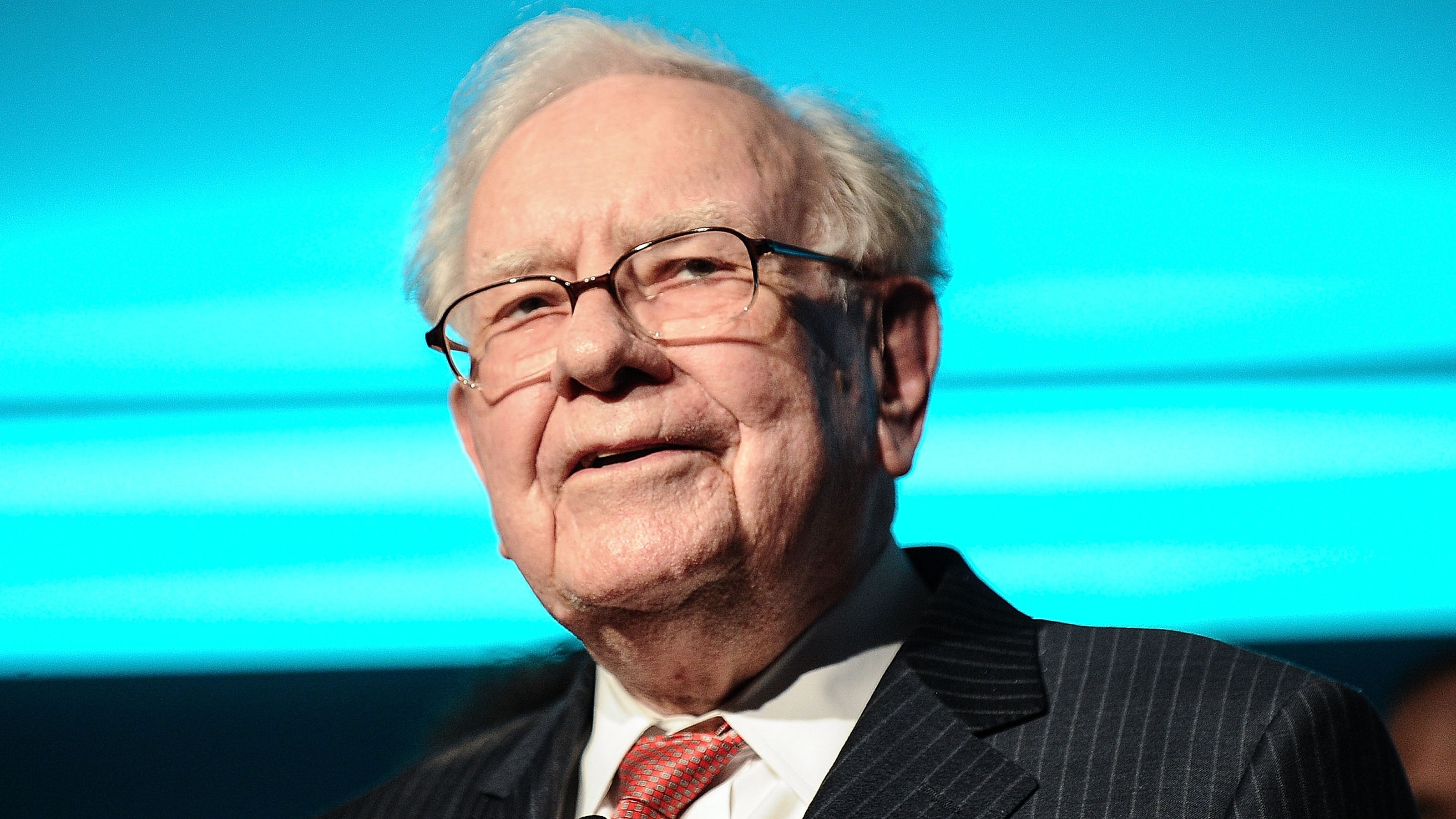

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

Buffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

On the hit Paramount+ TV series Landman, Tommy Norris, played by Billy Bob Thornton, says:

"It's in everything — that road you drove in on, the wheels on every car ever made, including yours, tennis rackets and lipstick, refrigerators, antihistamines and pretty much anything plastic. It's in your cell phone case, artificial heart valves, clothing that's not made of animal or plant fibers, soap, hand lotion, garbage bags ... you name it."

The ubiquitous "it" he references is oil, and it really is in nearly everything.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

Solar panels and wind turbines, the darlings of "clean" energy afficionados, are made almost entirely out of petroleum products. So is your TV, backpack, half of your grocery containers, couch pillows, wire coating and plumbing in your home, most medical devices, roof shingles, key fobs, shampoo bottles … even shampoo itself! All require oil.

So can oil play an integral role in your retirement ... by becoming a part of your IRA?

Beyond the traditional investment trio

I've studied IRA investing for many years, with books like The Psychology of Money by Morgan House, The Intelligent Investor by Benjamin Graham, Ed Slott's Retirement Decisions Guide, One Up on Wall Street by Peter Lynch and many others.

But I don't want to add to your reading list arbitrarily. The fact is, when searching for investment information, it's not a shortage of information that cripples us, it's a surplus.

A simple Google search on "IRA investing" yields literally millions of pages of "information," and unless you have years of experience in the field, you're likely to find most or all of it confusing, self-serving, contradictory or explicitly designed to sell products or services.

Small wonder, then, that so many investors struggle to know what to listen to or whom to trust.

Drill a little deeper (pun intended) and you will find the majority of this information focuses exclusively on stocks, bonds or real estate. Many investors logically draw the conclusion that these are their best — or only — options. And that simply isn't true.

I'm not opposed to stocks, bonds or real estate; I own these investments myself, and most of my clients do, too.

However, over my three decades observing investors' portfolios, I've found that 9 out of 10 investors have all their wealth concentrated in just these three asset classes, with a handful reserving a sliver of cash or gold.

Ask yourself: Is your entire net worth in stocks, bonds and real estate? Could you be missing opportunities for greater diversification and potentially better results? Statistically speaking, it's quite possible, even likely.

As a financial planner in Houston — the oil and gas capital of the world — I've observed that many of the most sophisticated high-net-worth and accredited investors include oil and gas investments in their IRA portfolios.

While specific oil and gas returns must be discussed within a Private Placement Memorandum (PPM), I can tell you that accredited investors tend to benefit from comparing stocks and bonds with the expected returns, risk profiles and cash flows of certain oil and gas partnerships.

Each investor must draw their own conclusions, and of course no investment is risk-free.

Nevertheless, allocating a portion of your IRA to oil and gas allows many accredited investors to potentially amplify total returns, increase withdrawal rates, lower overall risk through diversification and ultimately enhance retirement income.

A real-world example

We recently counseled a couple approaching retirement who wanted to make sure they were as well prepared as they could be.

Robert and his wife, Susan — not their real names — had followed sound financial principles throughout their marriage: living below their means, saving and investing, avoiding debt and practicing prudent money habits.

Robert had worked for a Fortune 500 company, while Susan had just finished her 30th year as a schoolteacher.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Their diligent approach had paid off, enabling them to put three children through college, start education funds for four grandchildren, pay off their home, acquire several rental properties and still accumulate just over $4 million in 401(k)s, which they planned to roll into IRAs at retirement. They were poised to retire debt-free, with considerable assets.

Overall, it was an enviable position to be in, but Robert and Susan still had questions and concerns. Robert had relatives who had retired just before the 2008 financial crisis, and when their retirement savings were severely damaged, they were forced to return to the workforce.

Robert and Susan wanted protection against similar risks, having witnessed various market cycles during their 30 years of investing. They also wondered about income planning, asset preservation, when to claim Social Security and what kinds of tax strategies to follow in retirement.

What impressed us about this couple was not just their dedication to learning about investment and retirement planning, but the ways they had followed the principles they had learned.

They correctly noted that the recommended withdrawal rate from IRAs for income should be around 3.5% to 4%, meaning each million dollars in their accounts would generate $35,000 to $40,000 annually.

They had always believed stocks and bonds were their only investment options. Then we introduced them to the concept of broader diversification through oil and gas investments, Class A apartment buildings, self-storage facilities, preferred stocks and corporate credit funds available exclusively to accredited investors — options no one had previously mentioned to them.

They were particularly drawn to oil and gas investments after reading about ongoing demand and learning how investors like Warren Buffett were increasing allocations to this asset class.

Robert consulted his brother, who had worked for a major oil company for nearly three decades. His brother explained why oil and gas prospects appeared favorable for the next decade or more.

Robert learned how ESG investing had diverted capital from major firms like Chevron and Exxon, creating opportunities for higher-tier independent producers to co-invest directly into partnerships with majors such as Exxon, Chevron, ConocoPhillips and Occidental.

Understanding oil and gas for IRAs

A typical IRA-suitable oil and gas partnership from a top-tier sponsor might last four to five years, potentially generating quarterly cash flow of 8% to 12%. Investments could involve anywhere from 20 to over 100 wells.

These partnerships typically target total returns of about 15% to 20% annually, though returns aren't guaranteed and are subject to various risks.

Every accredited investor must review the PPM, seek qualified advice and determine if the risk aligns with their personal situation.

Robert and Susan reasoned that by allocating a portion of their IRAs to oil and gas, they could improve their odds of generating an enhanced income stream as they moved into retirement compared to investing only in stocks and bonds.

Due diligence questions

If you're considering an oil and gas partnership for your IRA, it's crucial to conduct thorough due diligence. Key questions should address the sponsor's track record and reputation, projected cash flows, well locations, drilling strategy, investment duration, expected returns, break-even oil price, hedging strategies and partnerships with major companies.

Ask about risks including commodity price risk, execution risk and legislative risk.

These represent just a few of the 21 critical criteria we recommend investors learn more about before proceeding. A reputable company will provide clear, substantive answers to all your questions. If you don't receive satisfactory responses, continue your search.

Discuss income planning with IRAs using oil and gas investments with your financial adviser as part of a larger conversation about expanding your diversification.

If your adviser maintains a limited view focused only on stocks, bonds, real estate and a dash of cash, consider finding someone better versed in these important alternative asset classes or who works within a setting offering a broader menu of options.

Related Content

- 7 Stocks Warren Buffett Is Buying (and 8 He's Selling)

- Warren Buffett Advice: Why You Should Pick Businesses, Not Stocks

- 5 of Warren Buffett's Best Investments

- 7 of Warren Buffett's Biggest Misses

- What Is the Buffett Indicator?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Daniel Goodwin is a Kiplinger contributor on various financial planning topics and has also been featured in U.S. News and World Report, FOX 26 News, Business Management Daily and BankRate Inc. He is the author of the book "Live Smart - Retire Rich" and is the Masterclass Instructor of a 1031 DST Masterclass at www.Provident1031.com. Daniel regularly gives back to his community by serving as a mentor at the Sam Houston State University College of Business. He is the Chief Investment Strategist at Provident Wealth Advisors, a Registered Investment Advisory firm in The Woodlands, Texas. Daniel's professional licenses include Series 65, 6, 63 and 22. Daniel’s gift is making the complex simple and encouraging families to take actionable steps today to pursue their financial goals of tomorrow.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.