Five Ways to Save on Back-to-School Shopping

Make a budget and stick to it when spending on your kids' back-to-school supplies.

Ben Demers

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

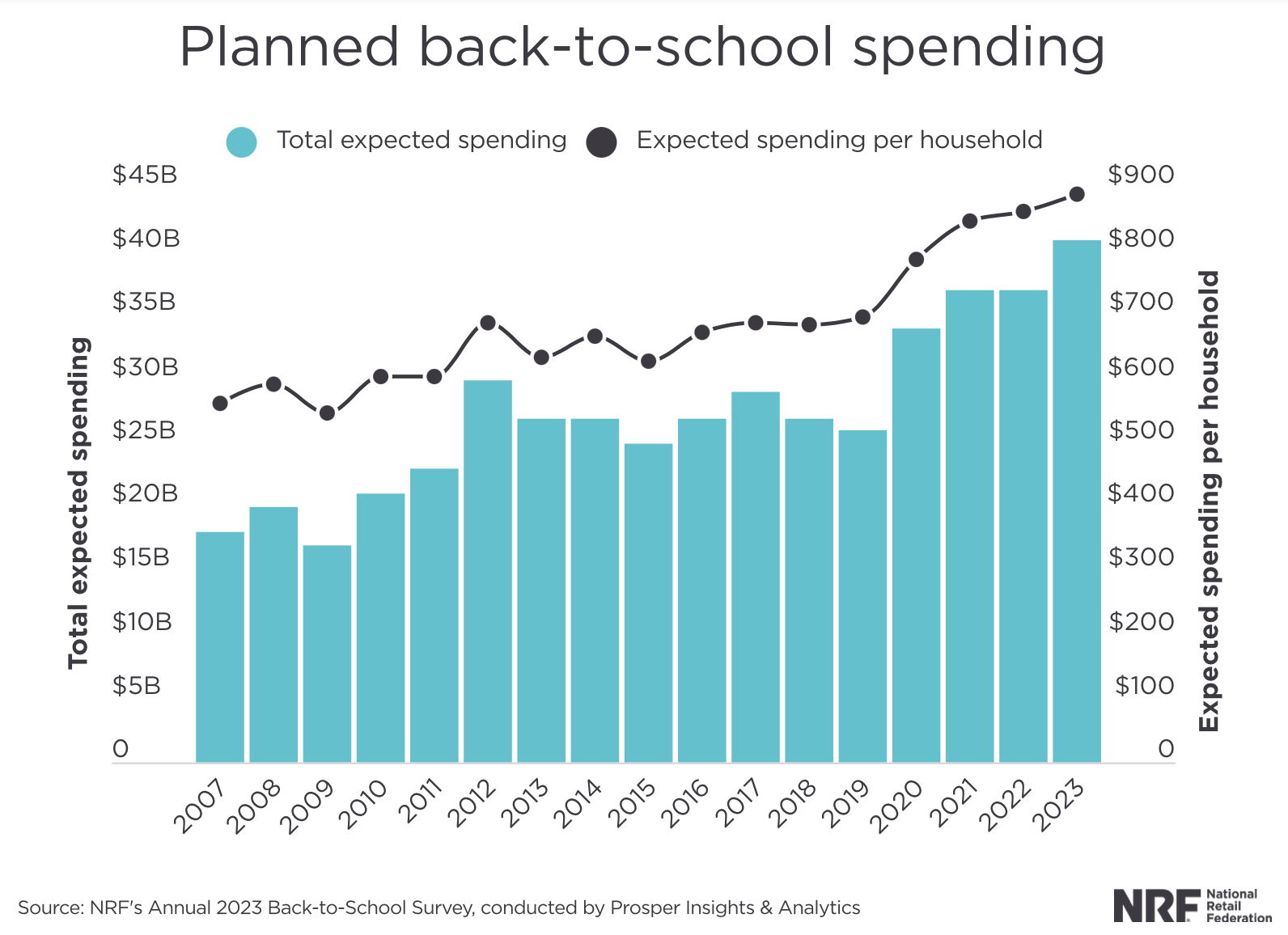

With back-to-school shopping season in full swing, concerns on how to afford clothing and educational supplies are increasing, especially as core inflation remains stubbornly elevated. Back-to-school consumer spending is expected to reach a record $41.5 billion, up from $36.9 billion last year, according to the National Retail Federation's (NRF) latest Back-to-School Survey. The average family with children in grades K-12 will spend about $890 on apparel, shoes, supplies and electronics, surpassing the previous high of $864.

NRF reports that the spending boost is largely driven by increased electronics demand. A record 69% of back-to-school shoppers plan to buy electronics or computer accessories this year, a 4% increase from 2022.

With ever-rising costs weighing on family budgets, here are some tips to save at this pricey time of year:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1) Purge the Closet

Kids grow like weeds. A pair of shoes bought just a month ago might no longer fit. Rummage through clothing to see what fits and what is in good condition. Hang onto what you can to pass on to younger siblings, friends or Goodwill. Everything else can be tossed or recycled for a craft project. Talk to your children to make decisions about what they could reuse. This encourages a youngster to think creatively about how to make things last and not waste.

For supplies, look at what the child has from the previous school year. Do you have unused glue, paper and folders that are in good shape? Reuse them or, if there is another child in the household, give them the materials.

2) Make a Budget

Kids need limits, especially financial limits. Sit down with a child and discuss how much can be spent on clothing, supplies and miscellaneous items such as a laptop or high-tech gadget for class. Ask the child to come up with ways to stretch a buck or contribute to the fund.

If the child is older and wants an expensive pair of shoes, offer to pay for half and have him or her come up with the rest. This kind of conversation can be part of a bigger push to teach kids good money habits. An extra benefit: This gives them practice to earn that A in math.

3) Hit the Thrift Stores

Kids today love a good "throwback" and enjoy finding cool retro items from Goodwill stores or rummage sales. Perhaps as guardian or parent, you may have some items in storage that would appeal to the kids in the household. Grandpa's vintage jean jacket from 1960 might look awesome to a teen on the first day of school.

4) Check Online and on Social Media

Surf the web with your child and see if stores such as Target, Walmart, Office Max, etc. are offering deals via their Twitter, Facebook, Instagram or other social media accounts. Many stores post on upcoming sales targeting back-to-school shoppers. Also look up sites such as Amazon.com or Overstock.com for cheaper versions of higher-end items. Consider it virtual rummage sale shopping.

5) Next Year, Start Early

Back to school time is a rush of papers, book bags and clothing flying off the racks and shelves. Next year, think about starting shopping around March and buying certain items such as winter clothing ahead of time when they're on clearance. While everyone else is thinking spring, you will be a savvy shopper thinking about scoring a decent deal on boots for someone in the family.

Related Content

- Back-to-School and 4 Other Florida Tax Holidays Happening Now

- 11 Things You Don’t Need for College

- Virginia Tax-Free Weekend Gone Despite Massive Budget Surplus

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Marguerita M. Cheng is the Chief Executive Officer at Blue Ocean Global Wealth. She is a CFP® professional, a Chartered Retirement Planning Counselor℠ and a Retirement Income Certified Professional. She helps educate the public, policymakers and media about the benefits of competent, ethical financial planning.

- Ben DemersAudience Engagement Manager, Kiplinger.com

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised FundIf a charitable remainder trust puts too many constraints on your family's charitable giving, consider combining it with a donor-advised fund for more control.

-

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in RetirementThis kind of planning focuses on the intentional design of your estate, philanthropy and long-term care protection.

-

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in Prison

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in PrisonThis young man needed to be scared straight after his mother expressed her fear that he was on a path to prison. Hearing these eight do's and don'ts worked.

-

How Money Guilt Holds Women Back (and How You Can Send It Packing)

How Money Guilt Holds Women Back (and How You Can Send It Packing)Women shouldn't let guilt limit the way they manage their hard-earned wealth. It's time to separate emotion from financial decision-making.