Thinking About Day Trading? Read This First

More people are getting into day trading these days, but don’t believe the hype. While some get lucky, the odds are stacked against you. If you really want to give it a try, limit your risk with these three tips.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In the midst of the pandemic, you may have noticed a rather unusual trend: More and more people are jumping into the stock market.

Despite, or perhaps even because of, extreme volatility in the market and endless speculation about what could happen next — not just with the economy but in the wider world due to the seismic shifts we’re experiencing because of COVID-19 — there’s been a recent proliferation of day trading.

While the mediums might be new — Robinhood wasn’t around 20 or even 10 years ago — the sudden spike in the popularity of day trading isn’t. We saw a similar rush of interest during the dot-com bubble.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That might point to one of the reasons for the recent interest in this extremely speculative (and therefore exceedingly risky) way of participating in financial markets: When times are bad and things get tough, people will look for seemingly new or easier ways to make ends meet.

Unfortunately, despite what you might hear from a co-worker, neighbor or friend, day trading is rarely a good solution for most folks. So, if you’ve been considering joining in on this currently popular trend, I’d urge you to reconsider before you put your hard-earned money at risk.

Day Trading Isn’t an Easy Way to Wealth

The Wall Street Journal recently wrote a piece on the flurry of activity on day trading platforms. It’s an article that gives reason for concern on many levels.

For example, take Sharmila Viswasam, who shared some of her story with the WSJ for the article. She’s a 38-year-old real estate agent who couldn’t work due to the pandemic — and found that her unemployment checks weren’t enough to pay her bills. Her boss suggested she try day trading as a way to solve this problem and close the gap between her benefits and her expenses. Viswasam read Trading for Dummies and watched YouTube videos before she opened an ETrade account and tried her hand at day trading.

The problem here is that the very people who cannot afford to take the inherent risks associated with highly speculative investments are engaging in day trading in an attempt to hit it big.

But that’s just it: Day trading is hardly investing. It’s much more like gambling, and the odds of winning aren’t good. In fact, the same Wall Street Journal article noted that Barclays “examined trades by Robinhood customers between March and early June and concluded that the more they bought a specific stock, the worse that stock performed.”

Investing Works, But Day Trading Is More Like Gambling

To be clear, I do believe that investing in stocks and bonds is the best way to grow wealth. But you need to do so strategically, which means adjusting for risk, considering diversification, and allocating your portfolio in such a way that it is aligned with your goals and time horizon.

Day trading takes none of this into account, and again, is more akin to gambling than wise, strategic investing where you can reasonably expect to earn a moderate return over time. And in this gambling game, the odds are stacked against you.

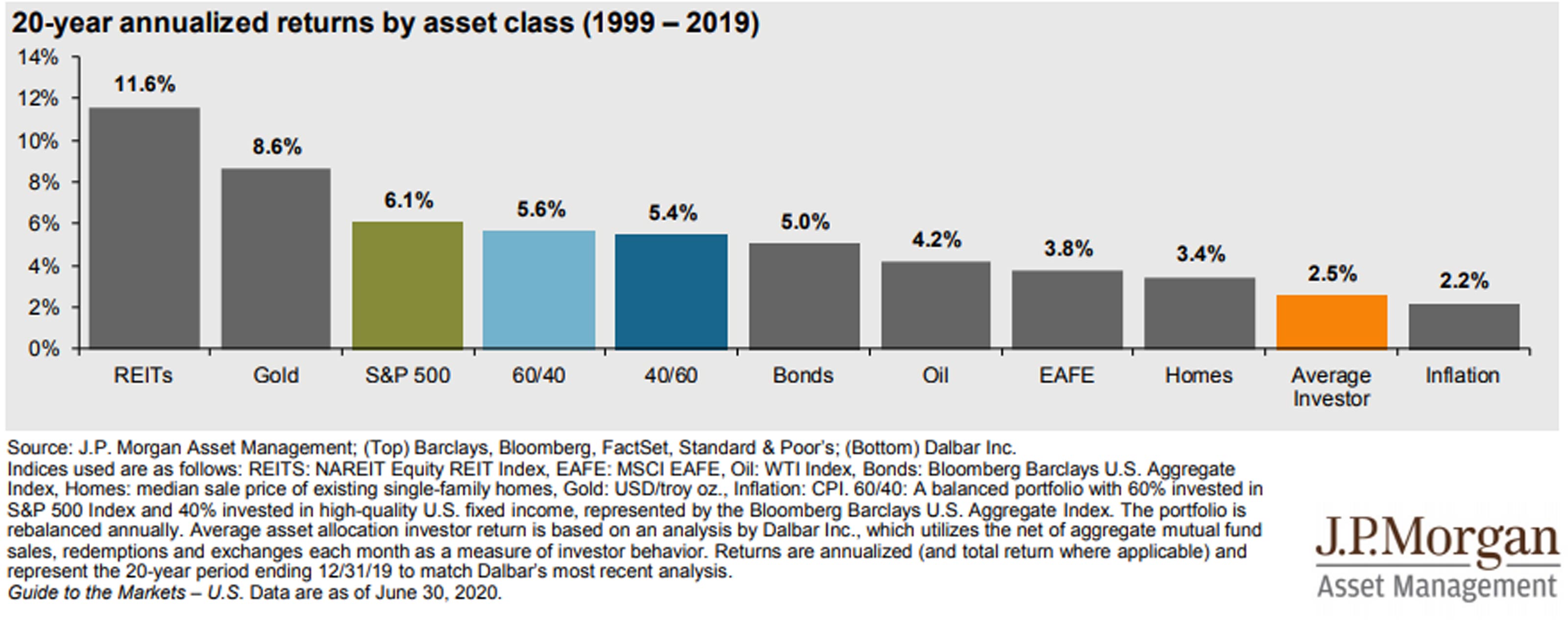

Don’t just take my word for it, though. Day traders — and even average investors who are trying to DIY their own portfolio management along the way — fall short of a variety of benchmarks in various asset classes:

Why does this happen? Because as a day trader, you are attempting to outsmart giant financial markets with millions of participants — some of which are corporate entities that exist solely to attempt to gain an edge, advantage or piece of information before anyone else knows about it in order to make money in the market, and who have entire departments of experts dedicated to these tasks.

The odds that you, as an individual with no such powerful tools at your disposal, would outguess everyone else are, to put it mildly, rather slim. Think about playing a game of poker with you and four friends. You might have a good chance to win some money. But what if you sat down to the table with four of the best poker players in the world? How good are your chances now?

That’s what the scenario looks like for you against the rest of the traders of the world.

If You Must Speculate, Mitigate the Risks First

While I suggest that you use a diversified, low-cost portfolio of index funds and ETFs to invest and cultivate your money in the market over time, you may be dead-set on trying day trading for yourself. If so, then first, I recommend watching this video on penny stocks from the Motley Fool. Then, try to stick to these rules whenever dipping your toe into more speculative investment waters:

- Only invest what you are prepared to lose. And by lose, I mean losing all of it. If you can’t handle the idea of losing 100% of what you put into a single stock position, then you should not be making that investment (or, more accurately, that bet). If you are buying individual names, you must be prepared — and actually able to afford — to lose your principal. Therefore, I recommend that you trade with less than 5% of your net worth to avoid racking up losses that you will struggle to recover from.

- Don’t buy on margin. Buying on margin means that you’re borrowing money to buy even more shares. It’s a bad idea for newer investors and can quickly amplify your losses.

- Avoid penny stocks. If that video wasn’t enough, let me reiterate it here: Companies are penny stocks for a reason. Stay away!

So, all this being said, I suppose it’s fair to ask … can’t you just get lucky? Isn’t it at least possible to strike it rich with something like day trading?

Sure. It is possible. But that doesn’t mean it’s likely, and in order to get lucky you might have to spend and lose a significant amount of money along the way (which clearly would have been better off in a more reliable investment vehicle, or even in cash!).

You can get lucky … but even slot machines pay out every once in awhile, and no one with any sense is claiming those are a great retirement plan.

And it isn’t spare change that most day traders are flinging into the market. It’s hard-earned dollars — dollars that could be working hard for you in turn if you only allocated them to a safer, more strategic, and more reliable way to grow wealth in the market instead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Sydlansky, founder of Lake Road Advisors LLC, has worked in the financial services industry for over 20 years. Prior to founding Lake Road Advisors, Paul worked as relationship manager for a Registered Investment Adviser. Previously, Paul worked at Morgan Stanley in New York City for 13 years. Paul is a CERTIFIED FINANCIAL PLANNER™ and a member of the National Association of Personal Financial Advisors (NAPFA) and the XY Planning Network (XYPN).

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.