bill passed by Congress will become law," say Raymond James analysts, echoing many other experts' sentiments.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, U.S. COVID hospitalizations hit a record 117,777 yesterday, and economic data was dour – durable-goods order growth decelerated sharply in November, as did U.S. new-home sales.

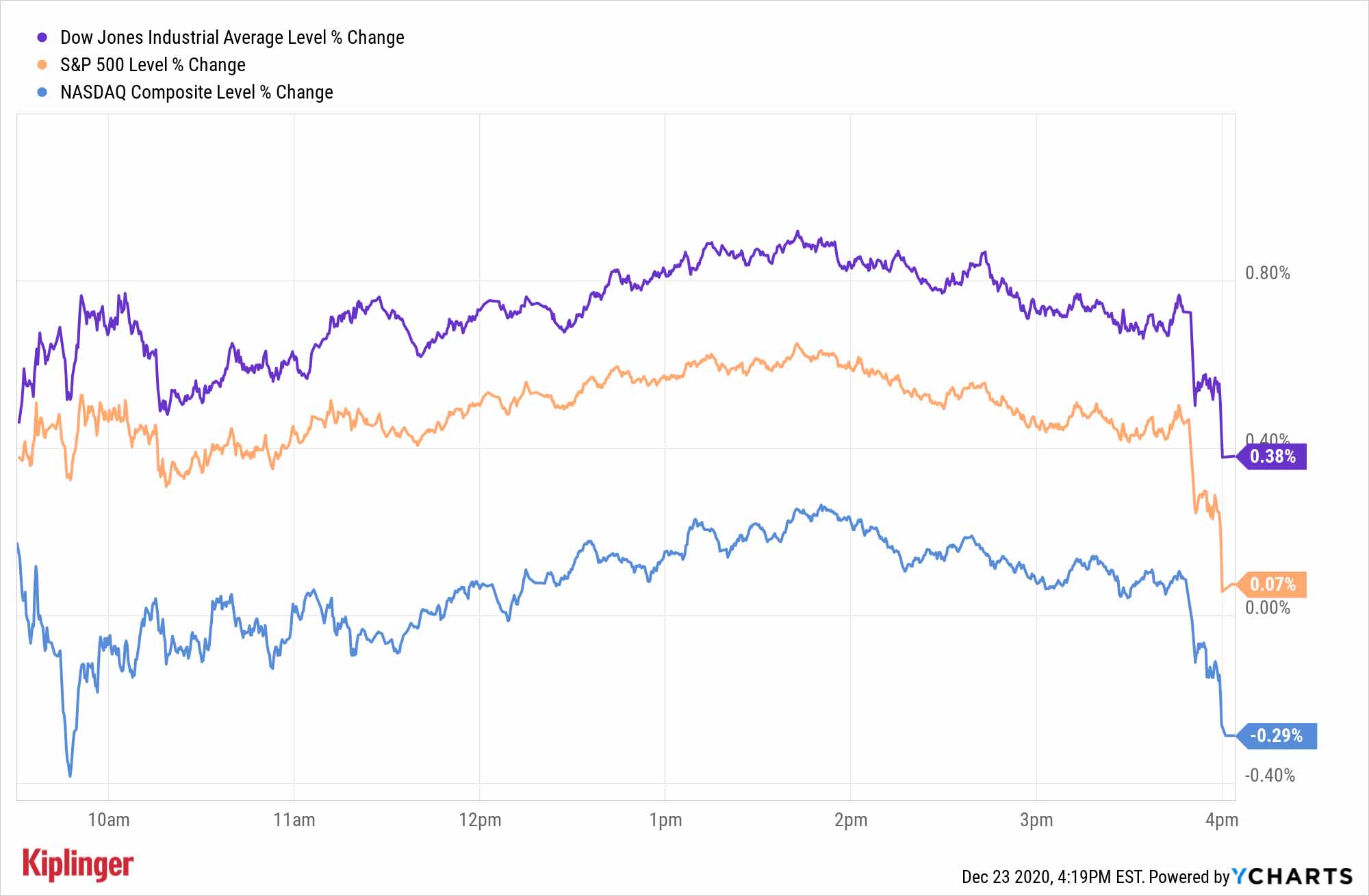

Nonetheless, the Dow Jones Industrial Average finished with a 0.4% gain to 30,129, and the small-cap Russell 2000 kept up the momentum with a 0.9% jump to a record 2,007.

Other action in the stock market today:

- The S&P 500 eked out a marginal gain to 3,690.

- The Nasdaq Composite declined 0.3% to 12,771.

- Gold futures lost 0.6% to settle at $1,870.30 per ounce.

- U.S. crude oil futures slumped for a second straight day, losing 2.0% to $47.97 per barrel.

Energy, Financials Lead the Way

It was hardly an even rally, however. Wednesday's clear winners were again part of the "rotation trade."

A big drawdown in U.S. crude inventories sent oil prices 2.3% higher, helping Dow component Chevron (CVX, +1.6%) and a host of other energy stocks. But green energy stocks continued to soar, too – the stimulus bill (at least in its current form) will extend tens of millions of dollars' worth of tax credits to solar and wind firms.

Financial stocks, including JPMorgan Chase (JPM, +2.8%) and Goldman Sachs (GS, +2.5%), also shot upwarD. Even though the financial sector still faces a major headwind in the form of near-zero interest rates, Wall Street broadly likes its chances in 2021 given expectations for continued economic recovery and a shift into underloved value stocks.

But the financial-sector equities catching the most attention heading into the new year might surprise you – there are a few banks, sure, but there are also less traditional plays such as lease-to-own financers and even data providers that are nonetheless vital to the sector. Read on as we highlight some of the best financial stocks to buy for 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.