A Tech Bubble? What Tech Bubble?

Today’s social networking is far different from the dot-com craze that blew up in 2000.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sky-high valuations for social media companies don’t signal a bubble in the tech industry à la the dot-com bubble, which burst in 2000.

Although some analysts see similarities between the two eras, the massive worth assigned to such private firms as Facebook, Twitter, Groupon and Zinga, is not, on its own, a sign of trouble ahead.

There are many differences between then and now.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For starters, the newer firms are on fairly firm financial footing. Facebook, linking 600 million people around the world, and Groupon, a mass coupon provider, are said to have annual revenue in excess of $1 billion each. The average for all tech firms going public in 2010 was $300 million. That’s more than double the average of $120 million in revenue for similar firms at the height of the dot-com boom.

During the dot-com bubble, valuations for public and private companies (most social networking companies are still private) were about equal, but today valuations for social networking companies are below the valuation multiples for public companies such as Google. In the late 1990s, valuation multiples were more than ten times higher than today.

Today’s younger companies are in no rush to go public, unlike earlier firms that rushed to sell shares, bringing many inexperienced investors into the picture.

A driver of a bubble is the oversupply of venture capital in the market, which isn’t the case now. Between 1998 and 2000, venture capital firms raised as much as $200 billion, equal to 0.55% of GDP -- more than in the previous 18 years combined. More recently, between 2008 and 2010, venture capitalists raised just $55 billion, or 0.12% of GDP.

Instead of issuing an initial public offering this year, Facebook, for example, raised $5 billion through a financing vehicle managed by Goldman Sachs, which attracted many savvy investors.

Moreover, the explosion in Web usage helps to keep today’s online sites profitable and growing.

Although expectations were high for the Internet during the dot-com bubble, the reality was not there. The consumer Internet market 10 or so years ago totaled 55 million people -- compared with 2 billion today -- and half of them were on dial-up connections, making for slow and cumbersome Web use. Expectations outstripped the reality. Today consumer bandwidth is 100 times what it was then, thanks to DSL, cable modems and high speed wireless.

Plus changes in technology have at the same time made it easier to start companies and have created huge new markets for those start-ups.

In the late 1990s start-ups spent quite a lot on office space, servers and equipment. Today, much of the infrastructure is in the “cloud” -- on servers maintained by other companies -- allowing entrepreneurs to focus more on the product than on building an infrastructure to support that product.

Furthermore, the move to cloud computing and mobile applications is opening up whole new areas of applications for today’s start-ups.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

When Tech is Too Much

When Tech is Too MuchOur Kiplinger Retirement Report editor, David Crook, sounds off on the everyday annoyances of technology.

-

I Let AI Read Privacy Policies for Me. Here's What I Learned

I Let AI Read Privacy Policies for Me. Here's What I LearnedA reporter uses AI to review privacy policies, in an effort to better protect herself from fraud and scams.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

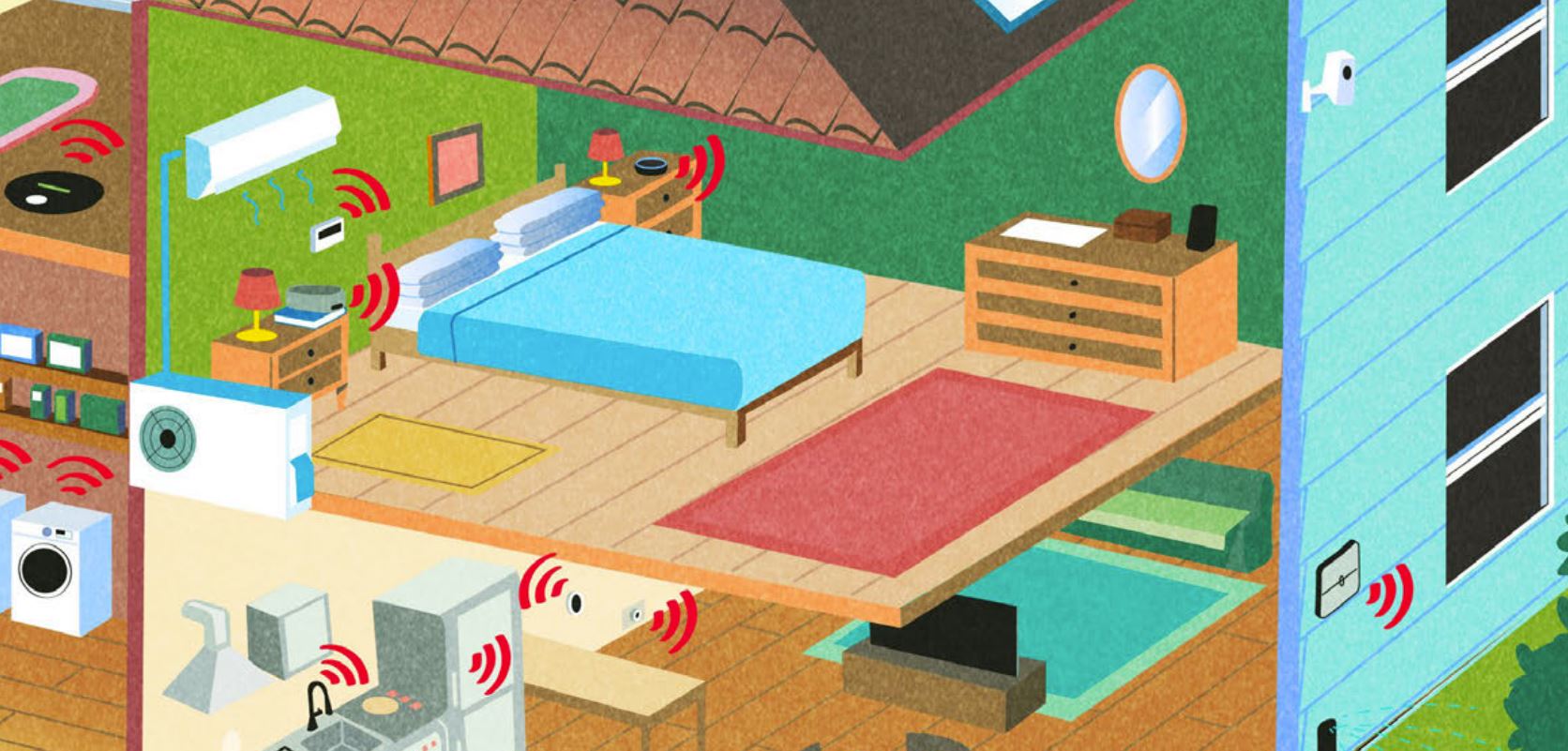

The 27 Best Smart Home Devices

The 27 Best Smart Home Devicesgadgets Innovations ranging from voice-activated faucets to robotic lawn mowers can easily boost your home’s IQ—and create more free time for you.

-

How to Choose the Right Payment App

How to Choose the Right Payment Appbanking Using PayPal, Venmo, Zelle and other apps is convenient, but there are pros and cons to each.

-

Shop for a New Wireless Plan and Save Big

Shop for a New Wireless Plan and Save BigSmart Buying Competition is fierce, and carriers are dangling free phones and streaming subscriptions.

-

Watch Out for Job Listing Fraud

Watch Out for Job Listing FraudScams If one of your New Year’s resolutions is to find new employment in 2022, be on guard against job-listing scams.

-

Virtual Numbers Add Security to Credit Card Shopping

Virtual Numbers Add Security to Credit Card ShoppingTechnology Some mobile wallets offer this feature, which randomly generates virtual digits that are linked to your credit card.