Get a 6.5% Yield With a Stew of Junk Bonds

Three shops, each using a different recipe, pick the bonds at Northern Multi-Manager High Yield Opportunity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

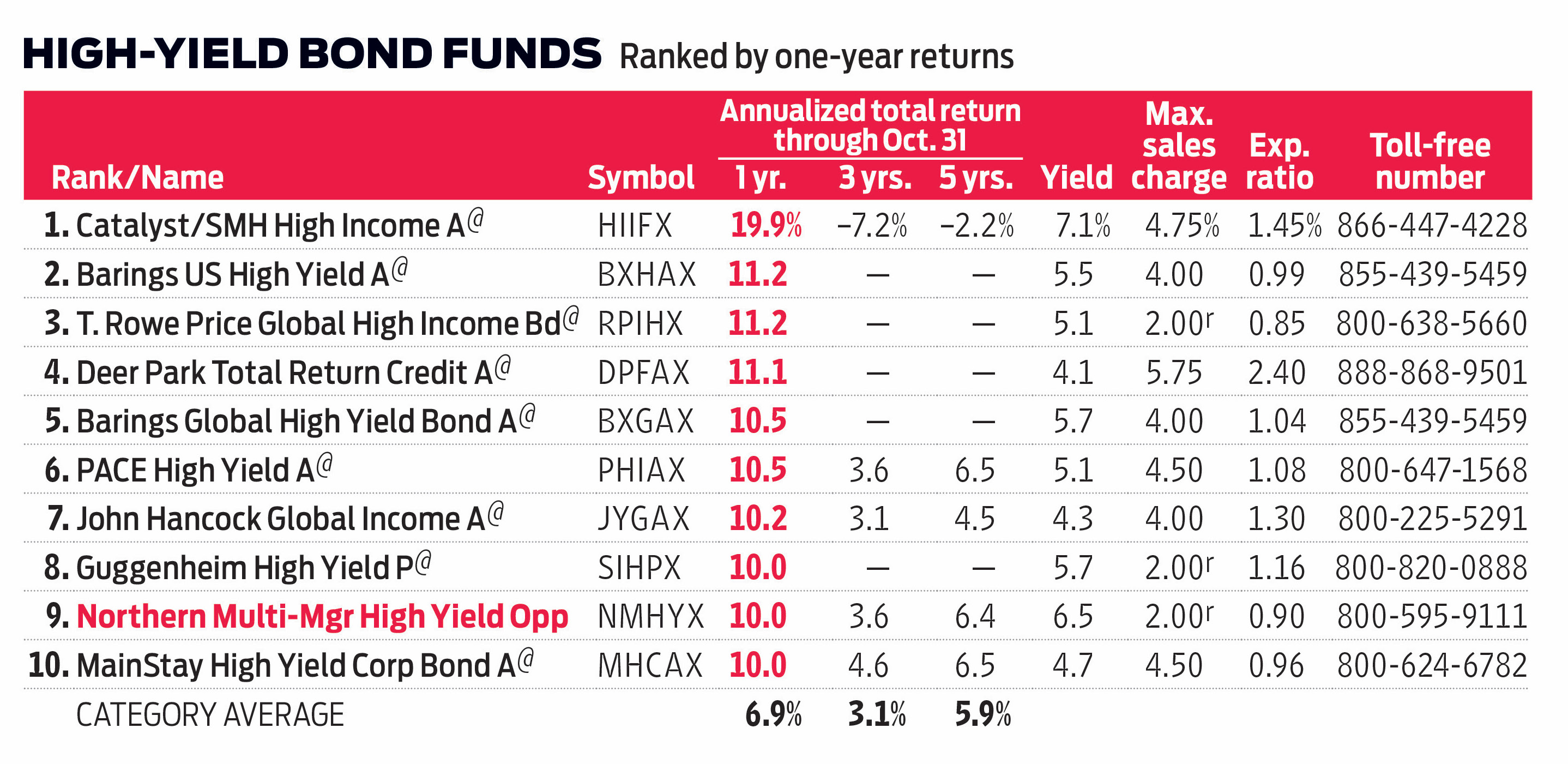

Too many cooks have yet to spoil the broth at Northern Multi-Manager High Yield Opportunity (symbol NMHYX), which divides its assets among three firms, each with its own philosophy for buying bonds with below-average credit ratings. Northern’s Chris Vella, who oversees the portfolio, says the strategies offer three different ways to generate market-beating returns. High Yield Opportunity, as a unified entity, hasn’t always achieved that goal, but over the past year it ranked in the top 5% of all junk-bond mutual funds.

Vella gives the subadvisers considerable autonomy over their chunks of the portfolio. Neuberger Berman, which manages 40% of the $312 million fund’s assets, uses what Vella calls a “traditional” high-yield strategy to assemble a diversified package of bonds with below-investment-grade credit ratings. DDJ Capital (30% of assets) invests mostly in debt of midsize firms, with a large allocation to floating-rate bank loans. Nomura (also 30%) uses big-picture analysis of the high-yield market to select bonds.

The fund yields a lusty 6.5%, thanks to a sizable allocation (70% of assets) to bonds rated single-B or below. Junk bonds are vulnerable to a recession or financial crisis. But the fund should be able to withstand rising interest rates better than investment-grade bond funds (rates and bond prices move in opposite directions).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.