Hennessy Cornerstone Value (HFCVX)'s Data-Driven Success

The managers use an algorithm to find solid stocks at bargain prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Staying the course can be difficult for many investors when the stock market gets choppy and drifts down, as it has of late. But that’s not the case for the three managers at Hennessy Cornerstone Value (HFCVX).

Over the past 12 months, managers Neil Hennessy, Ryan Kelley and Josh Wein have delivered an astonishing 14.0% return. That trounced the fund’s benchmark, the Russell 1000 Value index, by nearly 14 percentage points, and it topped 98% of the fund’s peers (funds that focus on value-priced, large-company stocks).

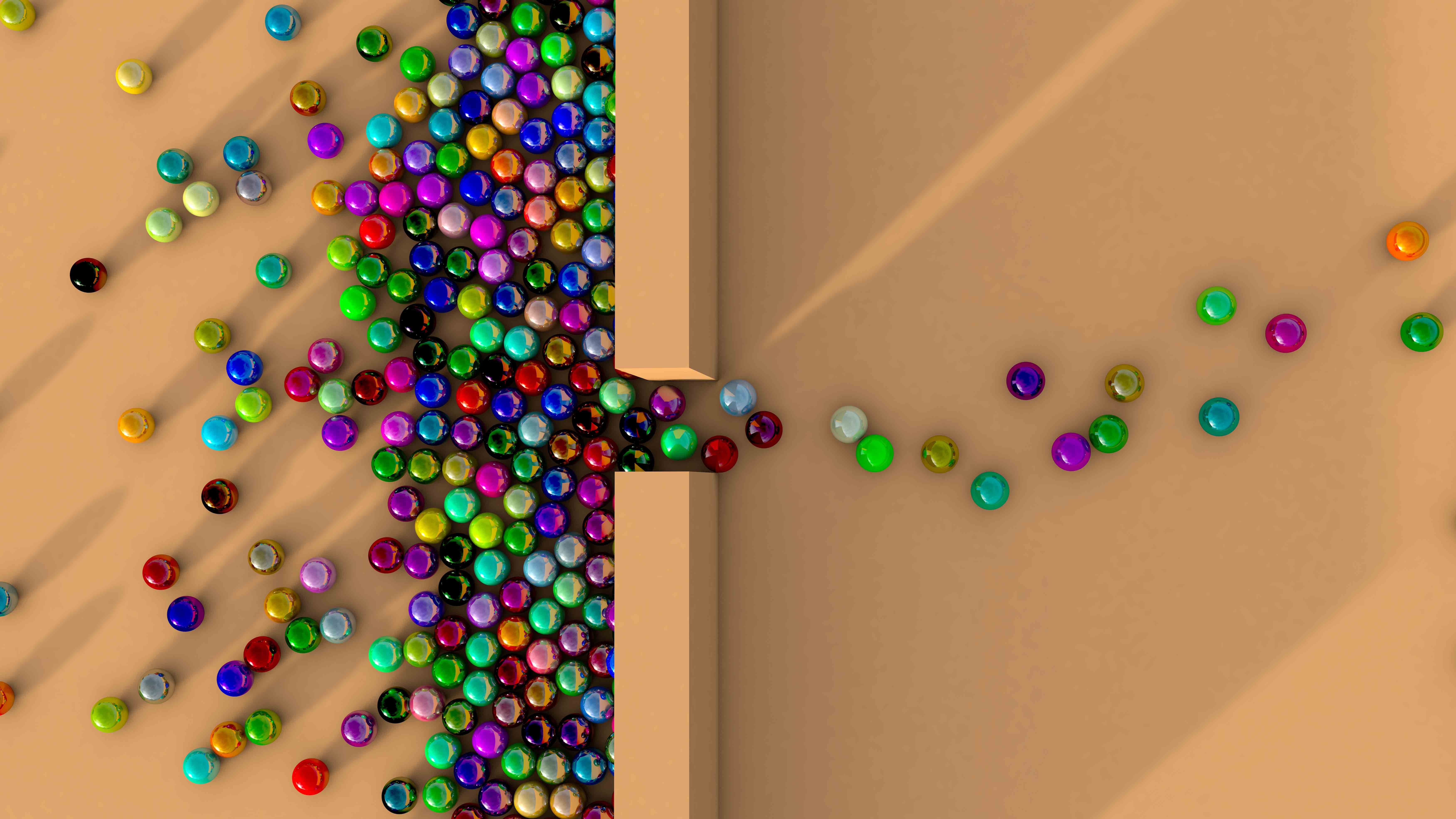

Cornerstone Value’s success lies with a stock-picking algorithm that has been in place since the fund launched almost 26 years ago. “Fundamentally, we’re a quantitative fund,” says Kelley. “We let data drive the investment process.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The computer screen focuses on large, dividend-paying firms that trade on a U.S. stock exchange, including foreign-company shares. They must be above average in terms of market value, the number of shares outstanding and cash flow, and they must have a share price of $5 or higher, among other criteria. The process often spits out undervalued shares.

In the final step, the stocks are ranked by dividend yield. The 50 highest-yielding stocks are purchased in equal proportions. A dividend is “a huge signal from management,” says Wein. “It says not only can the company pay a dividend now, but it can continue to pay a dividend because very few companies are going to play fast and loose with their dividend.”

The whole screen is rerun and the fund is rebalanced or reconstituted annually, usually in the first three months of the year. After the fund’s rescreening in early 2021, the managers snapped up shares in a lot of energy stocks, including Chevron (CVX), ExxonMobil (XOM), ConocoPhillips (COP) and others, just before the sector began to rebound. The energy stocks have been a big driver of the fund’s recent success.

Currently, the fund’s top three holdings are General Mills (GIS), Marathon Petroleum (MPC) and Intel (INTC). Other big, well-known companies, such as AT&T (T), Kraft Heinz (KHC), Coca-Cola (KO) and Bristol Myers Squibb (BMY), round out the portfolio. The fund charges a 1.23% expense ratio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rivan joined Kiplinger on Leap Day 2016 as a reporter for Kiplinger's Personal Finance magazine. A Michigan native, she graduated from the University of Michigan in 2014 and from there freelanced as a local copy editor and proofreader, and served as a research assistant to a local Detroit journalist. Her work has been featured in the Ann Arbor Observer and Sage Business Researcher. She is currently assistant editor, personal finance at The Washington Post.

-

Quiz: Do You Know How to Maximize Your Social Security Check?

Quiz: Do You Know How to Maximize Your Social Security Check?Quiz Test your knowledge of Social Security delayed retirement credits with our quick quiz.

-

Will You Get a Trump Tariff Refund in 2026? What to Know Now

Will You Get a Trump Tariff Refund in 2026? What to Know NowTax Law The Supreme Court's tariff ruling has many wondering about refund rights and how tariff refunds would work.

-

2026 Tax Refund Delays: 5 States Where Your Money Is Stuck

2026 Tax Refund Delays: 5 States Where Your Money Is StuckState Tax From New York to Oregon, your state income tax refund could be delayed for weeks. Here's what to know.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.