What You Need to Know About Bitcoin

Investing in cryptocurrencies is dicey. Instead, consider the underlying technology.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

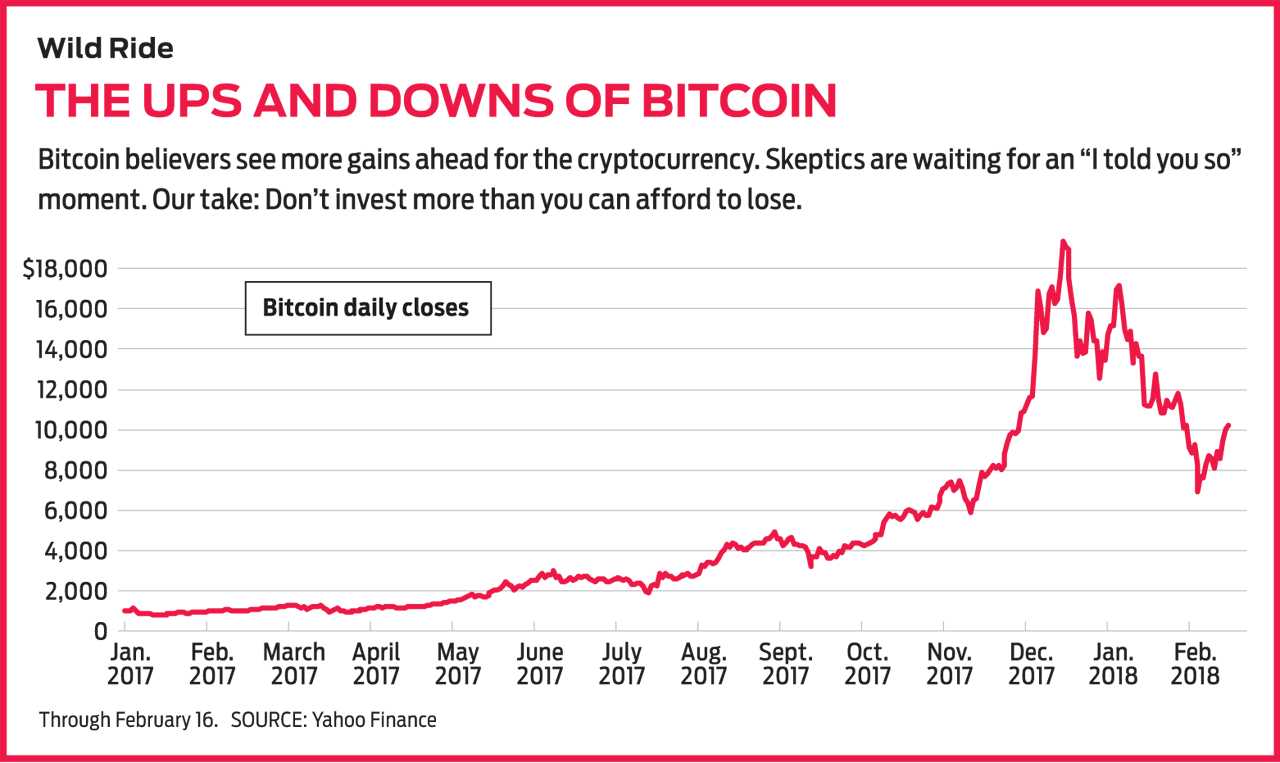

When "Bitcoin" appeared as a clue in the New York Times Sunday crossword puzzle earlier this year (the five-letter answer was "e-coin"), it was confirmation that the cryptocurrency had officially entered the zeitgeist. Such virtual currencies use computer-generated encryption to secure and track transactions, independent of a central bank. Bitcoin made headlines last year because of its meteoric rise from $963 per bitcoin at the start of 2017 to a high of nearly $20,000 in December. This year's news has been about bitcoin's descent, to a low of $7,000 in February, from which it was recently on the rebound.

What other risks come with buying digital currencies? For starters, hackers could steal your bitcoin. In January, cyber thieves stole more than $500 million worth of cryptocurrency from Coincheck, a Japanese exchange. Or you could lose access to your bitcoin, in much the same way your cash is gone when you lose your wallet. When you own bitcoin, you have two Òkeys,Ó similar to the login ID and password you use to access traditional online financial accounts. One is called a private key; the other, a public key. The public key is analogous to your account number. The private key is akin to your personalized digital signature and is your proof of ownership. Lose your private key and you lose your claim to the bitcoin. Some wallet firms, including Xapo, will hold onto your private key for you.

Lastly, digital-currency accounts don't have the same level of insurance that protects customers if a bank or brokerage goes belly-up. There is some cushion, though. Big exchanges typically hold insurance policies against a cyberattack; proceeds from the policies can be used to pay you back for any stolen coins. And although digital assets aren't covered, any U.S. dollars held in an account at Coinbase are FDIC-insured, up to $250,000.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Is it the technology behind bitcoin, but not bitcoin itself, that I should be focusing on? Yes. Some say blockchain technology could be as world-changing as the internet. Companies all over the world are exploring ways blockchain can help them save money, store sensitive data, streamline transactions and improve information flow. "Every major financial institution and technology company is investing in blockchain," says van Eck. Alphabet, Citigroup, Goldman Sachs and Overstock.com are among the biggest blockchain investors today, according to research firm CB Insights. Gartner, the research firm, predicts that by 2030, 30% of global businesses will use blockchain technology.

How does blockchain work? Think of blockchain as an unalterable, official ledger of transactions stored on a vast network. Anyone can get on the network to help maintain the ledger, and everyone on the network collectively controls it. There is no central authority. It's super-secure because of the way the ledger is built—each transaction is connected to the last—and because it exists on thousands of computers. A hacker would have to break into every computer on the network at the same time—an impossible task—to do damage.

In the case of bitcoin, each transaction is sent to a vast worldwide network of computers that run the bitcoin software. (Anyone can download the software at https://bitcoin.org.) These computers are run by people who compete to approve the transaction by solving a complicated math problem. The first to solve the problem wins a reward of newly created bitcoins. That's why they're called bitcoin miners. (Mined bitcoins are taxable as income.) Network participants okay the new transaction, which is added to a block of other recently approved trades, and the block is connected to the chain, which is a record of all bitcoin transactions ever made. "The chain is immutable. It has never been hacked," says Laurie Rosini, an attorney with Perkins Coie in the firm's blockchain technology and digital currency group. Among business users, Walmart is exploring ways to use blockchain to improve food tracking and safety and Vanguard is testing whether it can smooth trades and simplify management of its U.S. stock index funds.

Can I invest in blockchain? Yes. For now, an ETF is probably your best bet. If you're looking for a pure blockchain tech company to invest in today, good luck. We found six publicly traded U.S. firms that are wholly tied to blockchain technology. But none earned a penny in the past 12 months; one trades for less than 2 cents a share; and three have market values that fall below $50 million.

That said, ETFs focused on this technology are fairly new, too. The four blockchain-related ETFs currently open launched this past January. All invest in firms that are exploring, adopting or enabling the use of blockchain technology. The good news is that the portfolios are filled with familiar companies. For example, each fund owns shares in IBM, Intel, Microsoft, Nvidia and Oracle.

Reality Shares Nasdaq NexGen Economy ETF (symbol BLCN), which tracks a proprietary index, is our favorite. It charges 0.68% in annual fees and has $100 million in assets. The ETF starts with firms that have at least $200 million in market value and $1 million in average daily trading volume. It then zeroes in on companies that are expected to benefit the most—either from cost savings, for example, or operational efficiencies—from blockchain technology, ranked by a proprietary score. BLCN holds 59 stocks, and at last report, the fund's top three holdings were Cisco Systems, Intel and Overstock.com.

Cops on the Bitcoin beat

State and federal regulators have keen eyes on digital currencies. Digital-currency exchanges and wallets must register and comply with rules set by the Treasury Department's Financial Crimes Enforcement Network (Fincen). These include collecting and verifying customer information.

And the Securities and Exchange Commission and the Commodity Futures Trading Commission are cracking down on fraudulent schemes. Virtual currencies mean "potential riches and the next big thing" to would-be investors, said CFTC chairman J. Christopher Giancarlo at a congressional hearing in February, but for scam artists, they're "a way to separate the unsuspecting from their money."

Earlier this year, the CFTC charged a Las Vegas, Nev.-based firm called My Big Coin Pay, and two men associated with it, with fraud and misappropriation of funds. The CFTC alleges that the men took more than $6 million from 28 investors, touting its digital currency, MBC, as a solid investment backed by gold (when it was not). Then they spent $645,000 of the money on a house, more than $500,000 on antiques and fine art, and $340,000 on jewelry, among other purchases, the CFTC charges.

Last December, a new unit of the SEC targeting cyber-related scams filed fraud charges against Quebec-based PlexCorps and two partners in connection with an initial coin offering. PlexCorps had raised $15 million selling a digital token called PlexCoin to tens of thousands of investors by promising them a 13-fold return in less than a month. The partners said they would invest the proceeds to deliver returns. Instead, according to the SEC complaint, they took the money and used some of it for personal home-improvement projects, including lawn care and painting.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Is Crypto Investing Coming to a Credit Union Near You?

Is Crypto Investing Coming to a Credit Union Near You?Credit unions are getting in on crypto investing through partnerships with third-party platforms, but the risks to investors still apply.

-

The GENIUS, CLARITY, and Anti-CBDC Acts: What Bitcoin Investors Need to Know

The GENIUS, CLARITY, and Anti-CBDC Acts: What Bitcoin Investors Need to KnowMovement on the crypto front at the federal level has the potential to usher in substantial change. Here's what it means for your portfolio.

-

Cryptocurrency May be Coming to Your 401(k) with Rules Change

Cryptocurrency May be Coming to Your 401(k) with Rules ChangeCrypto may be coming to a 401(k) near you. Financial experts weigh in on whether retirement savers should take the plunge.

-

Is It Too Late to Invest in Bitcoin?

Is It Too Late to Invest in Bitcoin?Bitcoin has been volatile in recent months, but several analysts believe the cryptocurrency will resume its winning ways. Should investors get in now?

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Silvergate Stock Sinks on Liquidation News

Silvergate Stock Sinks on Liquidation NewsSilvergate Capital stock is spiraling after the financial firm said it's shutting down operations at its crypto-friendly subsidiary.

-

Crypto Hackers Stole a Record $3.8 Billion in 2022. Don't Be Next.

Crypto Hackers Stole a Record $3.8 Billion in 2022. Don't Be Next.Cybercriminals stole a historic amount of crypto last year — a growing trend that puts every cryptocurrency investor at risk. The biggest hacks and how to protect yourself.

-

Stock Market Today: Nasdaq Pops as Tesla, Coinbase Stocks Soar

Stock Market Today: Nasdaq Pops as Tesla, Coinbase Stocks SoarBed Bath & Beyond was another big winner on Monday, despite last week's bankruptcy warning.