6 Stocks That Have Survived Their Industries’ Disruption

Things move fast today. These six firms have fought off paradigm-shifting challenges.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When Eastman Kodak filed for bankruptcy protection in 2012, it was hard to be surprised. By then, film cameras were an analog product in a digital world. And when the same day of reckoning came for Blockbuster Video and for Borders bookstores, the nostalgic among us may have felt a twinge of regret, despite having seen it coming. Of the three, only Kodak still exists or trades publicly, at a penny-stock price of $2 a share.

These companies were disrupted—unseated by forces that made their products or services obsolete. As we've grown more technologically advanced, this sort of disruption has become more common. In 1964, the average tenure for a company in Standard & Poor's 500-stock index—which represents 500 large U.S. firms—was 33 years, according to consulting firm Innosight. By 2016, it was 24 years, and the firm projects it will shrink to 12 years by 2027.

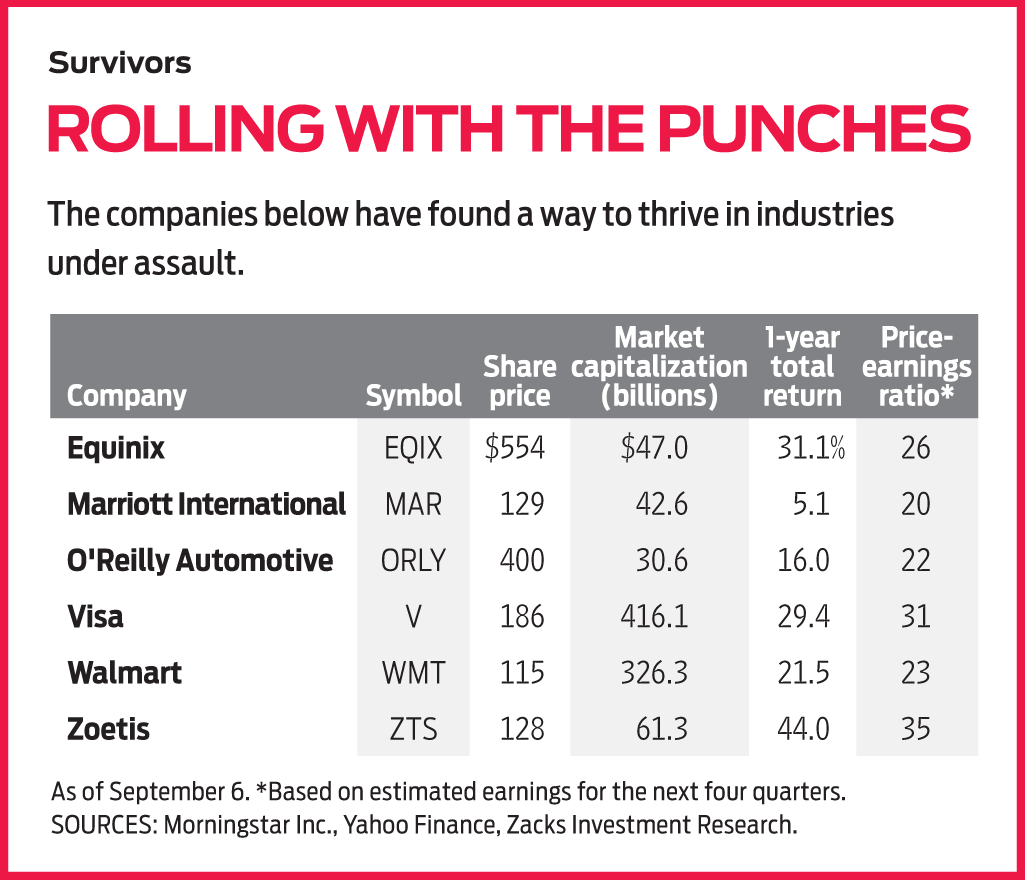

It behooves the long-term investor, then, to choose stocks that are unlikely to crumble in the face of persistent challenges. The stocks below are equipped to deliver long-term performance despite current or potential disruption within their industries. Some trade at lofty valuations, and all could be adversely affected by a bear market or recession. But if you're willing to hold for the long term, these firms should deliver healthy returns. Prices and other data are as of September 6.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Equinix (symbol EQIX, $554). Equinix has already proved it can thrive despite technological disruption. Equinix began as a "colocation" firm, renting out space in physical centers for companies' data storage and computer network equipment. "It essentially served as an on-and-off ramp to the internet," says Mike Lippert, portfolio manager at Baron Opportunity fund.

Then came the cloud, and widespread concern among investors that businesses would route their computing work through the data centers of major public cloud providers, such as Amazon Web Services and Microsoft Azure, making colocation centers like Equinix's obsolete. Instead, says Lippert, Equinix adapted, partnering with the major cloud players so that Equinix centers could function as clearinghouses where clients access numerous public cloud services. For example, an Equinix business client might access different public clouds, such as AWS and Azure, as well as cloud-based software applications, such as Salesforce and Workday, in one place.

Equinix's centers boast four times as many interconnections as its next-biggest competitor, and the company should steadily boost sales as it expands its capacity to meet strong demand for its business, says Keith Snyder, an analyst at investment research firm CFRA. Equinix, which is structured as a real estate investment trust, no longer comes cheap after returning 60% so far this year. But Lippert sees it as a solid long-term holding that can generate annual growth in funds from operations (a measure of REIT profitability) at a rate in the high-single-digit percentages over the next decade.

Marriott International (MAR, $129). Home-sharing websites are a growing problem for hotels. Airbnb lists more than 6 million properties on its site (up from 300,000 in early 2014)—a formidable figure, considering that there are 17 million rooms offered at hotels worldwide.

The intrusion has limited hotels' pricing power, says Becky Baker, portfolio manager at Fidelity Select Leisure. So far in 2019, revenue per available room, a measure of hotel profitability, has grown by only 1%, and Baker doesn't see growth picking up much anytime soon. But amid the hotel doldrums, Marriott is well positioned, with brighter growth prospects than its competitors, she says.

Helping matters is that Marriott owns practically none of its industry-leading 1.3 million rooms; 97% of them are either managed by the company or operated as a franchise. Such agreements allow Marriott to collect recurring fees from the hotels' owners and franchisees. The model requires practically no capital from Marriott to open a new hotel, Baker says, and the firm is boosting its supply of rooms more than twice as quickly as the rest of the industry. Marriott plans to add up to 295,000 new rooms by 2021, a move the firm expects to boost earnings per share by as much as an annualized 15% from 2018 levels.

O'Reilly Automotive (ORLY, $400). When Amazon entered the car-parts business in 2017, shares of auto-parts seller O'Reilly dropped precipitously. O'Reilly wouldn't have been the first store to be put out of business by the mega retailer's fast shipping, low prices and vast inventory. But O'Reilly's stock bounced back as the company showed that it has one of the rare business models that is insulated from the ubiquitous threat of e-commerce.

O'Reilly sells after-market parts and tools to professional mechanics and do-it-yourselfers. With about 5,300 stores, almost all located within 300 miles of a distribution center, O'Reilly can ship quickly to mechanics who need specific parts on short notice. "If you can't ship a part in 30 to 45 minutes, you won't remain a preferred distributor for long. Amazon has same-day shipping, but they can't move that fast," says Hennessy Focus portfolio manager Ira Rothberg. And O'Reilly's retail staff offer guidance and expertise for the DIY crowd that is harder to find at a large online retailer, he says.

O'Reilly will likely outpace its competitors in growth of store space, sales and earnings over the next few years, and it should benefit from the increasing age of vehicles on the road, which should create demand for more repairs, says CFRA analyst Garrett Nelson. He sees earnings rising by 8.7% in 2019, followed by a 15.7% increase in 2020. He rates the stock a "strong buy."

Visa (V, $186). Essentially the world's largest toll collector on electronic payments, Visa has benefited from a decades-long shift away from cash. But the firm is first to admit that innovations in mobile commerce and peer-to-peer payments, along with advancing technology (including the growth of internet-connected devices), will continue to drastically expand and change the way people and businesses exchange money. Visa has estimated that the number of devices used to make payments and the number of ways to accept them will increase 10-fold by 2022.

Analysts at financial services firm William Blair say Visa has remained ahead of the curve, investing in and partnering with financial technology firms to ensure that the electronic payments of the future "occur over Visa's rails."

Visa has benefited from the emergence of electronic payment platforms such as PayPal and its subsidiary Venmo, whose customers largely fund payments through credit and debit cards, says Brandon Ladoff, co-manager of Polen Growth fund.

Trading at 31 times estimated earnings for the 12 months ahead, Visa shares are not bargain-priced. But Ladoff sees plenty of room for long-term growth, especially considering that 85% of the world's transactions are still executed in cash. He expects Visa to boost earnings at an annual percentage rate in the high teens over the next half-decade.

Walmart (WMT, $115). When it comes to retail disruption, Walmart is "the only American retailer that can compete comprehensively with Amazon's retail offering," says Morningstar analyst Zain Akbari.

Walmart's grocery business gives the company an advantage over Amazon. Groceries account for more than half of sales at Walmart's U.S. stores. Walmart's ample facilities and parking lots are optimized for so-called "click and pick" (order online and pick up in-store) shopping models, which will be more difficult for Amazon to execute at its Whole Foods stores, says T. Rowe Price Value fund manager Mark Finn. Walmart's grocery offerings drive customers to more-profitable merchandise in the rest of the store, says Akbari.

Walmart is boosting its nascent e-commerce business, which accounts for just 4.7% of the U.S. division's net sales, says CFRA's Nelson. He says Walmart is well positioned to loosen Amazon's e-commerce stranglehold, having introduced in May free next-day shipping on orders over $35 (without a fee akin to the annual membership cost of Amazon Prime). He projects e-commerce sales growth of 35% in the fiscal year that ends in January, compared with the previous year. That should help Walmart (trading at 23 times year-ahead earnings) close the valuation gap on Amazon (trading at 71 times earnings), says Nelson. He rates Walmart stock a "buy."

Zoetis (ZTS, $128). The bad news for drugmakers is that lowering prescription drug prices is a bipartisan goal, promising disruption of old pricing models and volatile share prices. The Trump administration is mulling a plan that would base Medicare payments for certain drugs on the lower prices paid for those drugs in other countries. And analysts say a single-payer system, such as the one proposed under Medicare for All plans, could drastically reduce pharmaceutical firms' pricing power.

Zoetis, which makes medicines, vaccines and diagnostics for farm animals and pets, needn't worry about any of that. As Morningstar analyst Debbie Wang notes, the animal health industry "lacks large players like Medicare, single-payer governments or large insurance companies" that could potentially affect drugmakers' pricing. Additionally, Zoetis faces little competition from generics, and pet and large-scale livestock owners alike will pay a premium for prescriptions from a company they trust, says fund manager Ladoff.

Unlike many of its competitors—animal health divisions of human-pharma companies—Zoetis can focus on developing treatments targeting animal illnesses exclusively. Analysts at Credit Suisse are bullish on the firm's pipeline of treatments, and they believe Zoetis will boost earnings by 14% in 2019 followed by an 11% uptick in 2020. Though the shares earn an "outperform" rating from Credit Suisse, it's worth noting that they currently trade at 35 times year-ahead earnings, compared with an average forward P/E of 25 over the past five years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.