Stock Market Today: Bearish Tone Remains as COVID Picture Worsens

America's seven-day average of new cases hit a new high, and with stimulus still in limbo, investors saw little to get cheery about Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

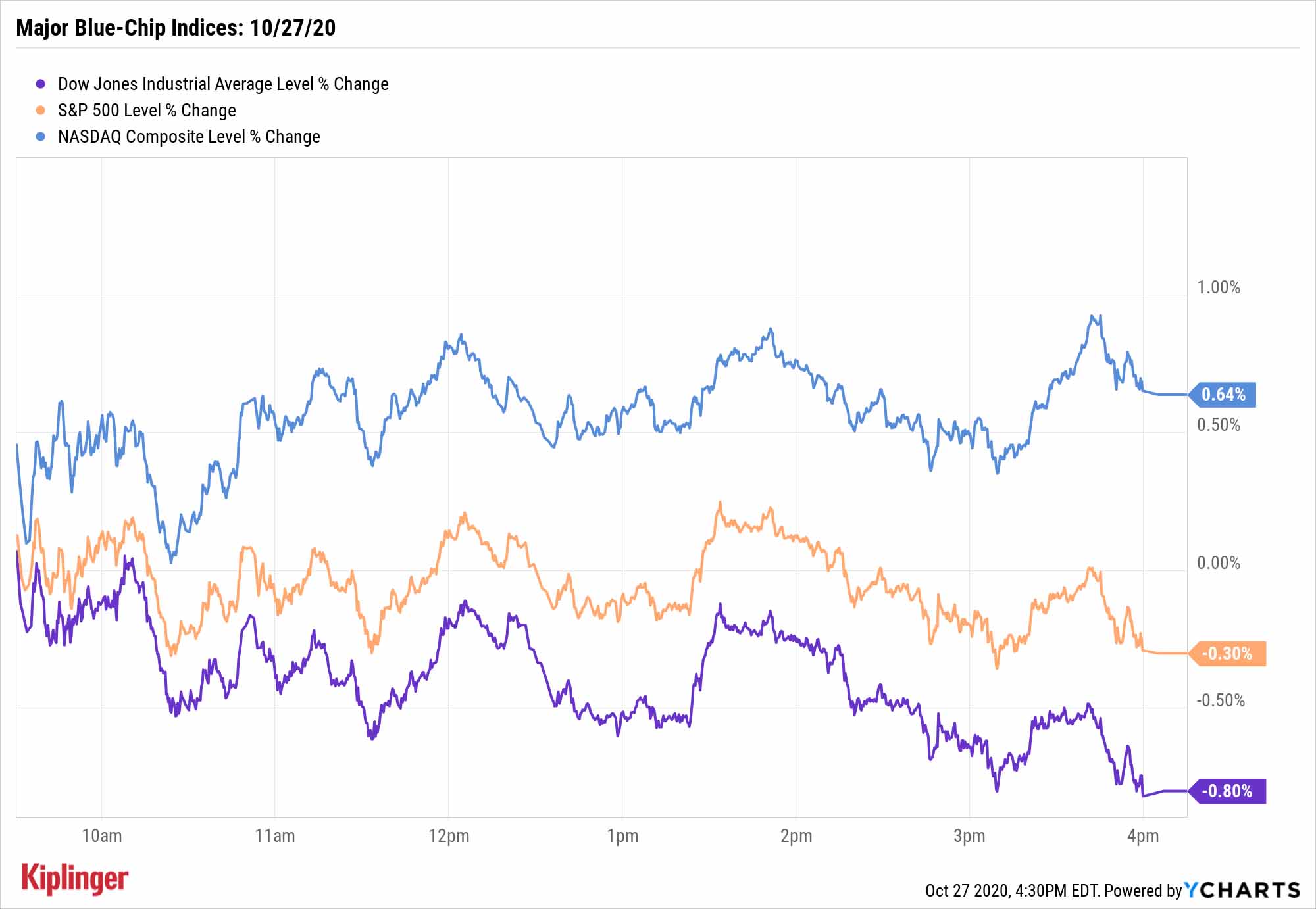

The broader markets managed to at least avoid another debacle like yesterday's, but stocks still struggled Tuesday as bullish catalysts remained scarce.

The U.S. logged a fresh high for seven-day average new COVID-19 cases, continuing worries that coronavirus will drag on the economy further this winter. Meanwhile, hopes for new stimulus continued to fade as negotiators in Washington remained mum.

"We think the ability to get stimulus done is fading each day as we get closer to the U.S. election," says Charlie Ripley, senior investment strategist for Allianz Investment Management, who adds that we "are reminded that volatility is expected to stay as uncertainties surrounding the path of the virus and the outcome of the election continue to weigh on investors' minds."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also of note was a mega-deal in the semiconductor space: Xilinx (XLNX, +8.6%) agreed to a $35 billion buyout offer from Advanced Micro Devices (AMD, -4.1%). Shareholders in the latter took some profits following a nearly 80% year-to-date return, but analysts still appear upbeat about both the deal and the stock's longer-term prospects.

"We positively view the announced acquisition of Xilinx this morning, as it brings together complementary product offerings and increases its addressable market. We see significant share gain on the horizon within its server business, with considerable interest for its next-generation Milan server processors set to begin volume shipments in early '21," writes CFRA Research's Angelo Zino, who rates AMD shares at Buy and upgraded his 12-month price target from $90 per share to $100.

The Dow Jones Industrial Average dipped 0.8% to finish at 27,463.

Other action in the stock market today:

- The S&P 500 lost 0.3% to 3,390.

- The Nasdaq Composite improved by 0.6% to 11,431

- The small-cap Russell 2000 finished 0.9% lower to 1,590.

- Caterpillar (CAT, -3.1%) dropped after reporting lower equipment demand for the third quarter, which led to a 54% decline in profits.

- 3M (MMM, -3.1%) had a much better earnings outing, topping profit and sales estimates, but got caught up in Tuesday's downdraft nonetheless.

- Microsoft (MSFT) shares were up slightly in Tuesday after-hours trading after announcing Street-beating earnings ($1.82 per share) and revenues ($37.2 billion).

Check out more earnings previews and estimates at our weekly earnings calendar.

Are You Excited About Tomorrow? Should You Be?

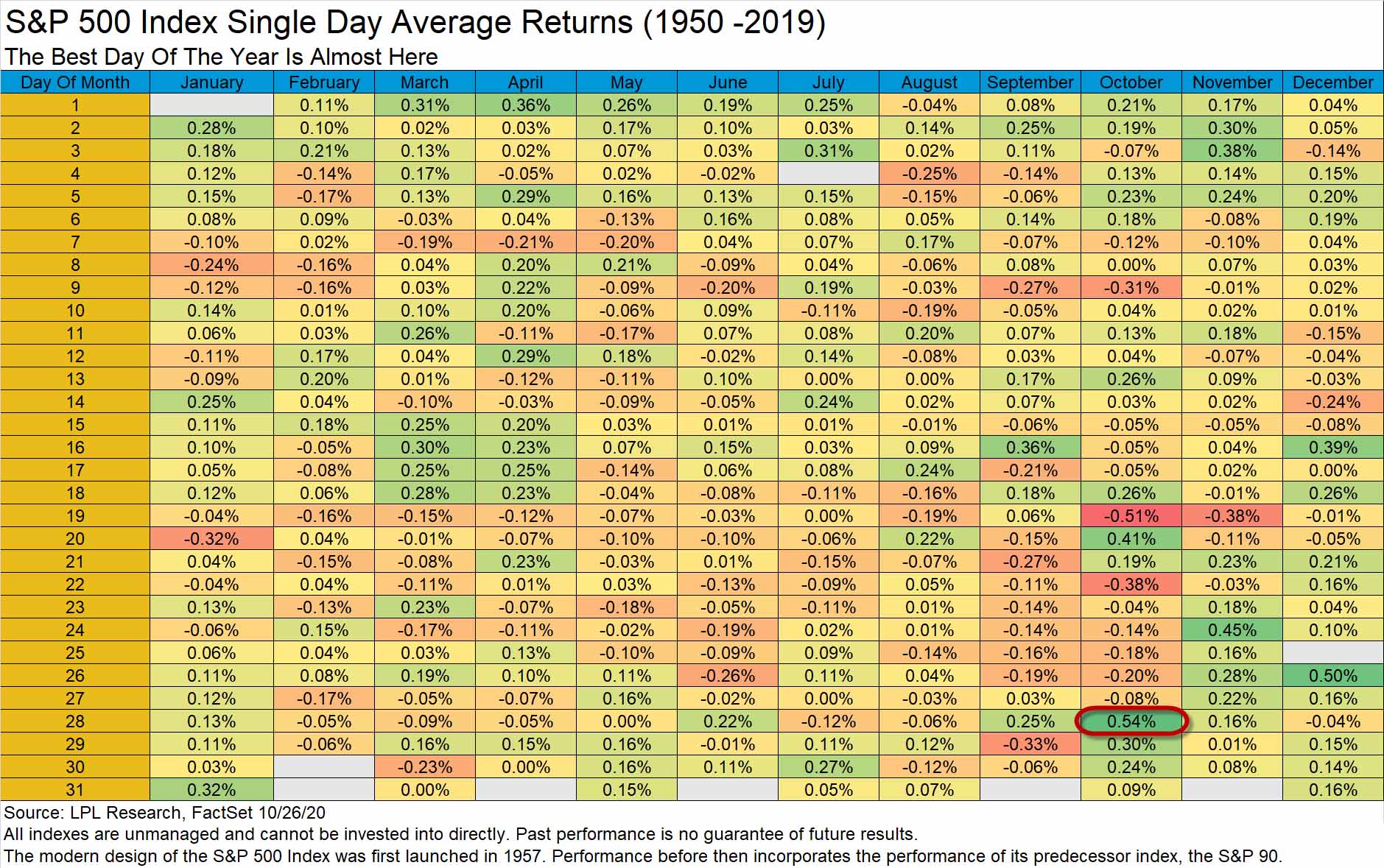

Tomorrow is the best day of the year ... statistically speaking.

Since 1950, the S&P 500 has enjoyed average daily returns of 0.54% on Oct. 28, making it the stock market's most fruitful day. That's according to LPL Financial Chief Market Strategist Ryan Detrick, who quips, "Maybe because it is my birthday, or perhaps it is simply random."

Here's a more in-depth look, via LPL's Chart of the Day:

While we (and Detrick) discourage investors from investing based on one day's historical performance, some gutsier investors have already been placing bets on a single day's historical importance.

That's Election Day, of course.

Presidential elections are something of a mixed bag for the broader stock market, but presidential policies can mean a great deal to certain industries, which has played out recently as so-called Biden stocks have outperformed Trump stocks as the former has maintained a wide lead in many national polls. So we've recently re-examined and added a few additional ideas to our presidential picks -- you can check out 13 stocks that could surge during a Joe Biden presidency, and 13 plays for another four years of President Donald Trump.

Regardless of the result, Trump has at least two more months to cement (or change) his position on the Mount Rushmore of market-friendly leaders: our list of the best and worst presidents by stock-market returns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.